How to Get Finance for Used Cars in India

Financing a used car in India has become increasingly simple and convenient, thanks to the growing number of lenders offering specialized used car loans. Whether you're buying your first car or upgrading to a better model, used car financing allows you to break down the cost into manageable monthly installments, making it easier to own a vehicle without putting financial pressure on your savings.

Why Choose Used Car Finance?

Choosing finance for a used car is a smart decision for buyers who want flexibility. Instead of paying the entire cost upfront, financing lets you spread the payments over several months or years. This approach helps maintain liquidity, especially if you need funds for other personal or business needs. Also, opting for finance allows you to consider slightly higher-end models that might have been out of reach if you were only relying on cash.

Who Offers Used Car Loans in India?

Today, several financial institutions offer attractive loan options for used cars. Leading banks such as SBI, HDFC Bank, ICICI Bank, and Axis Bank provide used car loans with flexible repayment tenures and competitive interest rates. Non-Banking Financial Companies (NBFCs) like Mahindra Finance, Shriram Finance, and Tata Capital also have strong offerings in the used car finance space.

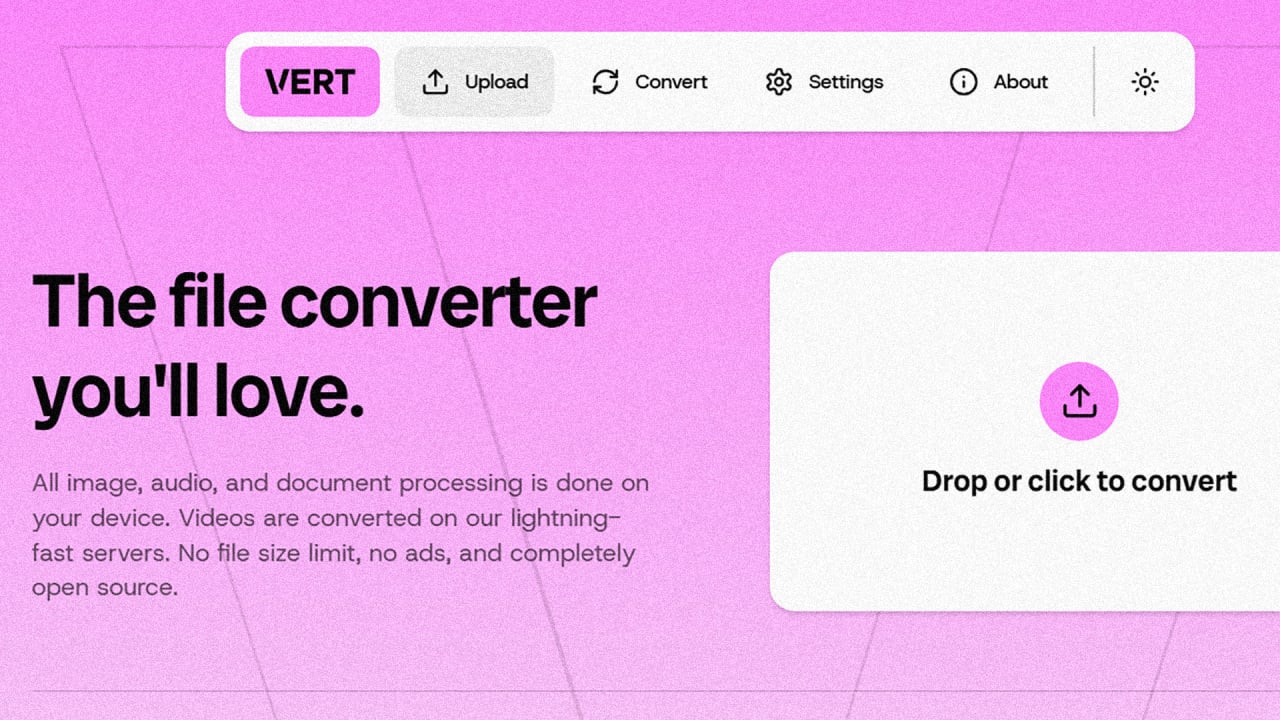

Additionally, online platforms such as Cars24, Spinny, OLX Autos, and CarDekho not only help customers find reliable pre-owned vehicles but also offer instant loan approvals and EMI calculators, making the entire process seamless and digital.

Eligibility Criteria

To qualify for a used car loan in India, you typically need to meet a few standard requirements. Most lenders expect applicants to be between 21 and 65 years of age. Whether you are a salaried employee or a self-employed professional, having a stable income is essential. Lenders will also evaluate your credit score to assess your repayment history. A score of 700 or above usually improves the chances of getting approval quickly.

Required Documents

Applying for a used car loan involves submitting a few important documents. These include a valid government-issued ID such as Aadhaar, PAN, or passport, along with proof of address like a utility bill or rent agreement. You’ll also need to provide income proof—salary slips, bank statements, or income tax returns for the past 2–3 years depending on your employment type. Lenders may also require recent passport-size photographs and vehicle details if you're applying through a dealer.

Loan Amount, Interest Rates, and Tenure

Most financial institutions finance up to 80–90% of the car's valuation. The loan amount depends on factors such as the age of the vehicle, its condition, and your creditworthiness. Used car loan interest rates typically range between 9% and 17%, slightly higher than new car loans due to the perceived risk. Repayment tenures generally range from 12 months to 60 months, giving you the flexibility to choose a term that suits your monthly budget.

Tips to Improve Loan Approval Chances

To increase your chances of getting a used car loan approved, make sure your credit report is in good standing. You can improve your chances further by opting for a certified pre-owned vehicle or buying from a reputable dealer. Offering a higher down payment can also work in your favour by reducing the lender’s risk and lowering your EMI burden. Applying with a co-applicant who has a solid credit history can also strengthen your application.

Where to Buy and Finance Together

Many buyers today prefer platforms where they can purchase a used car and get financing in one place. This saves time and effort. Websites like Spinny, Cars24, and CarDekho allow you to choose from verified cars and instantly apply for financing. If you’re looking to buy and sell used cars in Kerala, these platforms offer region-specific support, helping you find the right car, seller, or buyer and financing options—all in one convenient interface.

Final Thoughts

Financing a used car in India is no longer a complex process. With a wide range of banks, NBFCs, and online platforms offering tailor-made solutions, you can easily find a loan that suits your budget and requirements. Make sure to compare interest rates, check the loan terms, and choose a trustworthy lender. Whether you're buying from a dealer or directly from the owner, having the right financing partner can make your used car buying experience smooth and stress-free.

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)

![How Smart PMs Scale Their Careers in Any Org [TPG Live Recap]](https://tpgblog.com/wp-content/uploads/2025/06/2025-06-12-thumbnail-action.png?#)