Can a Section 8 Company Be an NGO

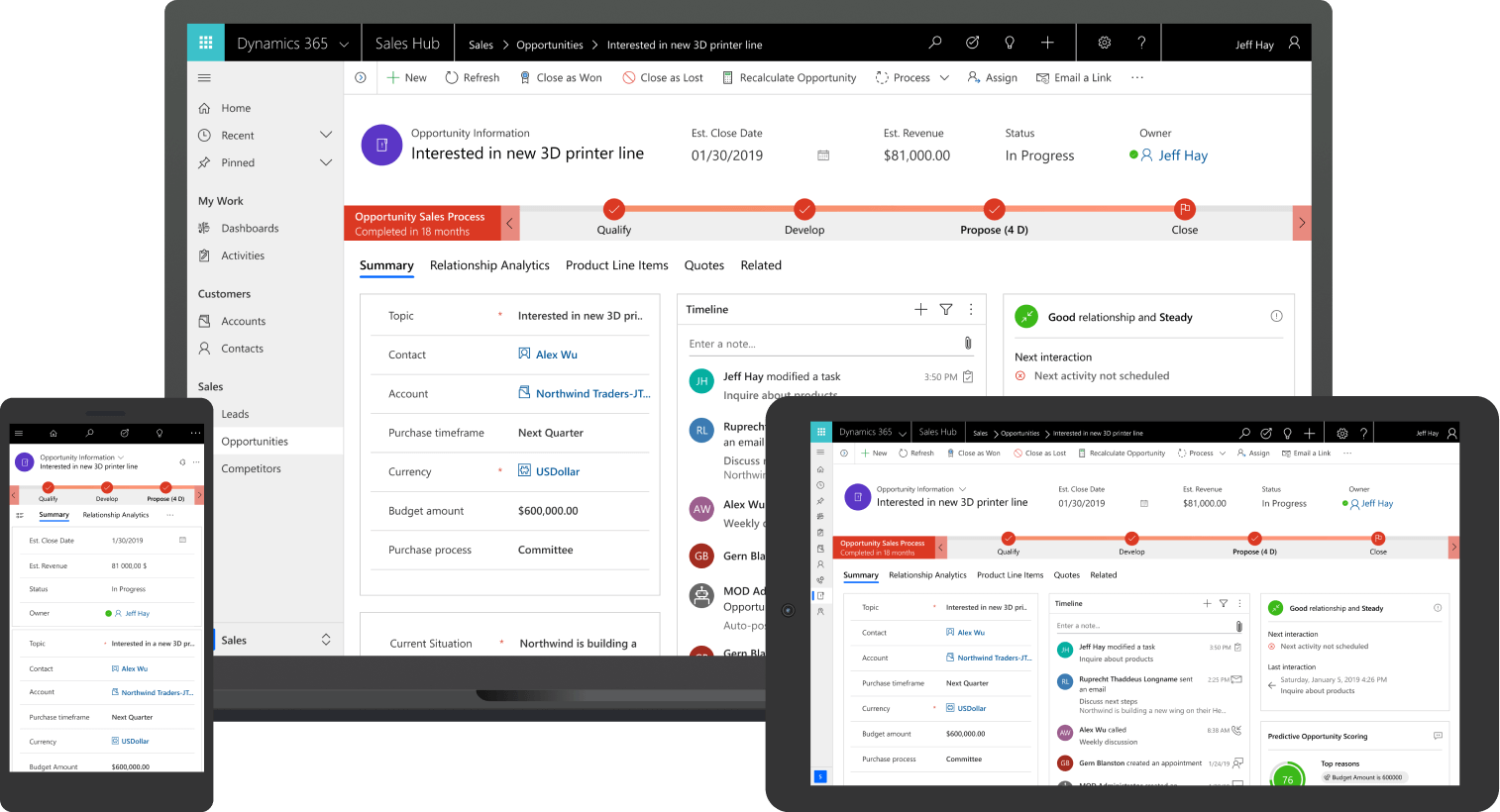

A Section 8 company enjoys high credibility due to its registration under the Companies Act

In India, the term NGO (Non-Governmental Organization) often brings to mind organizations that work toward social, charitable, or developmental goals without the motive of profit. One of the most popular legal structures for forming an NGO in India is a Section 8 company. But can a Section 8 company truly be considered an NGO? Let’s explore this in detail.

What is a Section 8 Company?

A Section 8 company is a type of company registered under Section 8 of the Companies Act, 2013. It is formed with the objective of promoting commerce, art, science, sports, education, research, social welfare, religion, charity, environmental protection, or any other similar objective. Unlike other companies, a Section 8 company does not aim to earn profits for distribution among its members. Instead, all income and profits must be used solely to promote the company's objectives.

Section 8 Company vs. NGO: Understanding the Terminology

The term "NGO" is a broad label that covers various types of non-profit organizations. In India, NGOs can be registered as:

-

Trusts under the Indian Trusts Act, 1882

-

Societies under the Societies Registration Act, 1860

-

Section 8 companies under the Companies Act, 2013

So, to answer the question directly: Yes, a Section 8 company can absolutely be an NGO. In fact, it is considered one of the most structured and legally robust forms of NGO registration in India.

Why Choose a Section 8 Company for an NGO?

There are several reasons why individuals or groups choose to register their NGO as a Section 8 company:

-

Legal Recognition: A Section 8 company enjoys high credibility due to its registration under the Companies Act and its compliance with strict governance norms.

-

Tax Benefits: Donors to a Section 8 company can avail tax exemptions under Section 80G of the Income Tax Act, provided the company has obtained the necessary certification.

-

Transparency and Governance: Since Section 8 companies are regulated by the Ministry of Corporate Affairs (MCA), they must follow stringent compliance procedures, which ensures transparency.

-

Perpetual Succession: Like any other company, a Section 8 company has a separate legal identity and perpetual succession. This means it continues to exist even if the founders or members change.

-

Foreign Funding: A Section 8 company is eligible to receive foreign contributions under the Foreign Contribution Regulation Act (FCRA), once it obtains the necessary approvals.

Requirements to Register a Section 8 Company

If you're considering forming an NGO, here's how you can register a Section 8 company:

-

Minimum 2 Directors: At least two individuals are required to form a Section 8 company. One of them must be a resident of India.

-

No Minimum Capital: There is no minimum capital requirement for a Section 8 company, making it more accessible to smaller NGOs or charitable groups.

-

DIN and DSC: Directors must have a Director Identification Number (DIN) and a Digital Signature Certificate (DSC).

-

Name Approval: The proposed name must reflect the objectives of the NGO and should be approved by the Registrar of Companies (ROC).

-

MOA and AOA: The Memorandum of Association (MOA) and Articles of Association (AOA) should clearly outline the company’s objectives and operational rules.

-

License from MCA: Before incorporation, the applicants must obtain a special license from the Ministry of Corporate Affairs under Section 8 of the Companies Act.

How is a Section 8 Company Different from a Trust or Society?

While all three — Trusts, Societies, and Section 8 companies — can serve as NGOs, the Section 8 company stands out due to its legal structure and accountability. Trusts and societies are governed by state-specific laws and are often less regulated compared to Section 8 companies.

A Section 8 company must file annual returns and maintain proper books of accounts as per the Companies Act. This regular reporting enhances the NGO's credibility, especially when seeking donations or grants.

Limitations of a Section 8 Company

While there are many advantages, forming a Section 8 company also comes with certain challenges:

-

Compliance Costs: Regular filings and audits may increase operational costs.

-

Legal Formalities: The registration process is more time-consuming and complex compared to a trust or society.

-

Restrictions on Profit: A Section 8 company cannot distribute dividends or profits to its members.

Despite these limitations, many organizations prefer the Section 8 company structure for the legal protection, donor confidence, and institutional recognition it provides.

Final Thoughts

To conclude, a Section 8 company is not only eligible to be an NGO, but it is also one of the most favored forms for NGOs in India. The structure, regulation, and credibility associated with a Section 8 company make it a suitable choice for individuals or groups who are serious about social impact and long-term sustainability.

Whether you're planning to launch an educational charity, environmental initiative, or community development program, forming a Section 8 company could be the ideal legal route. It blends the mission-driven focus of an NGO with the organizational strength of a corporate entity — ensuring both impact and integrity.

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)

![How Smart PMs Scale Their Careers in Any Org [TPG Live Recap]](https://tpgblog.com/wp-content/uploads/2025/06/2025-06-12-thumbnail-action.png?#)