United States Online Grocery Market Insights 2025-2033| Growth & Opportunity Analysis

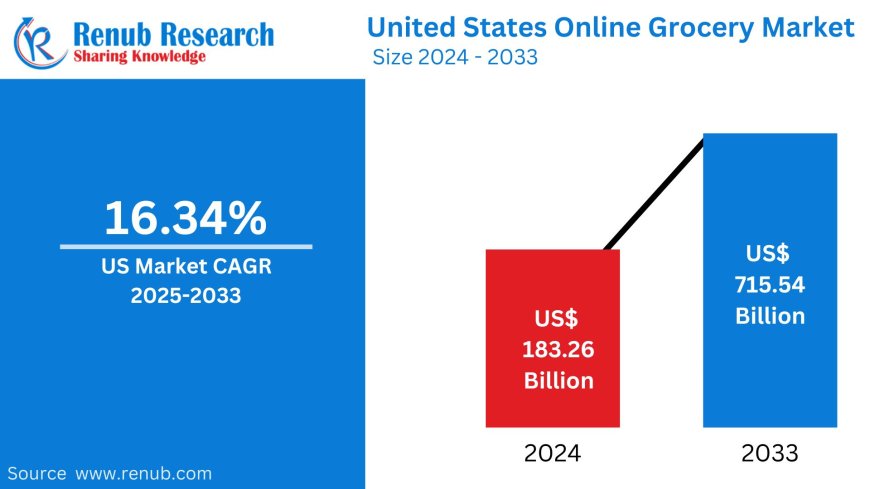

The United States online grocery market is projected to expand significantly, growing from US$ 183.26 Billion in 2024 to US$ 715.54 Billion by 2033, registering a CAGR of 16.34% during the forecast period (2025–2033).

United States Online Grocery Market Size and Share Analysis – Growth Trends and Forecast Report 2025–2033

Market Summary and Forecast

The United States online grocery market is projected to expand significantly, growing from US$ 183.26 Billion in 2024 to US$ 715.54 Billion by 2033, registering a CAGR of 16.34% during the forecast period (2025–2033). This growth is driven by increased consumer demand for convenience, technological innovation, and the widespread adoption of digital payment systems.

Market Definition

Online grocery refers to the purchase of food, beverages, and household products through digital platforms such as websites and mobile apps. It provides a convenient alternative to traditional in-store shopping, offering delivery or pickup services. This has become increasingly popular in the U.S., especially among busy professionals, elderly individuals, and people seeking contactless shopping solutions.

Key Market Trends and Drivers

1. Increasing Consumer Preference for Convenience

Consumer behavior in the United States is shifting towards solutions that offer greater convenience. Online grocery platforms provide flexible shopping experiences through home delivery, curbside pickup, and 24/7 accessibility. The integration of features like personalized recommendations and automatic reordering adds further value. According to the Meets Click and Mercatus Grocery Shopping Survey (November 2024), 77.8 million U.S. households shopped for groceries online—surpassing the pandemic-era high of 76.7 million in April 2020.

2. Technological Advancements & Digital Payments

Advancements in AI, machine learning, and real-time inventory management have optimized the online grocery experience. These innovations enable smart recommendations, efficient logistics, and automated restocking. Digital payment options like mobile wallets, Apple Pay, and Google Pay also support secure and rapid transactions. In December 2023, Instacart partnered with Fairway Market to launch "Fairway Now," a 30-minute grocery delivery service.

3. Growth of Subscription Services & Loyalty Programs

Subscription-based grocery models are increasingly popular, offering recurring deliveries, exclusive deals, and customizations. Loyalty programs are also helping retailers retain customers through reward points and discounts. As per The Bond Loyalty Report (2024), U.S. consumers held an average of 19 loyalty memberships, marking a 10-year high.

Market Challenges

1. Intense Competition and Price Sensitivity

The U.S. online grocery sector is crowded with players like Walmart, Kroger, Amazon, and niche startups. This has led to aggressive pricing, frequent promotions, and thin profit margins. Smaller retailers struggle to compete with the logistics and scale of large e-commerce firms.

2. Logistical and Delivery Constraints

Timely delivery of perishable items demands sophisticated cold chains and last-mile logistics. Failures in these areas can lead to spoilage, delays, and dissatisfied customers. Additionally, remote and rural regions present challenges for coverage and efficiency.

In-Depth Segment Analysis

United States Online Vegetables and Fruits Grocery Market

The demand for fresh, healthy, and organic produce is fueling growth in this segment. Consumers are increasingly purchasing locally sourced fruits and vegetables through online platforms. Retailers like The Fresh Market are expanding their presence, with new store launches in Washington, D.C., as of July 2024.

United States Online Subscription Purchase Grocery Market

This segment is expanding rapidly due to its convenience and value. Subscription services for groceries, meal kits, and health foods are particularly appealing to busy families and wellness-focused individuals. In April 2024, Amazon introduced a grocery subscription service for Prime members and SNAP beneficiaries, underscoring the market’s growth.

United States Click & Collect Grocery Market

Click & Collect blends digital ordering with physical pickup, providing flexibility and speed. It is especially appealing to time-pressed consumers. Walmart, in collaboration with DroneUp, launched an expanded drone delivery program in May 2022 to improve last-mile service, targeting 4 million homes across six states.

Market Segmentation

By Product:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat & Seafood

- Others

By Purchaser Type:

- Subscription Purchase

- One Time Purchase

By Delivery Type:

- Click & Collect

- Home Delivery

Key Companies Covered

Each company is profiled based on their:

- Company Overview

- Recent Developments

- Revenue Analysis

Major Players:

- Tesco Plc.

- Walmart Inc.

- Instacart

- The Kroger Co.

- Costco Wholesale Corporation

- Target Corporation

- FreshDirect

- Peapod Online Grocer, LLC

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)

![[PATREON EXCLUSIVE] The Power of No: How to Say It, Mean It, and Lead with It](https://tpgblog.com/wp-content/uploads/2025/06/just-say-no.jpg?#)