Will crypto replace banking? The Trump administration can’t decide

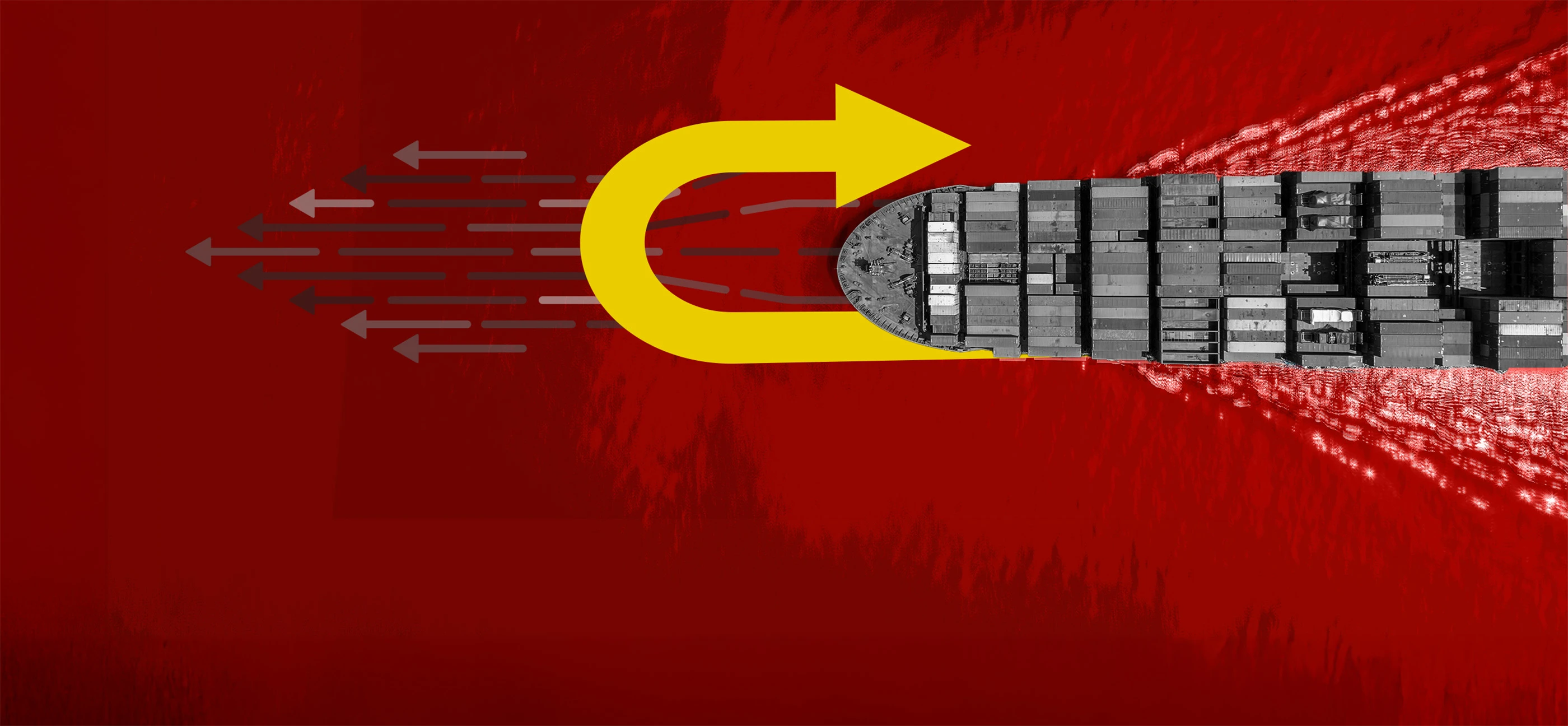

Last year, Donald Trump took the stage of the Las Vegas Bitcoin Conference to worship at the altar of cryptocurrency. He said he would fire Gary Gensler, the former chair of the Securities and Exchange Commission who led a yearslong crackdown on crypto fraud. The audience roared. He ended on a rousing note: “We will make America and Bitcoin bigger, better, stronger, richer, freer, and greater than ever before.” Some crypto activists were perturbed. Sure, Trump rallied behind Bitcoin as a source of industrial growth, but why wouldn’t he commit to outright replacing banking with digital currencies? Trump failed to comment on the traditional banks, which crypto advocates thought were discriminating against them by shutting down their accounts, or fiat currency, which some crypto boosters hope to replace entirely. One year later, President Trump skipped out on the Bitcoin Conference, but he sent his envoys. The administration’s crypto message has become even more muddled. While Vice President JD Vance emphasized that stablecoins regulated by the administration’s new crypto proposal (the GENIUS Act) don’t “threaten the integrity of the U.S. dollar,” Eric Trump said that he’d like to see some major banks “go extinct.” It seems no one will decide whether crypto is a strength to—or a replacement for—the U.S. financial system. Mixed signals at the 2025 Bitcoin Conference Vice President Vance headlined the conference, where he struck a similar tone to Trump’s 2024 speech. He emphasized that Bitcoin is part of the “mainstream economy,” calling it a digital asset—but not a currency. Vance also promoted the GENIUS Act, which would set regulations for currency or commodity-backed stablecoins (crypto currencies pegged to fiat currency or other reference asset) so they could flow more freely. The bill has already passed through the Senate, and is waiting for a House vote. Vance promised that these coins wouldn’t threaten the dollar. “Dollar-pegged stablecoins, particularly once GENIUS is enacted, are only going to help the American economy and [are] only going to help the American dollar,” he claimed. Central to Trump’s crypto strategy was the establishment of a Bitcoin reserve, allowing the government to collect and hold cryptocurrency from criminal or civil asset seizures. But whether this stockpile operates alongside, or in competition with dollar spending remains blurry. Bo Hines, the executive director of Trump’s digital assets advisory, spoke of Bitcoin as something the government could grow endlessly. “We want as much of it as we can possibly get,” he said at the conference. “We’re not going to sell any Bitcoin that we have in the U.S. government, period.” On the other hand, Trump’s crypto czar David Sacks was more measured in his words. He said that he “can’t promise anything,” but that he hoped the government would be able to buy more Bitcoin. “If either the Commerce Department or the Treasury Department can figure out how to fund it without adding to the debt, then they are allowed to create those programs,” he claimed. “Maybe find the money from some other program that’s not using it.” While they struck different tones, Vance, Hines, and Sacks all spoke of Bitcoin as an asset class. Whether it could constitute a new financial system—the currency’s original mission—was outside the question. But Eric Trump—while not an administration official, is certainly influential on Trump policy—claimed that crypto could replace banking entirely: “It makes everything cheaper, it makes it faster, it makes it safer, it makes it more transparent.” He said that he’d “love to see some of the big banks go extinct.” What does the Trump administration really think about Bitcoin? Trump has backed crypto expansion forcefully, but his rationale remains slippery. At the recent Blockworks Digital Asset Summit, Trump told the audience that they will “unleash an explosion of international growth,” but didn’t explain how, other than a brief reference to stablecoins supporting the dollar. “It is exciting to watch as you invent the future of finance,” Trump said, while not venturing to explain whether that future included traditional banks. Why is Trump so into crypto? Much of it is likely for personal gain. Trump has raked in millions on his memecoins and NFTs, sending cash directly to his wallet. Crypto advocates also helped Trump reach the White House in the first place. Their lobby has political heft: According to a New Yorker report, they tanked Katie Porter’s California Senate bid after she expressed mere glimmers of anti-crypto rhetoric. But there’s a political tension underlying Trump’s crypto push. If he says that crypto will replace banking—or even fiat currency—traditional financiers could riot. But, if he claims that Bitcoin is merely an asset class and not the future of finance, he could anger the crypto community. For now, Trump and his administration will try to sit on both si

Last year, Donald Trump took the stage of the Las Vegas Bitcoin Conference to worship at the altar of cryptocurrency. He said he would fire Gary Gensler, the former chair of the Securities and Exchange Commission who led a yearslong crackdown on crypto fraud. The audience roared. He ended on a rousing note: “We will make America and Bitcoin bigger, better, stronger, richer, freer, and greater than ever before.”

Some crypto activists were perturbed. Sure, Trump rallied behind Bitcoin as a source of industrial growth, but why wouldn’t he commit to outright replacing banking with digital currencies? Trump failed to comment on the traditional banks, which crypto advocates thought were discriminating against them by shutting down their accounts, or fiat currency, which some crypto boosters hope to replace entirely.

One year later, President Trump skipped out on the Bitcoin Conference, but he sent his envoys. The administration’s crypto message has become even more muddled. While Vice President JD Vance emphasized that stablecoins regulated by the administration’s new crypto proposal (the GENIUS Act) don’t “threaten the integrity of the U.S. dollar,” Eric Trump said that he’d like to see some major banks “go extinct.” It seems no one will decide whether crypto is a strength to—or a replacement for—the U.S. financial system.

Mixed signals at the 2025 Bitcoin Conference

Vice President Vance headlined the conference, where he struck a similar tone to Trump’s 2024 speech. He emphasized that Bitcoin is part of the “mainstream economy,” calling it a digital asset—but not a currency.

Vance also promoted the GENIUS Act, which would set regulations for currency or commodity-backed stablecoins (crypto currencies pegged to fiat currency or other reference asset) so they could flow more freely. The bill has already passed through the Senate, and is waiting for a House vote. Vance promised that these coins wouldn’t threaten the dollar. “Dollar-pegged stablecoins, particularly once GENIUS is enacted, are only going to help the American economy and [are] only going to help the American dollar,” he claimed.

Central to Trump’s crypto strategy was the establishment of a Bitcoin reserve, allowing the government to collect and hold cryptocurrency from criminal or civil asset seizures. But whether this stockpile operates alongside, or in competition with dollar spending remains blurry.

Bo Hines, the executive director of Trump’s digital assets advisory, spoke of Bitcoin as something the government could grow endlessly. “We want as much of it as we can possibly get,” he said at the conference. “We’re not going to sell any Bitcoin that we have in the U.S. government, period.”

On the other hand, Trump’s crypto czar David Sacks was more measured in his words. He said that he “can’t promise anything,” but that he hoped the government would be able to buy more Bitcoin. “If either the Commerce Department or the Treasury Department can figure out how to fund it without adding to the debt, then they are allowed to create those programs,” he claimed. “Maybe find the money from some other program that’s not using it.”

While they struck different tones, Vance, Hines, and Sacks all spoke of Bitcoin as an asset class. Whether it could constitute a new financial system—the currency’s original mission—was outside the question. But Eric Trump—while not an administration official, is certainly influential on Trump policy—claimed that crypto could replace banking entirely: “It makes everything cheaper, it makes it faster, it makes it safer, it makes it more transparent.” He said that he’d “love to see some of the big banks go extinct.”

What does the Trump administration really think about Bitcoin?

Trump has backed crypto expansion forcefully, but his rationale remains slippery. At the recent Blockworks Digital Asset Summit, Trump told the audience that they will “unleash an explosion of international growth,” but didn’t explain how, other than a brief reference to stablecoins supporting the dollar. “It is exciting to watch as you invent the future of finance,” Trump said, while not venturing to explain whether that future included traditional banks.

Why is Trump so into crypto? Much of it is likely for personal gain. Trump has raked in millions on his memecoins and NFTs, sending cash directly to his wallet. Crypto advocates also helped Trump reach the White House in the first place. Their lobby has political heft: According to a New Yorker report, they tanked Katie Porter’s California Senate bid after she expressed mere glimmers of anti-crypto rhetoric.

But there’s a political tension underlying Trump’s crypto push. If he says that crypto will replace banking—or even fiat currency—traditional financiers could riot. But, if he claims that Bitcoin is merely an asset class and not the future of finance, he could anger the crypto community.

For now, Trump and his administration will try to sit on both sides of the fence.