Best Small Cap Stocks to Buy in India (2025)

Explore the best small cap stocks to buy and learn how the best algo trading software in India can help. Discover smart picks and strategies today!

Best Small Cap Stocks to Buy in India – A Beginner’s Guide with a Smart Twist

Investing in small-cap stocks is like planting saplings in your garden—at first, they’re tiny and fragile, but with the right care, they might grow into mighty oaks. If you're looking to multiply your wealth and aren’t afraid of a little risk, this guide is exactly what you need. Plus, we'll show you how using the best algorithmic trading software India has to offer can supercharge your strategy!

Whether you're a newbie just dipping your toes or someone already exploring the markets, knowing the best small cap stocks to buy can be a game changer. And if you love automation and precision, pairing your picks with the best algo trading software in India might just be your secret weapon.

Explore the best small cap stocks to buy and learn how the best algo trading software in India can help. Discover smart picks and strategies today!

What Are Small Cap Stocks?

Small cap stocks refer to companies with a relatively small market capitalization—typically between ₹500 crore and ₹5,000 crore. These are not tiny startups, but they’re not industry giants either. Think of them as agile underdogs with immense potential.

Why Consider Small Cap Stocks?

Imagine betting on the next big thing before everyone else notices. That’s what small-cap investing offers. These stocks often have:

-

High growth potential

-

Lower entry cost

-

Less analyst coverage (which means hidden gems!)

Of course, where there’s potential, there’s also risk.

Risk vs Reward: The Small Cap Balancing Act

While small cap stocks can offer multi-bagger returns, they’re also more volatile. These companies may be more vulnerable during market downturns or face scalability challenges.

So, ask yourself: Are you ready for a bumpy but possibly rewarding ride?

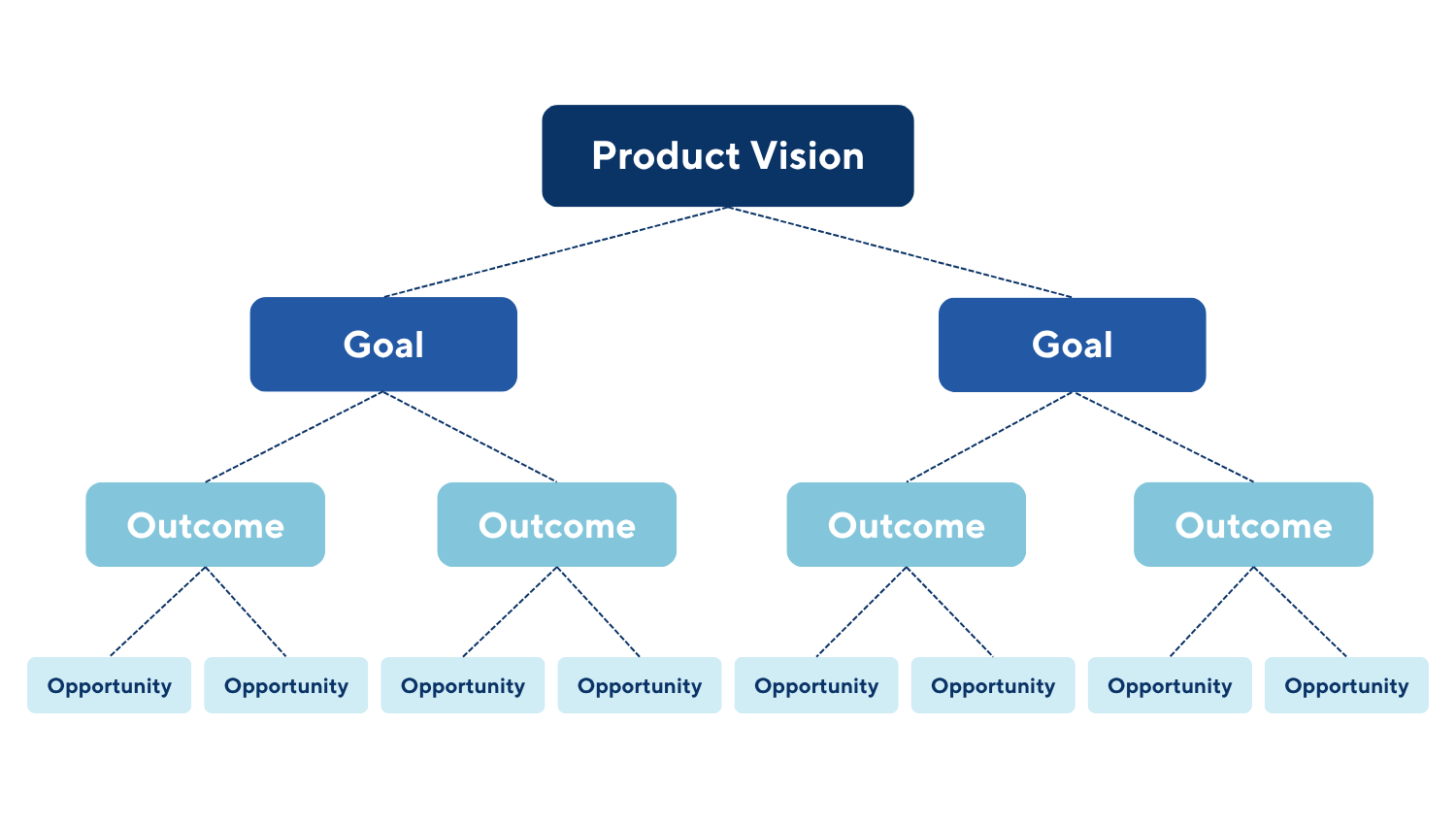

How to Identify the Best Small Cap Stocks to Buy

Here’s a simple framework:

-

Solid fundamentals (good debt-to-equity ratio, consistent revenue)

-

Competent management

-

Scalable business model

-

Sectoral tailwinds (emerging industries or post-pandemic rebounds)

-

Volume trends and technical breakout signals

Using the best algorithmic trading software India provides can help you screen these faster and with fewer emotional biases.

Top 10 Best Small Cap Stocks to Buy in 2025

(Note: These are examples and not investment advice. Always do your own research or consult a financial advisor.)

1. Greenpanel Industries – Riding the real estate and interiors boom

2. Vaibhav Global – Export-oriented jewelry & accessories player

3. IIFL Securities – Beneficiary of rising retail participation

4. KRBL Ltd. – India's largest basmati rice exporter

5. Kiri Industries – Specialty chemicals with a strong global footprint

6. Caplin Point Labs – Undervalued pharma export story

7. Apar Industries – Leader in conductors & cables

8. Tejas Networks – High potential in telecom infra

9. Nocil Ltd. – Rubber chemicals and a proxy to auto growth

10. Rategain Travel – A tech stock benefitting from the global travel comeback

How to Research Small Cap Stocks Like a Pro

No need to be Warren Buffet. Just follow a checklist:

-

Read Annual Reports

-

Track quarterly results

-

Monitor promoter holdings

-

Look for increasing ROE & ROCE

-

Stay updated on macro trends impacting the sector

Sectors Where Small Caps Shine Bright

Small caps aren’t evenly spread across all sectors. Here are a few sectors where they often punch above their weight:

-

Renewable Energy

-

Pharma & Biotech

-

Specialty Chemicals

-

Consumer Durables

-

IT Services & SaaS

These sectors have strong growth levers and are often favored by smart investors.

Common Mistakes to Avoid with Small Cap Investing

-

Chasing past returns (what went up may not continue)

-

Falling for rumors or pump-and-dump tips

-

Neglecting exit strategies

-

Over-concentration in one stock or sector

Using the Best Algo Trading Software in India

Now, let’s bring in the cool tech. Algorithmic trading is like having a robot assistant that never sleeps, watches the market 24/7, and makes moves based on data—not emotions.

Want to automate entries, exits, or even run backtests? The best algo trading software in India can help you make smarter decisions, faster.

Best Algorithmic Trading Software India: Top Picks

Here are some of the best algorithmic trading software India offers:

-

Quanttrix – Ideal for beginners and experts; powerful AI & strategy builder

-

AlgoTest – Great for backtesting NSE strategies

-

Tradetron – Cloud-based, user-friendly interface for retail traders

-

Streak by Zerodha – Seamless for Zerodha users

-

AmiBroker – Best for coders and pros needing deep customization

Each tool has unique features—some offer drag-and-drop bots, while others require coding.

. How Algo Trading Helps with Small Cap Investments

While large caps are liquid and less volatile, small caps are unpredictable. Here’s how algo trading helps:

-

Automated stop losses to reduce risk

-

Backtesting strategies on historical data

-

Momentum or breakout alerts

-

Custom alerts for news or earnings updates

-

Emotion-free execution

Comparing Manual vs Algorithmic Strategies

|

Feature |

Manual Trading |

Algorithmic Trading |

|

Speed |

Slower |

Lightning fast |

|

Emotion Involved |

High |

None |

|

Scalability |

Limited |

High |

|

Data Use |

Basic |

Advanced |

|

Monitoring |

Continuous required |

Automated |

So, if you're planning to actively trade best small cap stocks to buy, why not get a robotic ally on your side?

Building a Diversified Small Cap Portfolio

Diversification is your safety net. Don’t put all your chips on one stock. Instead:

-

Pick 5–7 high-potential stocks

-

Diversify across sectors

-

Allocate based on conviction and risk tolerance

Also, rebalance your portfolio at least every 6–12 months.

Long-Term vs Short-Term Gains in Small Caps

Long-term = Wealth Creation

Short-term = Volatility and Opportunity

Use long-term investing for fundamentally strong small caps and short-term trading (with help from algo tools) for swing trades or breakouts.

Final Thoughts: Should You Dive into Small Caps?

If you’ve got the stomach for volatility and a thirst for discovery, small cap investing could be a thrilling ride. Combine this adventurous spirit with the precision of the best algo trading software in India, and you’ve got a recipe that could work wonders.

But remember: smart investing is not just about making money—it’s about not losing it foolishly. So always research well, start small, and let your experience guide your journey.

FAQs

Are small cap stocks suitable for beginners?

Yes, but only with proper research and risk management. Beginners should start with small allocations and build up as they gain confidence.

Can I trade small cap stocks using algo trading software?

Absolutely! Many of the best algorithmic trading software India offers support small cap stock strategies with alerts, automation, and backtesting.

Is algo trading legal in India?

Yes, algorithmic trading is fully legal and regulated by SEBI. Ensure your platform complies with the guidelines.

Which is better for small caps: long-term investing or short-term trading?

It depends on your strategy. Long-term holds benefit from compounding; short-term trading works well if backed by data and discipline.

How much should I invest in small cap stocks?

A safe thumb rule is 10–20% of your equity portfolio. Adjust based on your risk appetite and experience.

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)

![[PATREON EXCLUSIVE] The Power of No: How to Say It, Mean It, and Lead with It](https://tpgblog.com/wp-content/uploads/2025/06/just-say-no.jpg?#)