Homebuilder unsold inventory swells to 2009 levels: Housing markets to watch

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Last month, in an address to investors, D.R. Horton CEO Paul Romanowski said the spring 2025 selling season is getting off to a slower-than-usual start for the nation’s largest homebuilder. “This year’s spring selling season started slower than expected as potential homebuyers have been more cautious due to continued affordability constraints and declining consumer confidence,” Romanowski said on the company’s earnings call. It isn’t just D.R. Horton. “Demand at the start of this spring’s selling season was more muted than what we have seen historically, despite a healthy level of traffic in our communities,” wrote Jeffrey Mezger, CEO of KB Home, in the company’s Q1 2025 earnings report. “In mid-February, we took steps to reposition our communities to offer the most compelling value, and buyers responded favorably to these adjustments.” Last quarter, Lennar spent the equivalent of 13% of home sales on buyer incentives—up from 1.5% in Q2 2022 at the height of the pandemic housing boom. A 13% incentive on a $400,000 home translates to $52,000 in incentives. This softer housing demand is causing unsold inventory to tick up. Indeed, since the pandemic housing boom fizzled out, the number of unsold completed U.S. new single-family homes has been rising: April 2018: 61,000 April 2019: 77,000 April 2020: 78,000 April 2021: 33,000 April 2022: 34,000 April 2023: 69,000 April 2024: 89,000 April 2025: 117,000 The April figure (117,000 unsold completed new homes) published last week is the highest level since July 2009 (126,000). Let’s take a closer look at the data to better understand what this could mean. ResiClub’s Finished Homes Supply Index puts the number of unsold completed new single-family homes into historic context. The index is one simple calculation: The number of unsold completed U.S. new single-family homes divided by the annualized rate of U.S. single-family housing starts. A higher index score indicates a softer national new construction market with greater supply slack, while a lower index score signifies a tighter new construction market with less supply slack. If you look at unsold completed single-family new builds as a share of single-family housing starts (see chart below), it still shows we’ve gained slack; however, it puts us closer to pre-pandemic 2019 levels than the 2007 to 2009 financial crisis. While the U.S. Census Bureau doesn’t give us a greater market-by-market breakdown on these unsold new builds, we have a good idea where they are based on where total active inventory homes for sale (including existing) has spiked above pre-pandemic 2019 levels. Most of those areas are in the Sun Belt around the Gulf. Some builders are experiencing pricing pressure, particularly in major housing markets like Florida and Texas, where resale inventory remains significantly higher than pre-pandemic levels. Big picture: There’s greater slack in the new-construction market now than a few years ago, giving buyers some leverage in certain markets to negotiate better deals with homebuilders.

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Last month, in an address to investors, D.R. Horton CEO Paul Romanowski said the spring 2025 selling season is getting off to a slower-than-usual start for the nation’s largest homebuilder.

“This year’s spring selling season started slower than expected as potential homebuyers have been more cautious due to continued affordability constraints and declining consumer confidence,” Romanowski said on the company’s earnings call.

It isn’t just D.R. Horton.

“Demand at the start of this spring’s selling season was more muted than what we have seen historically, despite a healthy level of traffic in our communities,” wrote Jeffrey Mezger, CEO of KB Home, in the company’s Q1 2025 earnings report. “In mid-February, we took steps to reposition our communities to offer the most compelling value, and buyers responded favorably to these adjustments.”

Last quarter, Lennar spent the equivalent of 13% of home sales on buyer incentives—up from 1.5% in Q2 2022 at the height of the pandemic housing boom. A 13% incentive on a $400,000 home translates to $52,000 in incentives.

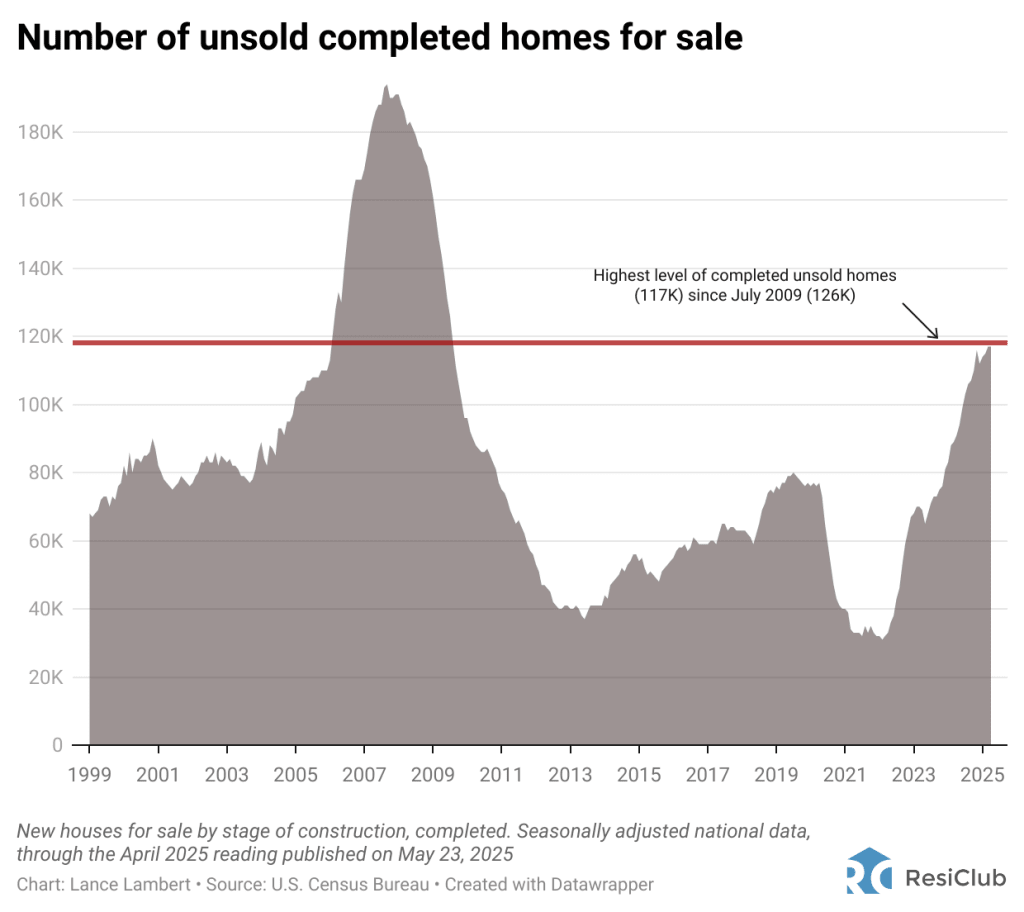

This softer housing demand is causing unsold inventory to tick up. Indeed, since the pandemic housing boom fizzled out, the number of unsold completed U.S. new single-family homes has been rising:

April 2018: 61,000

April 2019: 77,000

April 2020: 78,000

April 2021: 33,000

April 2022: 34,000

April 2023: 69,000

April 2024: 89,000

April 2025: 117,000

The April figure (117,000 unsold completed new homes) published last week is the highest level since July 2009 (126,000).

Let’s take a closer look at the data to better understand what this could mean.

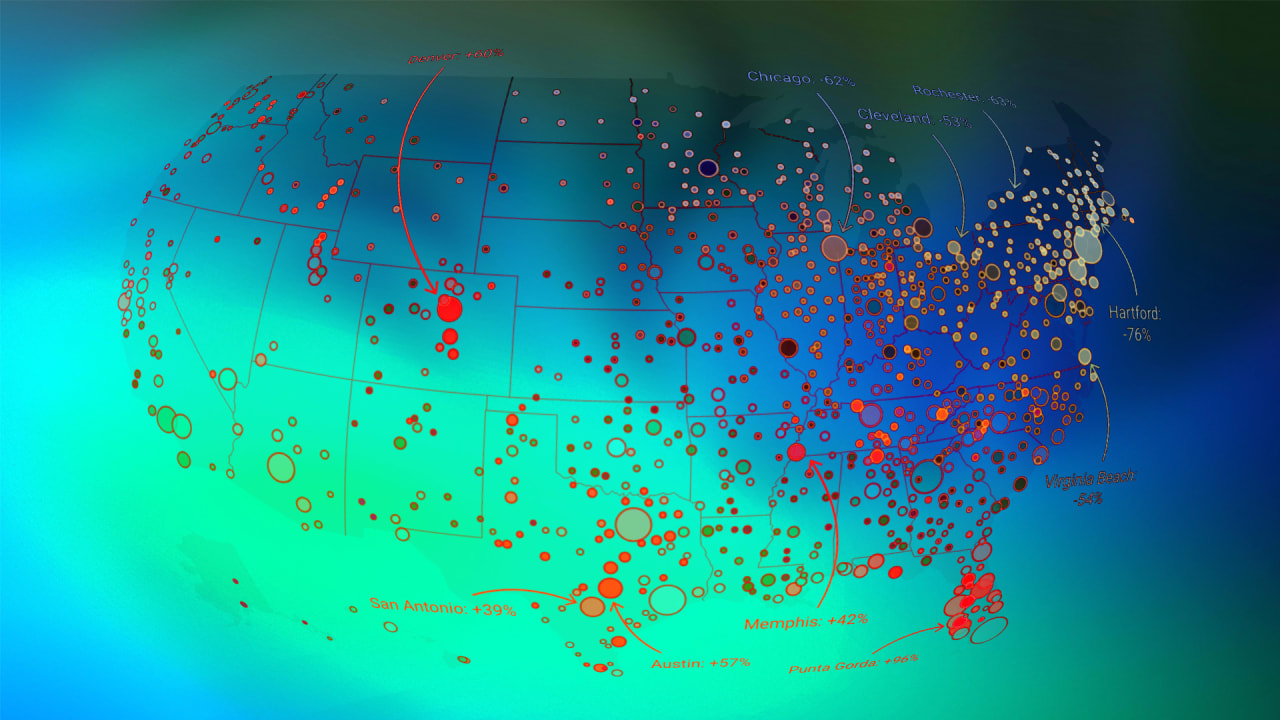

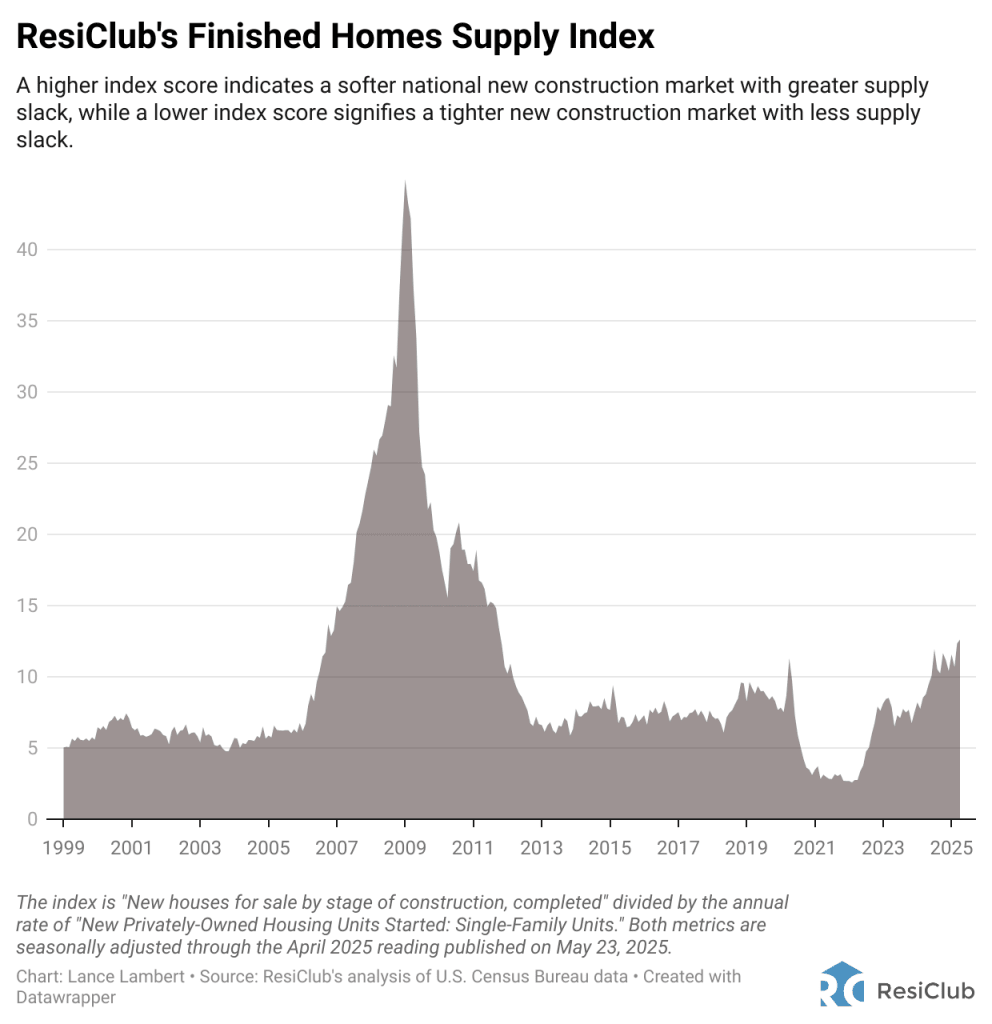

ResiClub’s Finished Homes Supply Index puts the number of unsold completed new single-family homes into historic context.

The index is one simple calculation: The number of unsold completed U.S. new single-family homes divided by the annualized rate of U.S. single-family housing starts.

A higher index score indicates a softer national new construction market with greater supply slack, while a lower index score signifies a tighter new construction market with less supply slack.

If you look at unsold completed single-family new builds as a share of single-family housing starts (see chart below), it still shows we’ve gained slack; however, it puts us closer to pre-pandemic 2019 levels than the 2007 to 2009 financial crisis.

While the U.S. Census Bureau doesn’t give us a greater market-by-market breakdown on these unsold new builds, we have a good idea where they are based on where total active inventory homes for sale (including existing) has spiked above pre-pandemic 2019 levels. Most of those areas are in the Sun Belt around the Gulf.

Some builders are experiencing pricing pressure, particularly in major housing markets like Florida and Texas, where resale inventory remains significantly higher than pre-pandemic levels.

Big picture: There’s greater slack in the new-construction market now than a few years ago, giving buyers some leverage in certain markets to negotiate better deals with homebuilders.