Mastercard partners with Fiserv to support new FIUSD token as stablecoin competition is expected to grow

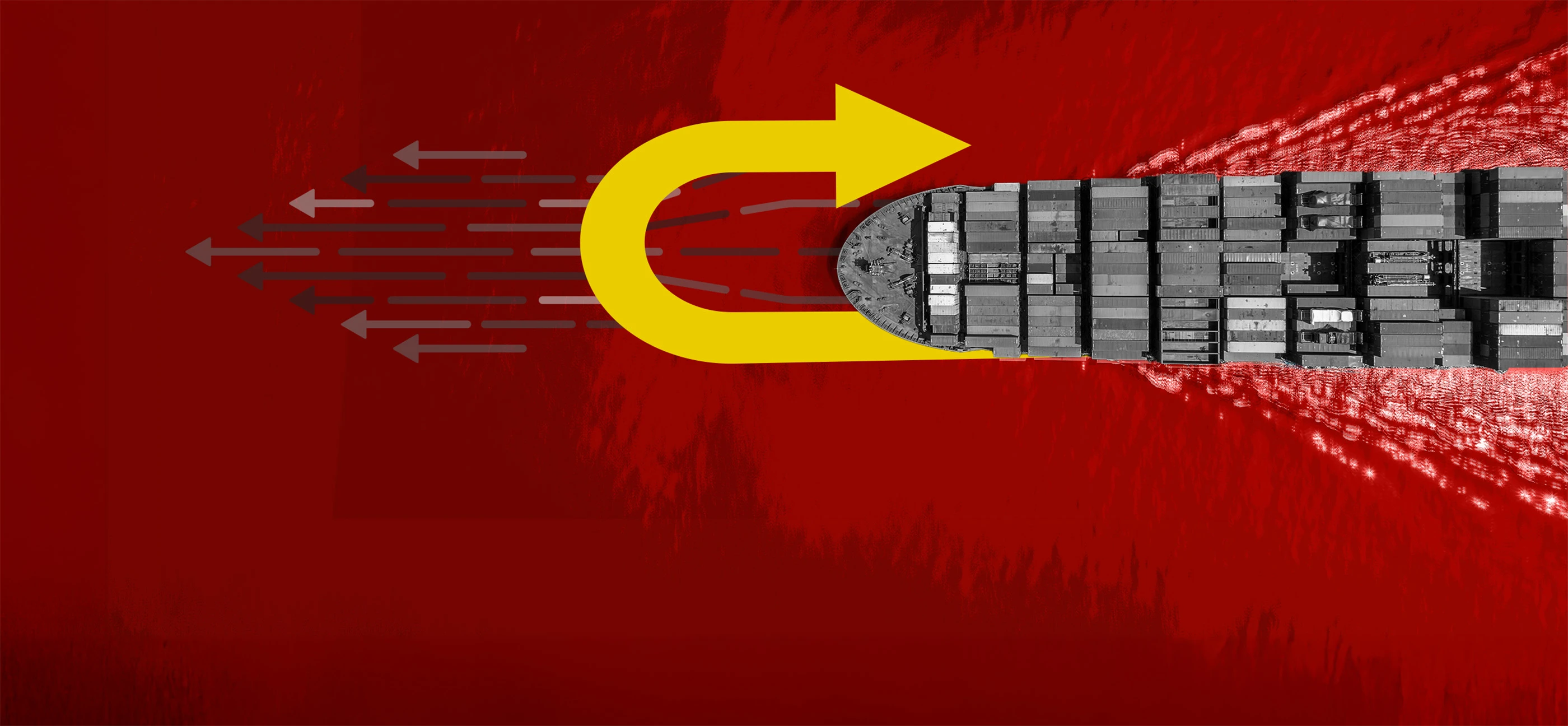

Mastercard has announced a partnership with global fintech Fiserv’s new stablecoin, FIUSD, in an effort to make the stabilized cryptocurrency “mainstream.” The multinational card provider plans to integrate the token across its global payments network, including stablecoin-linked cards, on- and off-ramping of funds, and global acquirers. “This work with Fiserv is setting the stage for a new era, where stablecoins are as ubiquitous and trusted as fiat currencies, driving choice and innovation for all,” Chiro Aikat, co-president, Americas at Mastercard, said in a statement. “Leveraging the power of the Mastercard network, as well as our deep capabilities across digital assets, we are creating a robust ecosystem that bridges traditional financial services with digital assets.” As of this afternoon, Fiserv stocks are up nearly 1%, while Mastercard stock is up 2.59%. This news comes the same day that stock for the largest stablecoin provider, Circle Internet Group (CRCL), is down nearly 15% as of Tuesday afternoon, just weeks after the company’s initial public offer (IPO) surged in its market debut—when stock was trading 706% above the IPO price. The move comes after an analyst note from Compass Point suggested recent regulatory action could encourage increased competition in the stablecoin industry. What’s the latest on stablecoins? Stablecoins are growing in popularity as a more stable cryptocurrency option, due to their value being tied to external commodities like gold or currencies like the U.S. dollar. The recently Senate-passed GENIUS Act would set standards for stablecoins and would ultimately allow for other card providers to widely implement them in their processes. Supporters of the bill say it would encourage more stablecoin competition and consumer protection, while those in opposition position the bill as too “industry-friendly” and financially beneficial for the current presidential administration. “To date, stablecoins have largely been a store of value,” Takis Georgakopoulos, chief operating officer of Fiserv, said. “Our work with Mastercard is promoting greater reach and utility of stablecoins by helping our financial institutions and merchants enable greater payments choice to their customers.” Other finance and banking giants like JPMorgan Chase, Bank of America, and WellsFargo have also begun to delve further into the world of stablecoins through joint partnerships, demonstrating the foothold that the cryptocurrency may be taking in the market.

Mastercard has announced a partnership with global fintech Fiserv’s new stablecoin, FIUSD, in an effort to make the stabilized cryptocurrency “mainstream.”

The multinational card provider plans to integrate the token across its global payments network, including stablecoin-linked cards, on- and off-ramping of funds, and global acquirers.

“This work with Fiserv is setting the stage for a new era, where stablecoins are as ubiquitous and trusted as fiat currencies, driving choice and innovation for all,” Chiro Aikat, co-president, Americas at Mastercard, said in a statement. “Leveraging the power of the Mastercard network, as well as our deep capabilities across digital assets, we are creating a robust ecosystem that bridges traditional financial services with digital assets.”

As of this afternoon, Fiserv stocks are up nearly 1%, while Mastercard stock is up 2.59%.

This news comes the same day that stock for the largest stablecoin provider, Circle Internet Group (CRCL), is down nearly 15% as of Tuesday afternoon, just weeks after the company’s initial public offer (IPO) surged in its market debut—when stock was trading 706% above the IPO price. The move comes after an analyst note from Compass Point suggested recent regulatory action could encourage increased competition in the stablecoin industry.

What’s the latest on stablecoins?

Stablecoins are growing in popularity as a more stable cryptocurrency option, due to their value being tied to external commodities like gold or currencies like the U.S. dollar.

The recently Senate-passed GENIUS Act would set standards for stablecoins and would ultimately allow for other card providers to widely implement them in their processes.

Supporters of the bill say it would encourage more stablecoin competition and consumer protection, while those in opposition position the bill as too “industry-friendly” and financially beneficial for the current presidential administration.

“To date, stablecoins have largely been a store of value,” Takis Georgakopoulos, chief operating officer of Fiserv, said. “Our work with Mastercard is promoting greater reach and utility of stablecoins by helping our financial institutions and merchants enable greater payments choice to their customers.”

Other finance and banking giants like JPMorgan Chase, Bank of America, and WellsFargo have also begun to delve further into the world of stablecoins through joint partnerships, demonstrating the foothold that the cryptocurrency may be taking in the market.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![Senior Support Engineer - US West [IC3] at Sourcegraph](

https://nodesk.co/remote-companies/assets/logos/sourcegraph.f91af2c37bfa65f4a3a16b8d500367636e2a0fa3f05dcdeb13bf95cf6de09046.png

)