Is the US Housing Market Heading for a Crash or Correction?

The US housing market has been a hot topic in recent years, with skyrocketing home prices, rising mortgage rates, and economic uncertainty leaving many wondering: Are we headed for a crash, or is a market correction on the horizon?

Understanding the difference between a crash and a correction is crucial for buyers, sellers, and investors. Let’s break down the key factors influencing the market and what they could mean for the future.

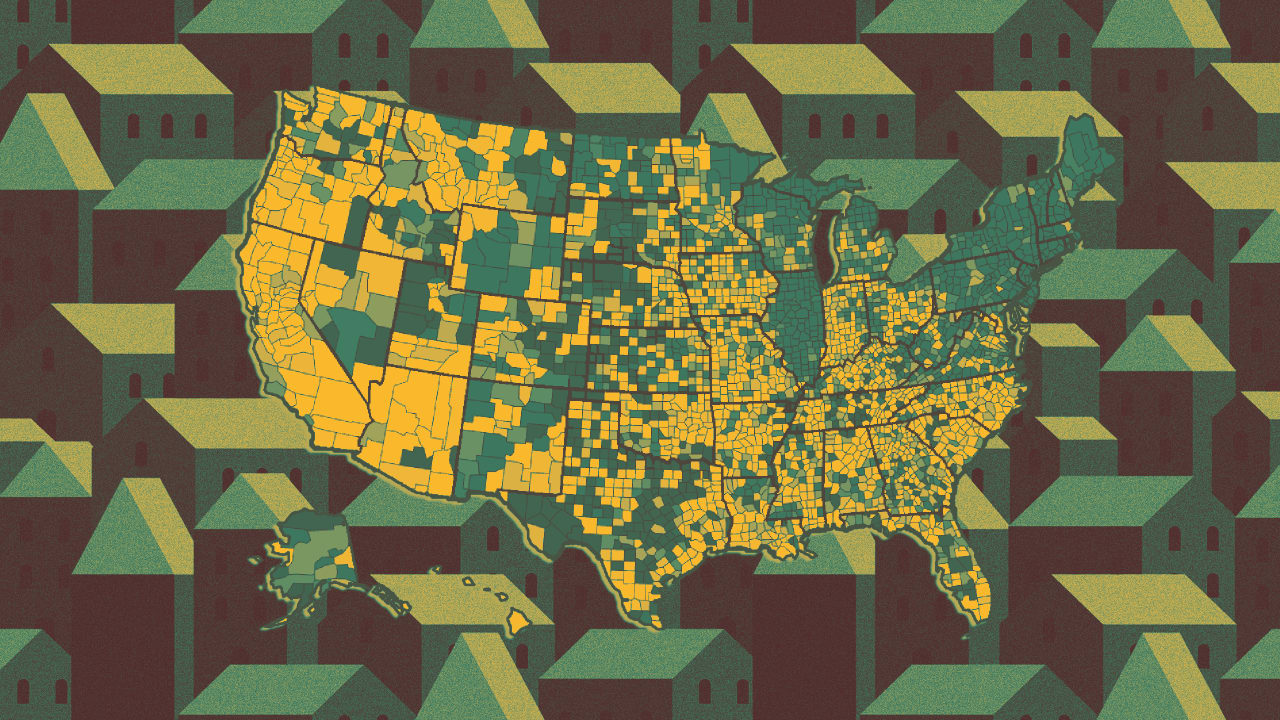

Current State of the US Housing Market

Over the past few years, the US housing market has seen unprecedented growth, driven by:

-

Low mortgage rates during the pandemic

-

High demand from millennials entering the market

-

Limited housing supply due to construction delays

However, recent trends suggest a shift:

-

Mortgage rates have risen sharply, making home loans more expensive

-

Home price growth has slowed in many markets

-

Inventory levels are improving, but affordability remains a challenge

Crash vs. Correction: What’s the Difference?

1. Housing Market Crash

A crash is a sudden, steep decline in home prices—often due to economic shocks, speculative bubbles, or financial crises (like the 2008 housing crash). Key indicators of a potential crash include:

-

Massive overvaluation of homes

-

High foreclosure rates

-

Banking instability

Currently, most experts believe a full-blown crash is unlikely because:

-

Lending standards are stricter than in 2008

-

Homeowners have strong equity positions

-

Demand still outweighs supply in many areas

2. Housing Market Correction

A correction is a moderate decline in prices (typically 10% or less) to balance overvaluation. Signs of a correction include:

-

Slowing price growth

-

Longer time on market for listings

-

More price reductions

Many economists predict a correction rather than a crash, as the market adjusts to higher interest rates and economic conditions.

Key Factors That Could Shape the Market

1. Mortgage Rates & Affordability

The Federal Reserve’s rate hikes have pushed mortgage rates to multi-decade highs. If rates stabilize or drop, demand could rebound.

2. Economic Conditions

A recession could weaken buyer demand, while strong job growth could sustain it.

3. Housing Supply

If construction accelerates and more homes hit the market, prices could stabilize.

4. Investor Activity

Large investors buying single-family homes could keep prices elevated in some areas.

What Should Buyers & Sellers Do?

For Buyers:

-

Be patient—wait for better rates or price adjustments

-

Get pre-approved to strengthen your position

-

Focus on long-term value rather than short-term market swings

For Sellers:

-

Price competitively to attract buyers in a slower market

-

Consider incentives like rate buydowns

-

Be flexible with negotiations

Final Thoughts: A Balanced Outlook

While a housing crash seems unlikely, a moderate correction is possible as the market adjusts to higher borrowing costs. The best strategy? Stay informed, work with trusted real estate professionals, and make decisions based on long-term goals.

For expert insights and investment opportunities in today’s shifting market, explore Avenza Land—your partner in smart real estate decisions.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)