Middle Office Outsourcing Market Size, Share, Trends, Key Drivers, Growth Opportunities and Competitive Outlook

Middle Office Outsourcing Market Size, Share, Trends, Key Drivers, Growth Opportunities and Competitive Outlook

**Introduction**

Middle office outsourcing refers to the practice of delegating non-client-facing functions such as risk management, compliance, trade processing, data management, and performance analytics to third-party service providers. This outsourcing enables financial institutions, especially asset managers, hedge funds, and investment banks, to streamline operations, reduce costs, and focus on core activities. Middle office functions act as a critical bridge between the front office, which handles trading and client interactions, and the back office, which manages settlements and recordkeeping. As financial services face increasing regulatory pressures and technological complexity, middle office outsourcing has become a strategic move to achieve operational efficiency and risk reduction.

More Info- https://www.databridgemarketresearch.com/reports/global-middle-office-outsourcing-market

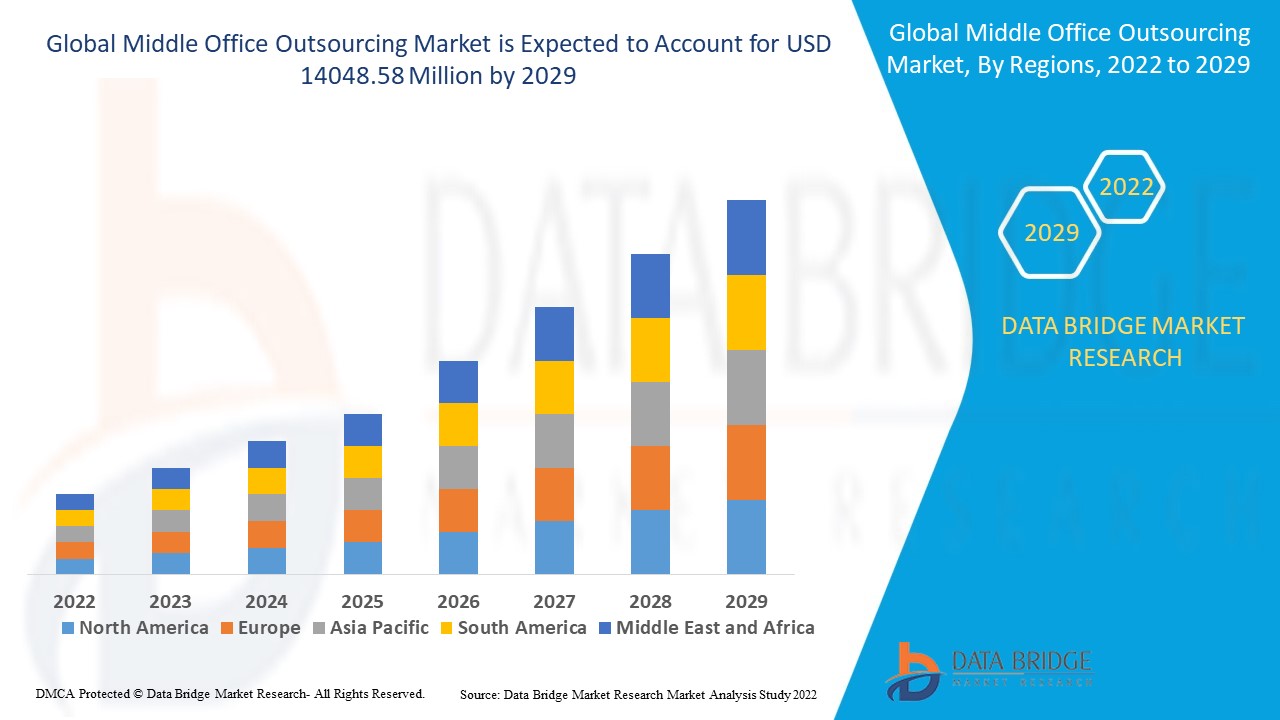

**Market Size**

The global middle office outsourcing market was valued at approximately USD 6.9 billion in 2024. With the rapid adoption of cloud-based platforms, AI-powered data analytics, and advanced risk management tools, the market is forecasted to reach nearly USD 12.4 billion by 2032. The compound annual growth rate (CAGR) is projected at around 7.5% during the forecast period. North America holds the largest market share, accounting for over 40% of global revenue due to its mature financial infrastructure and early adoption of outsourcing practices. Europe follows closely, driven by strict regulatory frameworks and operational cost pressures. The Asia-Pacific region is expected to grow at the highest CAGR due to the expansion of financial markets and digital transformation initiatives in countries like China, India, and Singapore.

**Market Share**

Leading market participants dominate the middle office outsourcing space by offering integrated platforms and specialized services. Key players include State Street Corporation, Citigroup Inc., JPMorgan Chase & Co., BNP Paribas, Northern Trust Corporation, BNY Mellon, and SS\&C Technologies. These companies collectively hold more than 60% of the market share due to their broad service portfolios, global client base, and strong IT infrastructure. State Street leads the market with its end-to-end servicing platform and long-standing relationships with major asset managers. SS\&C Technologies holds a significant share in the hedge fund outsourcing segment owing to its robust fund administration capabilities. Mid-tier service providers and fintech firms are gradually entering the market, targeting niche services such as ESG compliance, real-time risk analytics, and AI-driven data insights.

**Market Trends**

The market is witnessing several notable trends. The most prominent is the increasing adoption of digital technologies such as robotic process automation (RPA), machine learning, and artificial intelligence (AI) to automate complex middle office tasks. Cloud-based outsourcing platforms are gaining traction, offering flexibility, scalability, and faster deployment. Another trend is the rise in demand for customized outsourcing solutions tailored to specific client requirements rather than one-size-fits-all services. There is also a shift toward outcome-based service level agreements (SLAs), where providers are accountable for delivering predefined results. Environmental, Social, and Governance (ESG) analytics are emerging as a vital function within middle office operations, prompting providers to include ESG data processing in their service offerings. Regulatory technology (RegTech) integration is another key trend, especially for compliance and anti-money laundering (AML) functions. The increasing complexity of global regulations like MiFID II, Dodd-Frank, and GDPR is making regulatory reporting a core middle office function.

**Market Growth**

The middle office outsourcing market is experiencing steady growth, driven by increasing cost pressures and the need for operational agility. Financial institutions are recognizing that managing middle office functions in-house leads to high fixed costs, limited scalability, and a lack of access to specialized expertise. Outsourcing enables firms to convert fixed costs into variable costs and access the latest technologies without large capital investments. Small and medium-sized firms, in particular, are leveraging outsourcing to compete with larger players by gaining access to institutional-grade operations. The market is also growing due to the increasing demand for real-time analytics, customized reporting, and seamless integration between front and back office systems. Additionally, the COVID-19 pandemic accelerated digital transformation and remote working models, further increasing the reliance on outsourced solutions that offer resilience and scalability.

**Market Demand**

Demand for middle office outsourcing is surging across various segments of the financial services industry. Asset management firms account for the largest share of demand, followed by hedge funds, insurance companies, and wealth management firms. These entities face growing data volumes, compliance requirements, and client reporting expectations. As a result, they are turning to outsourcing partners to handle data aggregation, reconciliation, performance measurement, attribution analysis, and regulatory reporting. Hedge funds are increasingly outsourcing middle office functions to focus on alpha generation and reduce non-core operational burdens. Institutional investors are also pressuring their service providers to ensure timely and accurate reporting, creating further demand for advanced middle office services. The demand is particularly high in markets with complex regulatory environments and fast-growing financial sectors, such as the United States, United Kingdom, Germany, Singapore, and Hong Kong.

**Factors Driving Growth**

Several factors are propelling the growth of the middle office outsourcing market.

1. **Regulatory Complexity**: The global financial industry is subjected to an evolving and complex regulatory landscape. Compliance with regulations such as Basel III, Solvency II, and FATCA requires robust data handling and reporting capabilities, which outsourcing providers are better positioned to deliver.

2. **Technological Advancements**: The integration of AI, big data, blockchain, and cloud computing into middle office services is enhancing accuracy, speed, and transparency. Financial firms are increasingly seeking providers with advanced technological capabilities to manage their operations.

3. **Cost Optimization**: Outsourcing allows firms to reduce fixed operational costs and redirect resources to strategic priorities. It eliminates the need for expensive infrastructure, skilled labor, and software maintenance.

4. **Focus on Core Competencies**: Financial institutions are outsourcing middle office functions to focus on client engagement, investment strategies, and revenue-generating activities. This strategic reallocation improves business performance and competitiveness.

5. **Scalability and Flexibility**: Outsourced solutions offer the flexibility to scale operations up or down based on business needs and market conditions. This is particularly valuable in volatile market environments.

6. **Data-Driven Decision-Making**: The demand for real-time, data-driven insights has increased the importance of efficient data management. Outsourcing partners provide advanced analytics tools and dashboards that support timely decision-making.

7. **Globalization of Financial Services**: As financial institutions expand into emerging markets, they require localized support with global standards. Outsourcing providers with international reach offer consistent service delivery across regions.

8. **Shortage of Skilled Talent**: The middle office functions require specialized knowledge in areas such as compliance, risk management, and financial modeling. Outsourcing addresses the talent shortage by giving firms access to experienced professionals.

The middle office outsourcing market is poised for sustained growth as financial institutions continue to seek solutions that offer efficiency, compliance, and innovation. Providers that invest in technology, customization, and client-centric service models are expected to lead the next phase of market evolution.

Browse Trending Reports:

Amino Acid in Dietary Supplements Market

Two Wheeler Lead Acid Batteries Market

Near Field Communication (NFC) Chip Market

Aerospace and Defense C Class Parts Market

Poultry Compound Feed Market

Surgical Clips Market

Primary Pulmonary Hypertension (PPH) Treatment Market

Renewable Plastic Packaging Market

Space Situational Awareness Market

Ferroelectric Random-Access Memory (FRAM) Market

Artificial Intelligence (AI) Insurtech Market

Programmable Electronic Commercial Beverage Blender Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)