Off Plan Projects and Off plan Properties: A Strategic Investment Approach

Discover the benefits and risks of investing in off plan projects and off plan properties. Learn how to capitalize on flexible payment plans, lower entry costs, and potential capital growth

In the dynamic world of real estate, few investment strategies offer the potential returns and flexibility that off plan projects do. These terms refer to purchasing properties before they are completed—sometimes even before construction begins—based on architectural designs, floor plans, and developer assurances. For both seasoned investors and first-time buyers, offplan property investment is becoming increasingly popular for its accessibility, long-term gains, and strategic entry into emerging markets.

What Are Off Plan Projects?

Off plan projects are real estate developments that are in the planning or early construction stages. These could include residential towers, villas, townhouses, or commercial buildings that are not yet completed but are open for pre-sale. Investors commit to purchasing a unit before the structure is ready for handover, often based on a brochure, model, or digital renderings provided by the developer.

This type of investment is particularly appealing offplan properties because developers usually offer properties at lower prices in the early stages of a project to attract early buyers and secure project funding. This discount can lead to considerable capital appreciation once the property is completed and the market value increases.

Why Are Offplan Properties Gaining Popularity?

Offplan properties offer multiple advantages that are hard to find in the secondary real estate market. Here’s why more investors are turning toward this model:

1. Lower Initial Cost

One of the main advantages of off plan projects is that the purchase price is typically much lower than that of completed properties. Developers often provide competitive pricing during the launch phase to attract buyers, making this an ideal option for investors looking to enter the market at a lower cost.

2. Flexible Payment Plans

Unlike traditional purchases that often require a substantial upfront payment or mortgage approval, offplan properties are usually sold with flexible installment-based payment plans. This allows buyers to spread the cost over several months or years, reducing financial pressure and improving cash flow management.

3. Potential for Capital Appreciation

As construction progresses and the market matures, the value of an offplan property can increase significantly. Many investors take advantage of this by reselling the property before completion, often at a premium, thereby generating a healthy return on investment.

4. Customization Opportunities

Buying a property off the plan often gives the purchaser the opportunity to choose layouts, finishes, and fixtures, allowing for a more personalized home or investment unit. This is especially appealing for end-users and families looking for a tailor-made living space.

5. Brand-New Property

Upon completion, buyers receive a brand-new unit with modern architecture, updated building codes, and state-of-the-art facilities. Maintenance is minimal initially, and warranties provided by the developer add another layer of security for the buyer.

Risks of Off Plan Projects

Despite the numerous advantages, there are risks involved with offplan property investments. The most common concerns include:

-

Project Delays: Construction timelines can shift due to unforeseen circumstances, leading to delayed handovers.

-

Developer Reliability: Choosing an unproven or financially unstable developer can increase the risk of project failure or abandonment.

-

Market Volatility: Property values may fluctuate based on market conditions, potentially affecting the resale value of the property.

Mitigating Risks: What Investors Should Look For

To safely navigate the offplan market, investors should:

-

Research the Developer: Always work with reputable developers who have a track record of delivering projects on time and within budget.

-

Understand the Contract: Read the sales and purchase agreement thoroughly, including clauses related to delays, cancellations, and handover processes.

-

Verify Project Approvals: Ensure the project is registered with the relevant authorities and all permits are in place.

-

Evaluate the Location: Choose projects in prime or up-and-coming areas with strong infrastructure and growth potential.

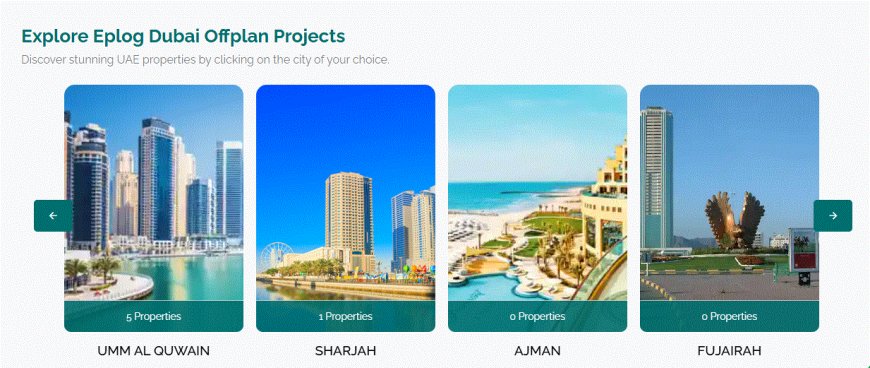

Global Trends in Offplan Properties

The concept of offplan investments is not confined to one region. Cities like Dubai, Abu Dhabi, London, and Kuala Lumpur have embraced this model, with major developers launching high-value off plan projects catering to both local and international investors. Technological advancements in virtual reality (VR) and 3D modeling have also made it easier for buyers to visualize their investments remotely, which has further accelerated global adoption.

In particular, offplan projects are seeing renewed interest post-pandemic as developers shift focus toward master-planned communities, sustainable living, and digital integration in residential properties. Investors are now looking for developments that offer lifestyle amenities, green spaces, and proximity to work and leisure hubs.

Who Should Invest in Offplan Properties?

Offplan investments are ideal for a wide range of buyers:

-

First-time Homebuyers: Looking for affordability and customization options.

-

Long-term Investors: Seeking capital growth over a multi-year horizon.

-

Buy-to-let Investors: Interested in new properties that command higher rental yields upon completion.

-

International Buyers: Who wish to enter a market remotely with minimal immediate capital outlay.

Final Thoughts

Off plan projects and offplan properties represent a forward-thinking approach to real estate investment. By entering the market early, buyers can benefit from lower prices, flexible payment schemes, and substantial growth potential. However, like any investment, due diligence is critical. With proper research and careful selection, offplan property investments can provide not only financial rewards but also long-term lifestyle benefits.

Whether you're looking to secure your first home, diversify your investment portfolio, or capitalize on emerging real estate markets, off plan projects offer a smart, strategic pathway to success.

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)

![How Smart PMs Scale Their Careers in Any Org [TPG Live Recap]](https://tpgblog.com/wp-content/uploads/2025/06/2025-06-12-thumbnail-action.png?#)