Why Audit Firms in Sharjah Are Essential for Small and Medium Enterprises

Discover reliable audit firms in Sharjah that offer expert financial assessments, ensuring compliance and driving business growth with tailored solutions.

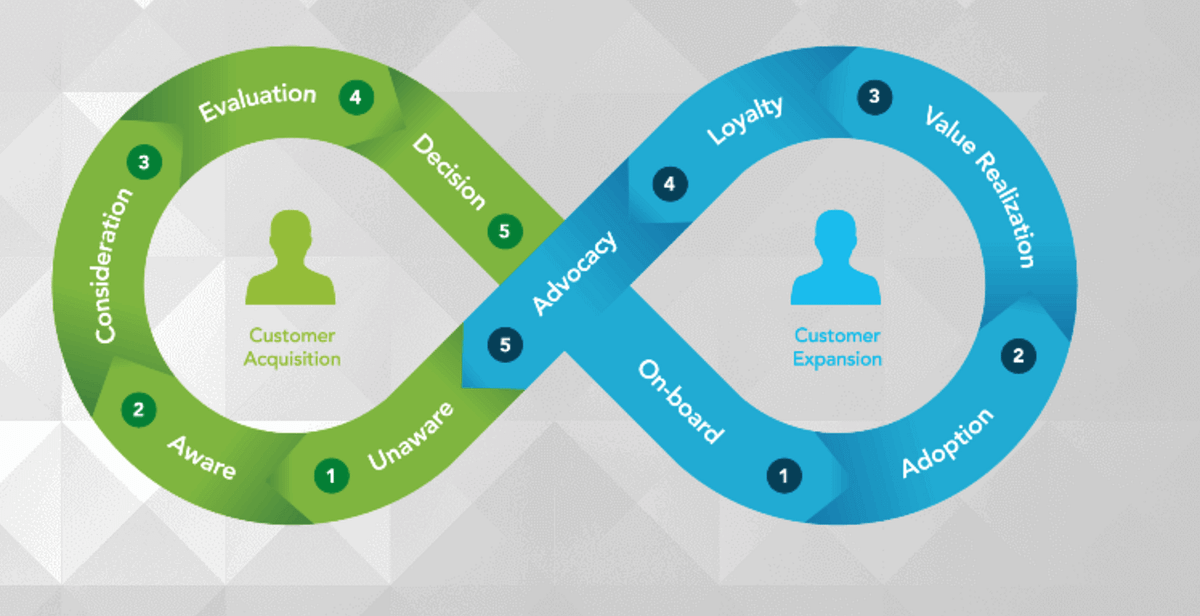

Small and medium enterprises (SMEs) are the backbone of the economy in Sharjah and across the UAE. These businesses face unique challenges as they strive to establish themselves in competitive markets, grow their customer base, and maintain financial health. One of the most important factors in ensuring long-term success and stability for these companies is sound financial management. In this context, audit firms in Sharjah play an essential role by providing the expertise and services necessary to help SMEs maintain financial integrity, comply with regulations, and make informed business decisions.

The Importance of Financial Accuracy and Transparency

For small and medium businesses in Sharjah, having accurate financial records is crucial. Whether it’s for managing day-to-day operations, applying for loans, or simply understanding the financial health of the business, accurate financial information is vital. Audit firms in Sharjah help SMEs ensure their financial statements are precise and reflect the true state of their business. These firms conduct thorough audits that scrutinize income, expenses, assets, liabilities, and financial transactions to confirm their accuracy.

By having an external audit firm review their financials, businesses gain an objective perspective on their operations. This transparency can boost trust among stakeholders, including investors, suppliers, and banks, ultimately strengthening the company’s reputation and fostering strong relationships with key partners. When financial records are transparent, SMEs can manage risks better and create a solid foundation for growth.

Ensuring Compliance with Local Regulations

In a rapidly changing regulatory environment, businesses in Sharjah, as well as across the UAE, must adhere to several legal and tax obligations. For SMEs, staying compliant with local and federal regulations can be a challenging task, especially as these regulations evolve. The UAE introduced VAT (Value Added Tax) in 2018, and businesses must ensure that they comply with this tax law along with other legal requirements such as corporate tax, labor laws, and licensing.

Audit firms in Sharjah specialize in helping SMEs stay compliant with these laws. They provide expert advice on how to comply with tax regulations and avoid penalties, fines, or legal trouble. Audit professionals stay updated on all regulatory changes, ensuring that their clients adhere to the latest laws. In particular, VAT return filings are an essential aspect of compliance, and auditors assist businesses in preparing and submitting accurate VAT returns on time.

Non-compliance can result in costly fines, damaged reputations, and a loss of trust from investors and customers. Therefore, outsourcing the responsibility of ensuring compliance to audit firms in Sharjah is a smart move for SMEs that want to focus on growing their business without worrying about legal complications.

Financial Planning and Decision-Making

Effective financial planning is the cornerstone of any successful business strategy, and SMEs are no exception. With limited resources, these businesses need to allocate their funds wisely to maximize their returns and minimize waste. Audit firms in Sharjah provide invaluable insights by analyzing the financial records and advising on the best practices for budgeting, cost-cutting, and cash flow management.

An external audit helps SMEs identify areas of inefficiency or excessive spending that could hinder their financial growth. Auditors can suggest cost-effective solutions, recommend better financial practices, and guide businesses on how to improve their profitability. Moreover, audit firms can assess business performance over time, offering suggestions on how to improve overall financial health and enhance decision-making processes.

In addition to improving current financial practices, audits can help SMEs plan for future growth by identifying investment opportunities and outlining potential risks. With the help of an experienced audit firm, businesses can implement strategies that optimize revenue generation and safeguard their financial future.

Facilitating Access to Financing and Investors

As SMEs grow, they often need external financing to fund expansion or take on larger projects. Whether it’s applying for a loan, attracting investors, or seeking partnerships, financial institutions and investors want assurance that the business has reliable financial records and a well-managed fiscal system. One of the key services provided by audit firms in Sharjah is the preparation of detailed financial reports that give potential investors and lenders the confidence they need to proceed with financial arrangements.

When businesses provide audited financial statements, they demonstrate a commitment to transparency, accuracy, and compliance. Investors and financial institutions feel more secure when they know that an independent audit firm has verified a company’s financials. This increases the likelihood of securing financing and attracting the right investors who can help the business scale and succeed.

Conclusion

Audit firms in Sharjah offer significant value to small and medium enterprises by providing expertise in financial management, compliance, and business strategy. By engaging these professionals, SMEs can gain transparency, reduce financial risks, and ensure that their operations are compliant with the latest regulations. Furthermore, audits provide businesses with the financial insights they need to make sound decisions, improve profitability, and facilitate growth. In a competitive market, the guidance of experienced auditors can give SMEs the tools and knowledge they need to thrive in Sharjah's dynamic business environment.

With the right audit partner, SMEs can unlock the full potential of their financial operations, prevent costly mistakes, and foster a culture of financial responsibility that drives long-term success.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)