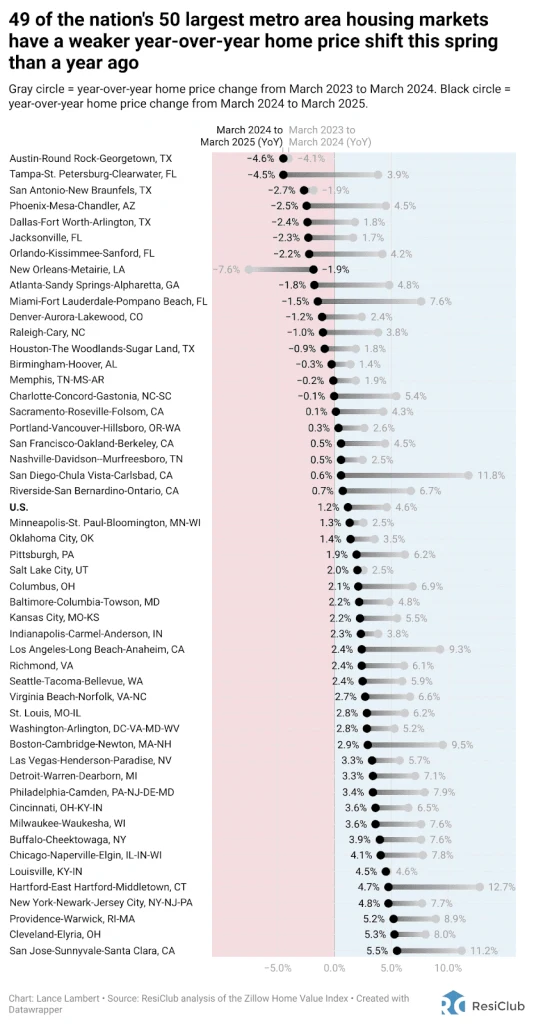

Widespread softening: Almost every major housing market is seeing softer pricing

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. As I’ve been closely tracking in ResiClub’s monthly metro- and county-level housing inventory analysis, over the past year the supply-demand equilibrium—measured by shifts and levels in active housing inventory and months of supply—has shifted directionally in favor of homebuyers. That doesn’t mean buyers have all the leverage, or that the picture is the same in every market. Directionally, however, homebuyers in most markets have gained leverage compared to the 2024 spring housing market. This shift is also showing up in the pricing data—specifically the rate of change. Indeed, 49 of the nation’s 50 largest metro-area housing markets have a weaker year-over-year home price shift this spring than a year ago. This widespread softening doesn’t mean home prices are falling in every market—they aren’t. Rather, in this context it means home price growth has decelerated across almost every market over the past 12 months, and more markets are seeing price declines compared to a year ago. In March 2024, 47 of the nation’s 50 largest housing markets were experiencing rising year-over-year home prices, and just three of them saw falling year-over-year home prices. In March 2025, 34 of the 50 largest housing markets saw rising year-over-year home prices and 16 were falling. ResiClub expects to see the number of major housing markets with falling year-over-year home prices rise further in the coming months. (Full-month April data publishes later this week.) As ResiClub has closely documented, the recent softening and weakening have been more pronounced in the Sun Belt, particularly in Gulf housing markets. The greatest weakness is evident in parts of Texas (especially Austin and San Antonio) and Florida (notably its condo market and Southwest Florida). Click here to view an interactive version of the chart below. Zooming out, the chart above shows what the ongoing price softening looks like in a recent historical context. The yellow line represents the national aggregate, which has decelerated in the Zillow Home Value Index. U.S. home prices went from rising 4.6% from March 2023 to March 2024 to rising just 1.2% from March 2024 to March 2025. The deceleration in home price growth is welcomed by many homebuyers who saw prices overheat during the pandemic. In more markets than last year, homebuyers will see their incomes rise faster than local home prices.

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

As I’ve been closely tracking in ResiClub’s monthly metro- and county-level housing inventory analysis, over the past year the supply-demand equilibrium—measured by shifts and levels in active housing inventory and months of supply—has shifted directionally in favor of homebuyers. That doesn’t mean buyers have all the leverage, or that the picture is the same in every market. Directionally, however, homebuyers in most markets have gained leverage compared to the 2024 spring housing market.

This shift is also showing up in the pricing data—specifically the rate of change. Indeed, 49 of the nation’s 50 largest metro-area housing markets have a weaker year-over-year home price shift this spring than a year ago.

This widespread softening doesn’t mean home prices are falling in every market—they aren’t. Rather, in this context it means home price growth has decelerated across almost every market over the past 12 months, and more markets are seeing price declines compared to a year ago.

In March 2024, 47 of the nation’s 50 largest housing markets were experiencing rising year-over-year home prices, and just three of them saw falling year-over-year home prices.

In March 2025, 34 of the 50 largest housing markets saw rising year-over-year home prices and 16 were falling.

ResiClub expects to see the number of major housing markets with falling year-over-year home prices rise further in the coming months. (Full-month April data publishes later this week.)

As ResiClub has closely documented, the recent softening and weakening have been more pronounced in the Sun Belt, particularly in Gulf housing markets. The greatest weakness is evident in parts of Texas (especially Austin and San Antonio) and Florida (notably its condo market and Southwest Florida).

Click here to view an interactive version of the chart below.

Zooming out, the chart above shows what the ongoing price softening looks like in a recent historical context. The yellow line represents the national aggregate, which has decelerated in the Zillow Home Value Index. U.S. home prices went from rising 4.6% from March 2023 to March 2024 to rising just 1.2% from March 2024 to March 2025.

The deceleration in home price growth is welcomed by many homebuyers who saw prices overheat during the pandemic. In more markets than last year, homebuyers will see their incomes rise faster than local home prices.

![Are AI Chatbots Replacing Search Engines? AI vs Google [New Research]](https://www.orbitmedia.com/wp-content/uploads/2025/05/How-often-are-we-using-AI-chatbots_.webp)