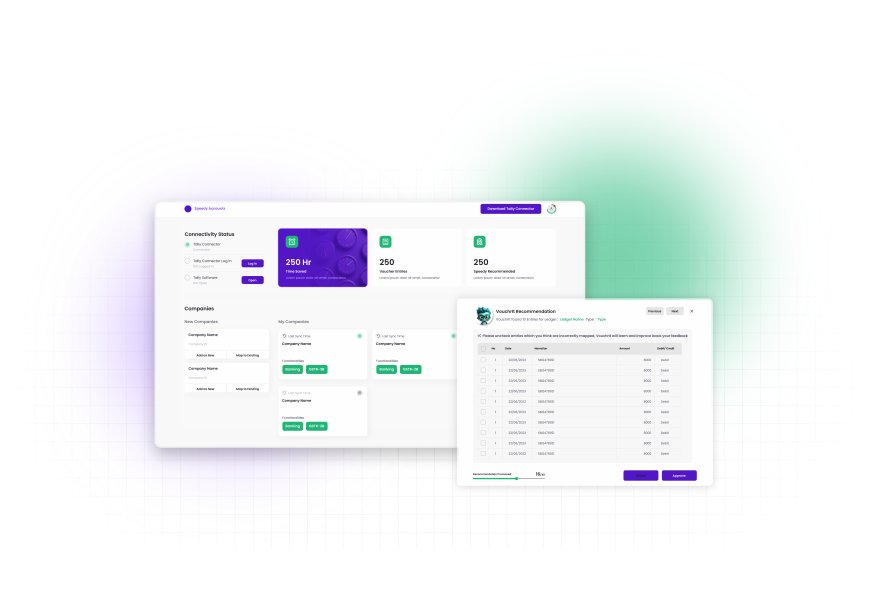

By the Numbers: How Automated Tally Entries Slashed Tax Filing Time by 60% in 2024–2025

And at the heart of this shift? A deceptively simple game-changer: automated Tally entries, powered by tools like VouchrIt.

Let’s be honest—tax season has never been kind to accountants.

Whether you're managing a tight portfolio of SMEs or overseeing the books of a mid-size enterprise, March to July can feel like a long hallway of stress, bottlenecks, and last-minute reconciliations. But what if I told you that a growing number of accounting firms have quietly trimmed their tax filing workload by 60%—sometimes more—in just one year?

That’s not a marketing headline. That’s automation at work.

And at the heart of this shift? A deceptively simple game-changer: automated Tally entries, powered by tools like VouchrIt.

“From Chaos to Clean Books” — The Shift Is Real

Back in 2023, most CA firms and internal finance departments were still wrestling with some version of this workflow:

-

Download bank statements (PDFs, CSVs…whatever the bank gave you)

-

Manually convert them into Excel

-

Manually feed that data into Tally (hello, Ctrl+C + Ctrl+V)

-

Triple-check every line for GST mapping, narration, voucher class, cost center

-

Pray the audit doesn’t uncover a misplaced entry

It was tedious. Error-prone. And frankly, a terrible use of highly-skilled professionals.

Fast forward to late 2024: early adopters of VouchrIt’s accounting automation report an average of 55–60% reduction in tax filing prep time. Some saw even more drastic numbers in environments where purchase entry in Tally had previously been manual and messy.

Let me break that down.

The Numbers Tell the Real Story

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)

![[PATREON EXCLUSIVE] The Power of No: How to Say It, Mean It, and Lead with It](https://tpgblog.com/wp-content/uploads/2025/06/just-say-no.jpg?#)