Could Tesla’s fall from grace upend the entire U.S. EV market?

When people are protesting at an automaker’s retail locations because of the CEO’s political actions, when that automaker’s sales are plummeting around the world, when that company’s vehicle lineup is sorely in need of a hot new model or redesign that isn’t coming any time soon, and when that company’s market valuation is based largely on the promise of technological advancements that have yet to be demonstrated, that company is in trouble. That company, of course, is Tesla, which is in the midst of a corporate self-destruction unlike any I’ve seen. To help you understand what we’re witnessing, I’m going to lay out Tesla’s problems, with assists from analysts, and then explain why—despite the pleasure many people derive from seeing Elon Musk’s company implode—we should worry about what a weakened Tesla means for the U.S. electric vehicle market. “I see a company that has accomplished a lot, but is facing more challenges than ever,” said Karl Brauer, a longtime auto industry analyst who now works for iSeeCars.com. “There’s nothing super exciting, or even really modestly exciting, coming down the Tesla product pipeline,” he said. “Every time we’ve been promised some new, refreshed version of one of [Tesla’s] cars, it’s been a pretty weak refresh, to be honest.” He’s talking about Tesla as an automaker, but it differs significantly from other car brands. Tesla’s justification for its market valuation is based on the idea that its cars are a step toward a future of profits in self-driving vehicles, robotics and other businesses. Auto sales help to provide a financial bridge to the future, and that bridge looks shaky. “We struggle to think of anything analogous in the history of the automotive industry, in which a brand has lost so much value so quickly,” said a March 12 research note from J.P. Morgan. The investment bank cut its estimates for how many vehicles Tesla will deliver in the first quarter and for 2025 as a whole, projecting that the automaker will fail to meet its sales guidance and continue to lose value. This financial reckoning follows a post-election boom for Tesla, whose CEO, Musk, is a leading supporter of Donald Trump and now oversees the newly created, agency-dismantling Department of Government Efficiency. Musk is working in government while maintaining his role as head of his companies. Tesla did not respond to a request for comment. Its share price peaked on Dec. 17 when it closed at $479.86. Its market capitalization, which is the sum of the value of its stock, was $1.5 trillion. As of the market close on Wednesday, the share price was $235.86, down 51% from the peak, and the market cap was $759 billion. For perspective, the market cap of General Motors is about $50 billion. [Image: Paul Horn/Inside Climate News] Plenty of other analysts share a bleak view of Tesla. For example, Wells Fargo Securities has set a price target of $130 per share for Tesla, which would be nausea-inducing for anybody who bought near the peak. “[I]investors are starting to agree that there is no fun in the fundamentals,” Wells Fargo said in a March 14 note. And yet, some analysts continue to see a bright future for Tesla. Wedbush Securities is sticking with its $550-per-share price target. Dan Ives, a Wedbush analyst, said in a recent note that Tesla is entering a period of major growth and innovation. One thing that just about every observer agrees on is the importance of Tesla’s launch of a self-driving taxi service in Austin, Texas, which Musk has said will happen in June. Also, Tesla has said it will provide more information about development of a low-cost car. Reuters reported last week that Tesla is developing a smaller and less expensive version of the Model Y crossover, which Tesla has not confirmed. The Model Y is the company’s top seller, and has a base price of $61,630 before the $7,500 federal tax credit. If the taxi launch and a new-model announcement happen and provide enough detail to assure investors, then Tesla could ease the panic. But many analysts aren’t betting on it. “We see a high probability of a delay or underwhelming launch,” said Wells Fargo, about the taxis. Aside from product issues, Musk is likely to continue to do things that alienate customers. His association with the Trump administration and his role in layoffs and agency overhauls have made Tesla a toxic brand. Opponents of Musk and Trump have organized protests at Tesla showrooms. Social media is filled with photos of Teslas that have been vandalized. Some Tesla owners have put stickers on their cars with messages showing their disapproval of Musk, such as “I bought this before we knew Elon was crazy.” It’s not just a U.S. phenomenon. Musk’s support for the far-right AfD party in Germany and his support for Trump have hurt Tesla with European buyers and helped inspire protests at Tesla locations there. (I’m reminded of Brewster’s Millions, the 1985 movie s

When people are protesting at an automaker’s retail locations because of the CEO’s political actions, when that automaker’s sales are plummeting around the world, when that company’s vehicle lineup is sorely in need of a hot new model or redesign that isn’t coming any time soon, and when that company’s market valuation is based largely on the promise of technological advancements that have yet to be demonstrated, that company is in trouble.

That company, of course, is Tesla, which is in the midst of a corporate self-destruction unlike any I’ve seen.

To help you understand what we’re witnessing, I’m going to lay out Tesla’s problems, with assists from analysts, and then explain why—despite the pleasure many people derive from seeing Elon Musk’s company implode—we should worry about what a weakened Tesla means for the U.S. electric vehicle market.

“I see a company that has accomplished a lot, but is facing more challenges than ever,” said Karl Brauer, a longtime auto industry analyst who now works for iSeeCars.com.

“There’s nothing super exciting, or even really modestly exciting, coming down the Tesla product pipeline,” he said. “Every time we’ve been promised some new, refreshed version of one of [Tesla’s] cars, it’s been a pretty weak refresh, to be honest.”

He’s talking about Tesla as an automaker, but it differs significantly from other car brands. Tesla’s justification for its market valuation is based on the idea that its cars are a step toward a future of profits in self-driving vehicles, robotics and other businesses. Auto sales help to provide a financial bridge to the future, and that bridge looks shaky.

“We struggle to think of anything analogous in the history of the automotive industry, in which a brand has lost so much value so quickly,” said a March 12 research note from J.P. Morgan.

The investment bank cut its estimates for how many vehicles Tesla will deliver in the first quarter and for 2025 as a whole, projecting that the automaker will fail to meet its sales guidance and continue to lose value.

This financial reckoning follows a post-election boom for Tesla, whose CEO, Musk, is a leading supporter of Donald Trump and now oversees the newly created, agency-dismantling Department of Government Efficiency. Musk is working in government while maintaining his role as head of his companies.

Tesla did not respond to a request for comment.

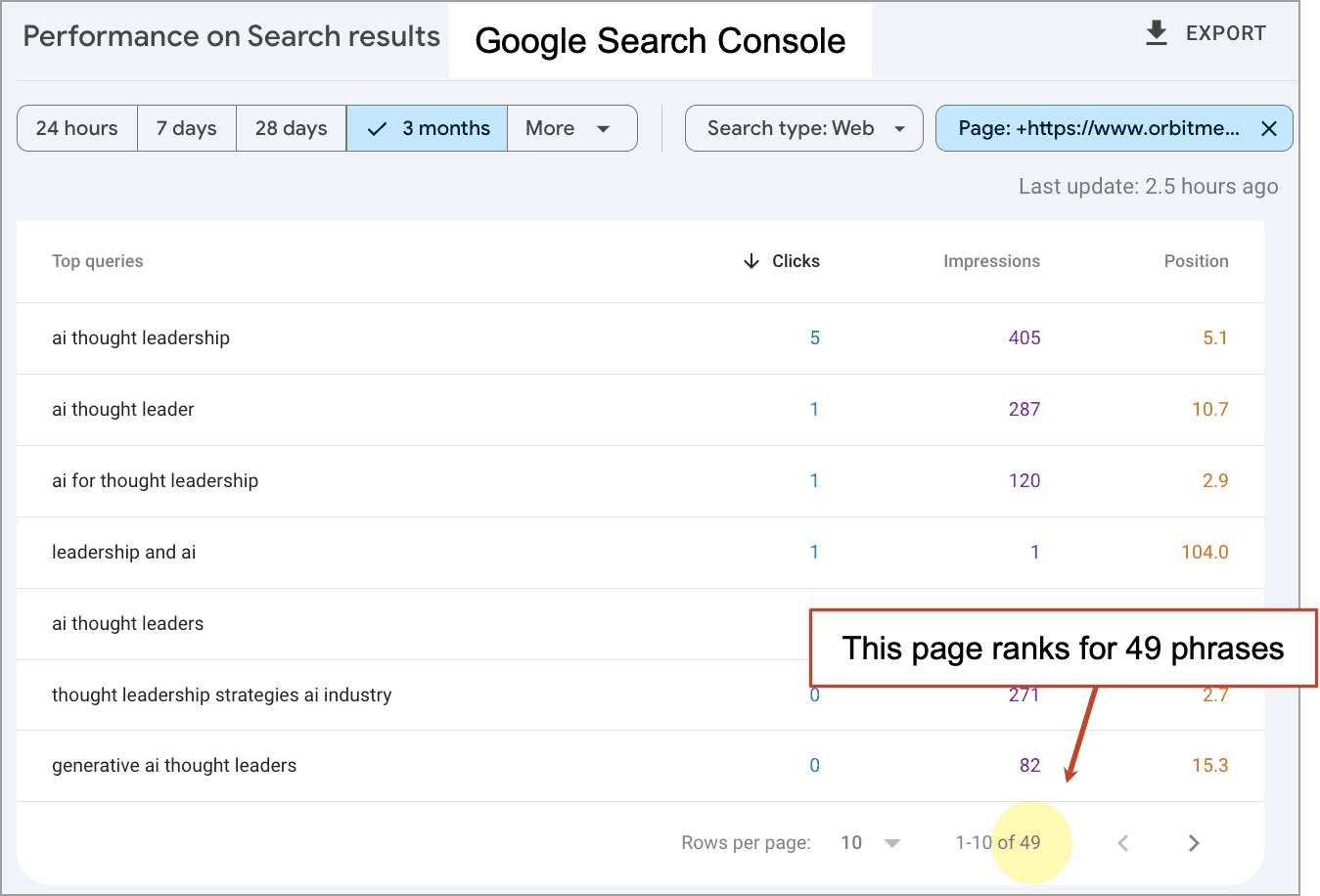

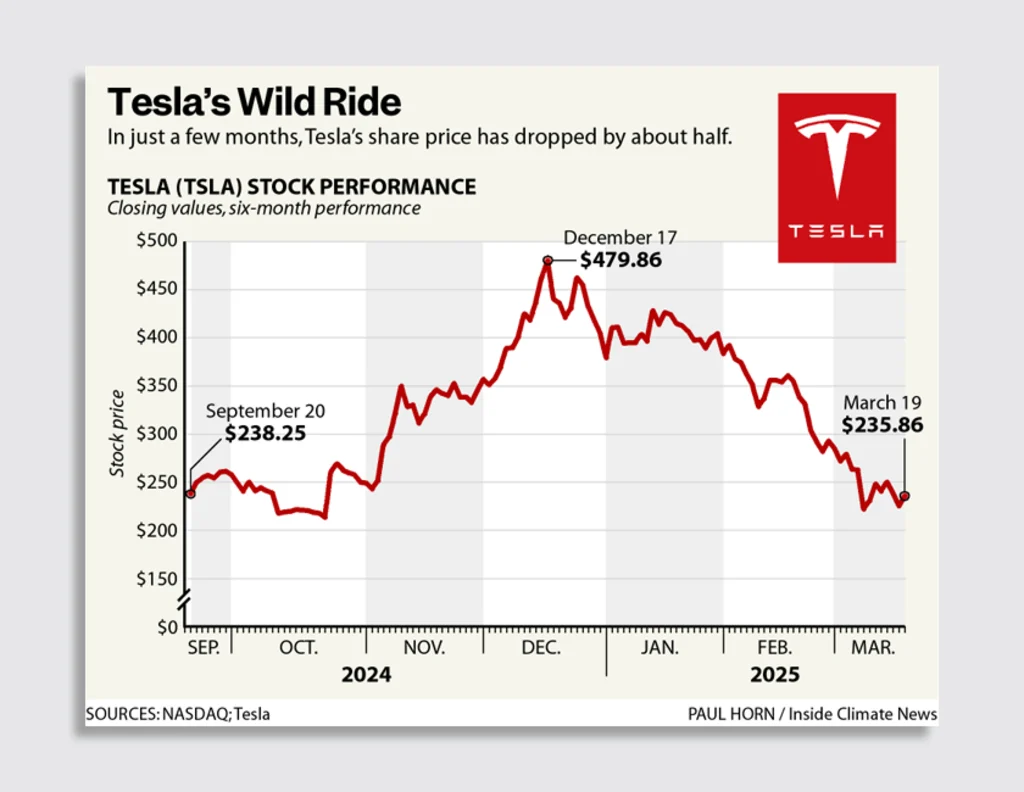

Its share price peaked on Dec. 17 when it closed at $479.86. Its market capitalization, which is the sum of the value of its stock, was $1.5 trillion.

As of the market close on Wednesday, the share price was $235.86, down 51% from the peak, and the market cap was $759 billion.

For perspective, the market cap of General Motors is about $50 billion.

Plenty of other analysts share a bleak view of Tesla. For example, Wells Fargo Securities has set a price target of $130 per share for Tesla, which would be nausea-inducing for anybody who bought near the peak.

“[I]investors are starting to agree that there is no fun in the fundamentals,” Wells Fargo said in a March 14 note.

And yet, some analysts continue to see a bright future for Tesla. Wedbush Securities is sticking with its $550-per-share price target. Dan Ives, a Wedbush analyst, said in a recent note that Tesla is entering a period of major growth and innovation.

One thing that just about every observer agrees on is the importance of Tesla’s launch of a self-driving taxi service in Austin, Texas, which Musk has said will happen in June.

Also, Tesla has said it will provide more information about development of a low-cost car. Reuters reported last week that Tesla is developing a smaller and less expensive version of the Model Y crossover, which Tesla has not confirmed. The Model Y is the company’s top seller, and has a base price of $61,630 before the $7,500 federal tax credit.

If the taxi launch and a new-model announcement happen and provide enough detail to assure investors, then Tesla could ease the panic. But many analysts aren’t betting on it.

“We see a high probability of a delay or underwhelming launch,” said Wells Fargo, about the taxis.

Aside from product issues, Musk is likely to continue to do things that alienate customers. His association with the Trump administration and his role in layoffs and agency overhauls have made Tesla a toxic brand.

Opponents of Musk and Trump have organized protests at Tesla showrooms. Social media is filled with photos of Teslas that have been vandalized. Some Tesla owners have put stickers on their cars with messages showing their disapproval of Musk, such as “I bought this before we knew Elon was crazy.”

It’s not just a U.S. phenomenon. Musk’s support for the far-right AfD party in Germany and his support for Trump have hurt Tesla with European buyers and helped inspire protests at Tesla locations there.

(I’m reminded of Brewster’s Millions, the 1985 movie starring Richard Pryor about a man who, for reasons of plot contrivance, has 30 days to get rid of an immense amount of money. A U.S. corporate executive taking time to give a live video address at an AfD rally is a Brewster’s Millions kind of move. A recent Google search tells me I am nowhere near the first person to make this observation.)

Tesla sales also are way down in China, the world’s largest automotive market, which is likely due to a combination of backlash against Musk for his support of Trump, and competition from cheaper Chinese EV brands.

While some people may be pleased to see Tesla and Musk struggle, and most of the damage was self-inflicted, Tesla’s swoon is probably bad for the U.S. EV market.

It helps to have a sense of just how big Tesla is relative to other EV makers that sell in the United States. Last year, 48% of the EVs sold here were Teslas and no competitor cracked 10%, according to Cox Automotive.

Tesla also is a key player in building and maintaining EV charging stations. If any of the companies behind charging infrastructure run into financial problems, that could be a big concern, said Samantha Houston, a senior manager for the Clean Transportation program at the Union of Concerned Scientists.

“Having those publicly accessible networks be reliable, and expanding them, is an essential piece,” she said.

If Tesla or other charging companies scale back their efforts, it would be an impediment to increasing EV ownership for all brands. This is especially true now that most automakers have adopted Tesla’s North American Charging Standard, which means Tesla charging stations can be used by people driving other brands, Houston said.

In addition to practical issues such as charging, Tesla’s struggles could fuel a perception problem for EVs.

“I don’t think it’s good for the EV market to have Tesla seen in a negative light—imploding,” said William Roberts, senior research analyst for Rho Motion, the United Kingdom-based research firm that covers batteries and EVs.

He explained that Tesla is synonymous with EVs, especially for consumers in the United States. For Tesla to be viewed as an object of derision is not helpful for easing the concerns of potential buyers, especially those who are deciding between an EV and a gasoline vehicle.

At the same time, sales figures show that other automakers were able to increase their EV sales to offset Tesla’s decline, and then some. Tesla’s U.S. sales were down 5.6% last year compared to 2023, while overall EV sales in the nation—which includes Tesla—were up by 7.3%, according to Cox.

Through the first two months of 2025, Tesla sales were down, especially in Europe and China, but global EV sales were way up, according to Rho Motion. Global sales were up 30%, including an increase of 35% in China and 20% in Europe and the United States/Canada. (Rho Motion includes plug-in hybrids in its totals, while Cox doesn’t.)

I just don’t see the EV sales surge as a reason to think that the market is shaking off Tesla’s problems. The reason is simple: We don’t know what sales would have been with a strong Tesla.

In sports terms, a star player is limping. That’s almost never good for the game.

This article originally appeared on Inside Climate News. It is republished with permission. Sign up for their newsletter here.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How 6 Leading Brands Use Content To Win Audiences [E-Book]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/content-marketing-examples-600x330.png?#)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)