Payroll Tax Compliance Specialist

A company is looking for a Payroll Tax Compliance Specialist for a remote contract position.

Key Responsibilities:

Process payrolls regularly and generate accurate payroll reports

Ensure timely submission of employee timesheets and respond to payroll inquiries

Support payroll audits and maintain compliance with tax deposit requirements

Required Qualifications:

Previous payroll experience is required

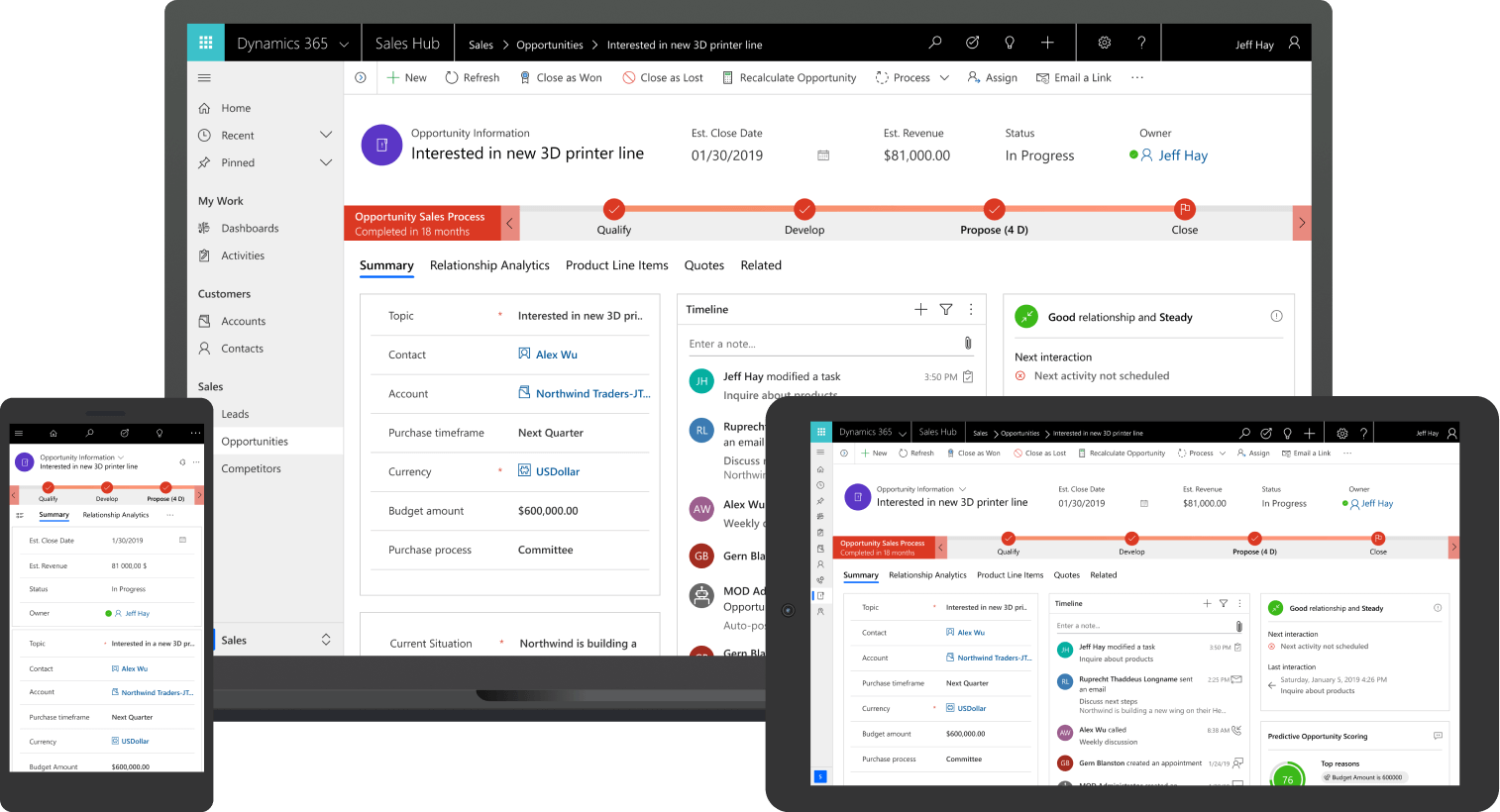

Proficiency in Microsoft Office Suite, Microsoft Teams, and Workday

Familiarity with U.S., Canadian, and Puerto Rican payroll tax regulations is preferred

Associate degree (minimum 2-year degree) required

Strong understanding of federal and multi-state payroll tax requirements

A company is looking for a Payroll Tax Compliance Specialist for a remote contract position.

Key Responsibilities:

Process payrolls regularly and generate accurate payroll reports

Ensure timely submission of employee timesheets and respond to payroll inquiries

Support payroll audits and maintain compliance with tax deposit requirements

Required Qualifications:

Previous payroll experience is required

Proficiency in Microsoft Office Suite, Microsoft Teams, and Workday

Familiarity with U.S., Canadian, and Puerto Rican payroll tax regulations is preferred

Associate degree (minimum 2-year degree) required

Strong understanding of federal and multi-state payroll tax requirements

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)