The risk to the housing market if Fannie Mae and Freddie Mac conservatorship ends

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Fannie Mae and Freddie Mac support the mortgage industry by buying mortgages from lenders and selling mortgage-backed securities to investors. They were placed into conservatorship by the Federal Housing Finance Agency (FHFA) in September 2008 after suffering massive losses during the housing crash, threatening the stability of the U.S. financial system. The U.S. Treasury provided a bailout to keep them afloat, and they have remained under government control ever since—despite returning to profitability. While the U.S. Treasury owns the majority of Fannie Mae and Freddie Mac profits through senior preferred stock agreements, the common and preferred shares that existed before conservatorship were never fully wiped out. Once Wall Street realized Donald Trump had won the 2024 election, the stocks of Fannie Mae and Freddie Mac spiked as the market priced in higher odds that the second Trump administration would attempt to end that conservatorship. After all, one of Trump’s biggest backers this cycle was Bill Ackman, a leading proponent of releasing Fannie Mae and Freddie Mac from conservatorship. The odds of conservatorship ending—or at the very least, an attempt to unwind it—increased this week after Trump posted on social media: “I’m giving very serious consideration to bringing Fannie Mae and Freddie Mac public.” Then, on Thursday evening, Bill Pulte, the director of FHFA, tweeted out a podcast he did with Donald Trump Jr. centered on the future of Fannie Mae and Freddie Mac. Those aren’t the kind of public moves the administration would make unless it is seriously considering a push to end conservatorship or wants to further test financial market reaction to the idea. What would this do to mortgage rates? The reason housing stakeholders should pay attention is the long standing concern that ending conservatorship could put upward pressure on mortgage rates and more strain on housing affordability. Once released, Fannie Mae and Freddie Mac could need to hold more capital to absorb losses. To build and maintain that capital, they may need to increase guarantee fees charged to lenders. In addition, upon release, unless there’s an “explicit guarantee” or backstop from Congress, investors may demand higher returns to account for increased risk. Those concerns are real enough that back in February, Treasury Secretary Scott Bessent said that Freddie Mac and Fannie Mae wouldn’t get released from conservatorship if doing so put upward pressure on mortgage rates/mortgage spreads. “The priority for a Fannie and Freddie release, the most important metric that I’m looking at is any study or hint that mortgage rates would go up. Anything that is done around a safe and sound release [of Fannie Mae and Freddie Mac] is going to hinge on the effect of long-term mortgage rates,” Bessent said in February. On Friday, Bessent reaffirmed in an interview with Bloomberg that the privatization of Fannie Mae and Freddie Mac hinges on mortgage rates, saying: “It [privatization of Fannie and Freddie] is a goal for this administration. Again, we’re doing peace deals, tax deals, and trade deals. As we land some of those deals then we will focus on that [privatization of Fannie and Freddie]. But what I can tell you is that we are doing a great deal of studying at Treasury because the one requirement for this privatization is that they are privatized in such a way that mortgage spreads do not widen.” To understand how mortgage rates could respond in different Freddie Mac/Fannie Mae release scenarios, read this housing research we published earlier this year.

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Fannie Mae and Freddie Mac support the mortgage industry by buying mortgages from lenders and selling mortgage-backed securities to investors. They were placed into conservatorship by the Federal Housing Finance Agency (FHFA) in September 2008 after suffering massive losses during the housing crash, threatening the stability of the U.S. financial system. The U.S. Treasury provided a bailout to keep them afloat, and they have remained under government control ever since—despite returning to profitability.

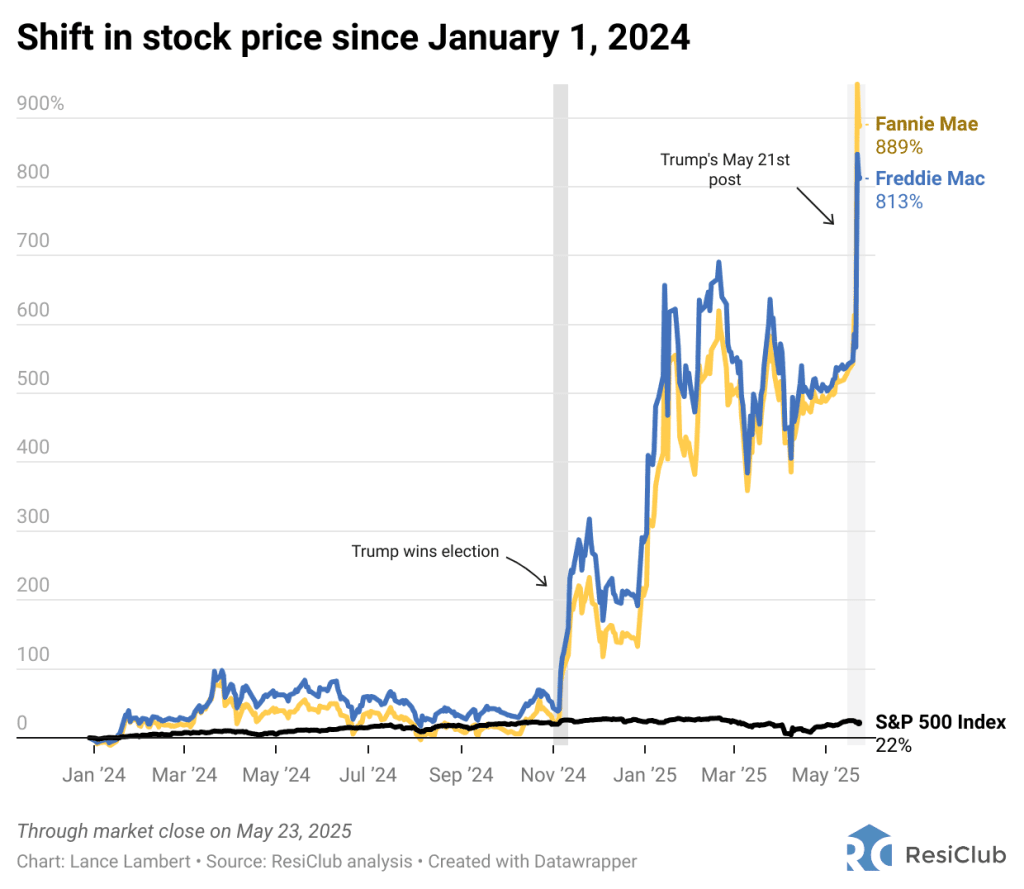

While the U.S. Treasury owns the majority of Fannie Mae and Freddie Mac profits through senior preferred stock agreements, the common and preferred shares that existed before conservatorship were never fully wiped out. Once Wall Street realized Donald Trump had won the 2024 election, the stocks of Fannie Mae and Freddie Mac spiked as the market priced in higher odds that the second Trump administration would attempt to end that conservatorship. After all, one of Trump’s biggest backers this cycle was Bill Ackman, a leading proponent of releasing Fannie Mae and Freddie Mac from conservatorship.

The odds of conservatorship ending—or at the very least, an attempt to unwind it—increased this week after Trump posted on social media: “I’m giving very serious consideration to bringing Fannie Mae and Freddie Mac public.” Then, on Thursday evening, Bill Pulte, the director of FHFA, tweeted out a podcast he did with Donald Trump Jr. centered on the future of Fannie Mae and Freddie Mac.

Those aren’t the kind of public moves the administration would make unless it is seriously considering a push to end conservatorship or wants to further test financial market reaction to the idea.

What would this do to mortgage rates?

The reason housing stakeholders should pay attention is the long standing concern that ending conservatorship could put upward pressure on mortgage rates and more strain on housing affordability.

Once released, Fannie Mae and Freddie Mac could need to hold more capital to absorb losses. To build and maintain that capital, they may need to increase guarantee fees charged to lenders. In addition, upon release, unless there’s an “explicit guarantee” or backstop from Congress, investors may demand higher returns to account for increased risk.

Those concerns are real enough that back in February, Treasury Secretary Scott Bessent said that Freddie Mac and Fannie Mae wouldn’t get released from conservatorship if doing so put upward pressure on mortgage rates/mortgage spreads.

“The priority for a Fannie and Freddie release, the most important metric that I’m looking at is any study or hint that mortgage rates would go up. Anything that is done around a safe and sound release [of Fannie Mae and Freddie Mac] is going to hinge on the effect of long-term mortgage rates,” Bessent said in February.

On Friday, Bessent reaffirmed in an interview with Bloomberg that the privatization of Fannie Mae and Freddie Mac hinges on mortgage rates, saying: “It [privatization of Fannie and Freddie] is a goal for this administration. Again, we’re doing peace deals, tax deals, and trade deals. As we land some of those deals then we will focus on that [privatization of Fannie and Freddie]. But what I can tell you is that we are doing a great deal of studying at Treasury because the one requirement for this privatization is that they are privatized in such a way that mortgage spreads do not widen.”

To understand how mortgage rates could respond in different Freddie Mac/Fannie Mae release scenarios, read this housing research we published earlier this year.