United States Energy Drinks Market Size, Share, Trends, Industry Analysis, Report 2025-2033

The United States energy drinks market is rapidly growing, driven by demand for functional beverages, active lifestyles, and youth consumers.

Market Overview 2025-2033

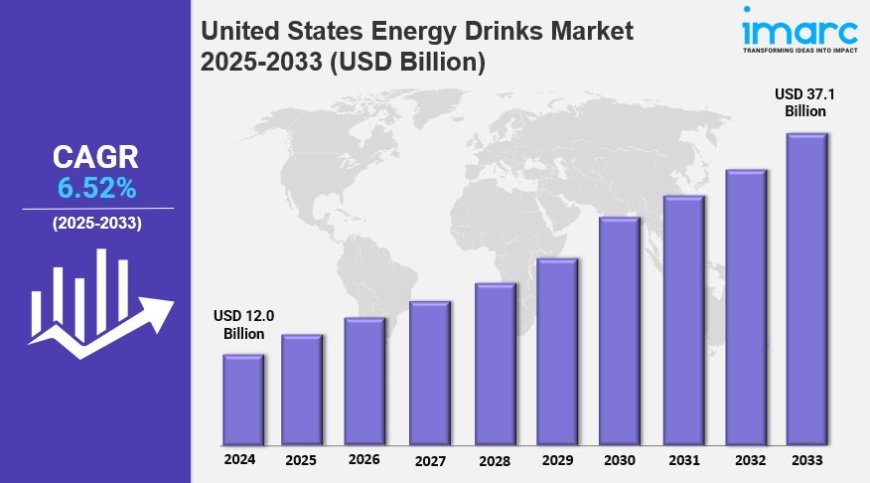

The United States energy drinks market size reached USD 12.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 37.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.52% during 2025-2033. The market is experiencing strong growth, driven by rising demand for functional beverages, busy lifestyles, and growing health-conscious consumer behavior. Key trends include the popularity of sugar-free and natural energy drinks, with major players focusing on new flavors and targeted marketing strategies.

Key Market Highlights:

✔️ Strong growth driven by rising health awareness and demand for functional beverages

✔️ Increasing preference for sugar-free, organic, and natural energy drinks

✔️ Expanding urban population fueling on-the-go consumption trends

✔️ Rapid innovation in flavors and performance-enhancing ingredients

✔️ Strategic marketing and endorsements boosting brand visibility and consumer engagement

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-energy-drinks-market/requestsample

United States Energy Drinks Market Trends and Drivers:

The United States energy drinks market is witnessing a significant shift driven by the growing health consciousness among consumers. As people become more aware of the nutritional content of their beverages, there is an increasing demand for energy drinks that offer functional benefits beyond mere caffeine stimulation. Consumers are gravitating towards products that incorporate natural ingredients, vitamins, and minerals, aiming for healthier alternatives to traditional energy drinks. This trend is particularly prominent among younger demographics, including millennials and Gen Z, who prioritize wellness and are more inclined to choose products that support their active lifestyles. Brands are responding by reformulating their products to include ingredients like green tea extract, B vitamins, electrolytes, and adaptogens, which are believed to enhance energy levels and improve focus without the crash often associated with high-sugar energy drinks. Furthermore, the rise of plant-based and organic energy drinks reflects a broader consumer shift towards sustainability and environmental responsibility. This dynamic is reshaping the competitive landscape, as companies strive to differentiate themselves by offering innovative, health-oriented products that align with consumer preferences for transparency and quality.

Another crucial dynamic shaping the United States energy drinks market is the expansion of distribution channels, particularly the growth of e-commerce. Traditionally, energy drinks have been predominantly sold through convenience stores, supermarkets, and gas stations. However, the rise of online shopping is transforming how consumers access these products. E-commerce platforms offer convenience and a wider variety of options, allowing consumers to explore niche brands and specialty energy drinks that may not be available in local stores. This shift is further accelerated by the COVID-19 pandemic, which has led to an increase in online purchasing behaviors across all demographics. Brands are capitalizing on this trend by enhancing their online presence and investing in digital marketing strategies to reach a broader audience. Additionally, subscription services for energy drinks are gaining traction, providing consumers with the convenience of regular deliveries while often offering discounts or exclusive products. As e-commerce continues to grow, it is expected to play a pivotal role in driving sales and expanding market reach for energy drink manufacturers, ultimately contributing to the overall growth of the sector.

The United States energy drinks market is also being significantly influenced by the rising popularity of sugar-free and low-calorie options. As health awareness increases, consumers are becoming more cautious about their sugar intake, leading to a decline in the demand for traditional energy drinks that are high in sugar. In response, many brands are reformulating their products to offer sugar-free alternatives that retain the same energy-boosting benefits without the added calories. These products often utilize artificial sweeteners or natural sugar substitutes, catering to health-conscious consumers who are looking for guilt-free energy solutions. The trend is particularly appealing to fitness enthusiasts and individuals managing their weight, as they seek beverages that can enhance performance without compromising their dietary goals. Furthermore, the marketing of these sugar-free and low-calorie options often emphasizes the absence of sugar as a key selling point, appealing to a broader audience. As this dynamic continues to evolve, it is likely to drive innovation within the energy drinks market, prompting brands to explore new formulations and flavor profiles that align with changing consumer preferences.

The United States energy drinks market is currently experiencing a transformative phase characterized by several key trends that are reshaping consumer preferences and industry dynamics. One of the most notable trends is the increasing emphasis on natural and organic ingredients in energy drinks. As consumers become more health-conscious, there is a growing demand for beverages that are free from artificial additives and high sugar content. This shift is pushing brands to innovate and develop energy drinks that incorporate natural sources of caffeine, such as green tea or yerba mate, along with functional ingredients that promote overall well-being. Additionally, the market is seeing a surge in the popularity of plant-based energy drinks, which appeal to consumers seeking sustainable and environmentally friendly options. By 2025, it is projected that the demand for these healthier alternatives will significantly increase, as more consumers prioritize their health and wellness. Another trend influencing the market is the rise of energy drinks targeting specific demographics, such as athletes or busy professionals. Brands are launching products tailored to meet the unique energy needs of these groups, often fortified with vitamins and minerals that enhance performance and recovery. As the market continues to evolve, these trends will shape the future of energy drinks in the United States, driving innovation and growth in the sector.

United States Energy Drinks Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

- Alcoholic

- Non-Alcoholic

Breakup by End User:

- Kids

- Adults

- Teenagers

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145