Expert Financial Advice from Tevan Asaturi for Smart Money Moves

Discover expert financial advice from Tevan Asaturi to make smart money moves. Learn practical strategies for budgeting, saving, investing, and achieving financial stability.

A Journey to Financial Empowerment

Imagine standing at a crossroads, with one path leading to uncertainty and the other to stability and growth. This was the reality for many, including Tevan Asaturi, who transformed his life through informed financial decisions. Growing up in Zurich and later moving to the U.S., Tevan faced the challenges of navigating complex money matters. Through perseverance and a commitment to financial literacy, he not only achieved personal success but also dedicated his life to guiding others toward financial stability.

Who is Tevan Asaturi?

Tevan Asaturi is a renowned financial expert and wealth strategist with over 20 years of experience in the industry. His career includes significant roles at top-tier firms like Merrill Lynch and JPMorgan Chase, where he managed portfolios for high-net-worth clients and developed complex strategies. Tevan's educational background is equally impressive, holding an MBA from the University of Southern California and certifications in AI and data analytics from Northwestern University.

Beyond his corporate accolades, Tevan founded "All for All, Inc.," a nonprofit supporting underserved communities. His dedication to spreading life-changing financial advice is showcased through his Money Mastery Program.

The Pillars of Financial Stability

1. Budgeting: The Foundation of Financial Health

Budgeting lays the groundwork for achieving long-term financial stability. Tevan emphasizes crafting a budget that fits your income and lifestyle while leaving room for savings and growth. By tracking your habits and setting clear goals, you avoid debt traps and gain financial clarity.

"A budget is not about restricting your freedom; it's about giving you the freedom to spend without guilt." — Tevan Asaturi

Try the 50/30/20 rule—split 50% of your income toward needs, 30% to wants, and 20% to savings or debt payments. It’s a practical system that promotes financial stability without feeling restrictive.

2. Saving: Building a Financial Safety Net

Saving is about preparing for the unexpected—and building peace of mind. Tevan advises automating savings so you're consistently investing in your future. This ensures you're not left scrambling when surprise expenses hit.

"Saving is the act of paying yourself first. It's a commitment to your future self." — Tevan Asaturi

A 2023 Bankrate survey revealed that only 39% of Americans could handle a $1,000 emergency using their savings. That's a wake-up call for anyone aiming for real financial stability.

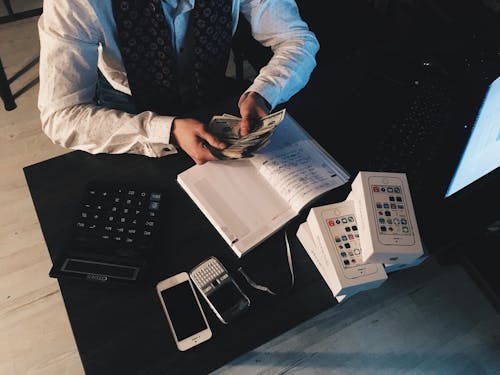

3. Investing: Growing Wealth Over Time

Investing isn't just for the wealthy—it's for anyone looking to make their money work for them. Tevan encourages starting small and early, even with modest contributions. The power of compound interest multiplies those early efforts into substantial gains over time.

"Investing is not about timing the market; it's about time in the market." — Tevan Asaturi

Use tax-advantaged accounts like IRAs or 401(k)s and seek diversified options. With the right approach, you can enjoy sustainable financial stability without taking wild risks. Tevan’s program helps you build these plans from scratch.

4. Debt Management: Eliminating Financial Burdens

To build lasting financial stability, you must take control of debt. Tevan teaches techniques like the debt avalanche method (paying high-interest debt first) and the snowball method (tackling the smallest debts to build momentum).

"Debt is a tool; used wisely, it can build wealth. Misused, it can destroy it." — Tevan Asaturi

Being informed about loan terms, interest rates, and repayment plans ensures debt becomes manageable—not overwhelming.

Tevan Asaturi's Money Mastery Program

The Money Mastery Program is Tevan’s signature educational experience, empowering individuals with comprehensive, personalized financial tools. Covering everything from budgeting and saving to investing and debt reduction, this hands-on course delivers authentic financial advice in an engaging, real-world format.

Real-Life Impact: Success Stories

Here’s how Tevan’s work is making a difference:

"Before joining the program, I was living paycheck to paycheck. Tevan's guidance helped me create a budget, start saving, and invest wisely. Now, I feel in control of my finances and optimistic about the future."

That transformation reflects the power of honest, actionable financial advice.

Conclusion: Taking Control of Your Financial Future

True financial stability doesn’t happen overnight—it takes knowledge, discipline, and intentional action. Tevan Asaturi’s expert perspective equips you with tools to budget wisely, save consistently, invest strategically, and reduce debt. With his support, you can stop reacting to money problems and start building your financial future with confidence.

FAQs

Q1: What is the first step to achieving financial stability?

A: Begin by creating a personalized budget that matches your income and lifestyle. This step gives you clarity and structure.

Q2: How much should I save each month?

A: Ideally, save at least 20% of your income. Start smaller if necessary and increase as your income grows.

Q3: When should I start investing?

A: As soon as possible. Even small, early investments benefit from compound growth over time.

Q4: How can I effectively manage my debt?

A: Use structured methods like the avalanche or snowball approach, and prioritize high-interest debts.

Q5: What resources does Tevan Asaturi offer for financial education?

A: His Money Mastery Program includes coaching, workshops, and tools to help you build lasting financial stability.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)