Fewer than 500 people are responsible for $3.2 trillion of artificial crypto trading

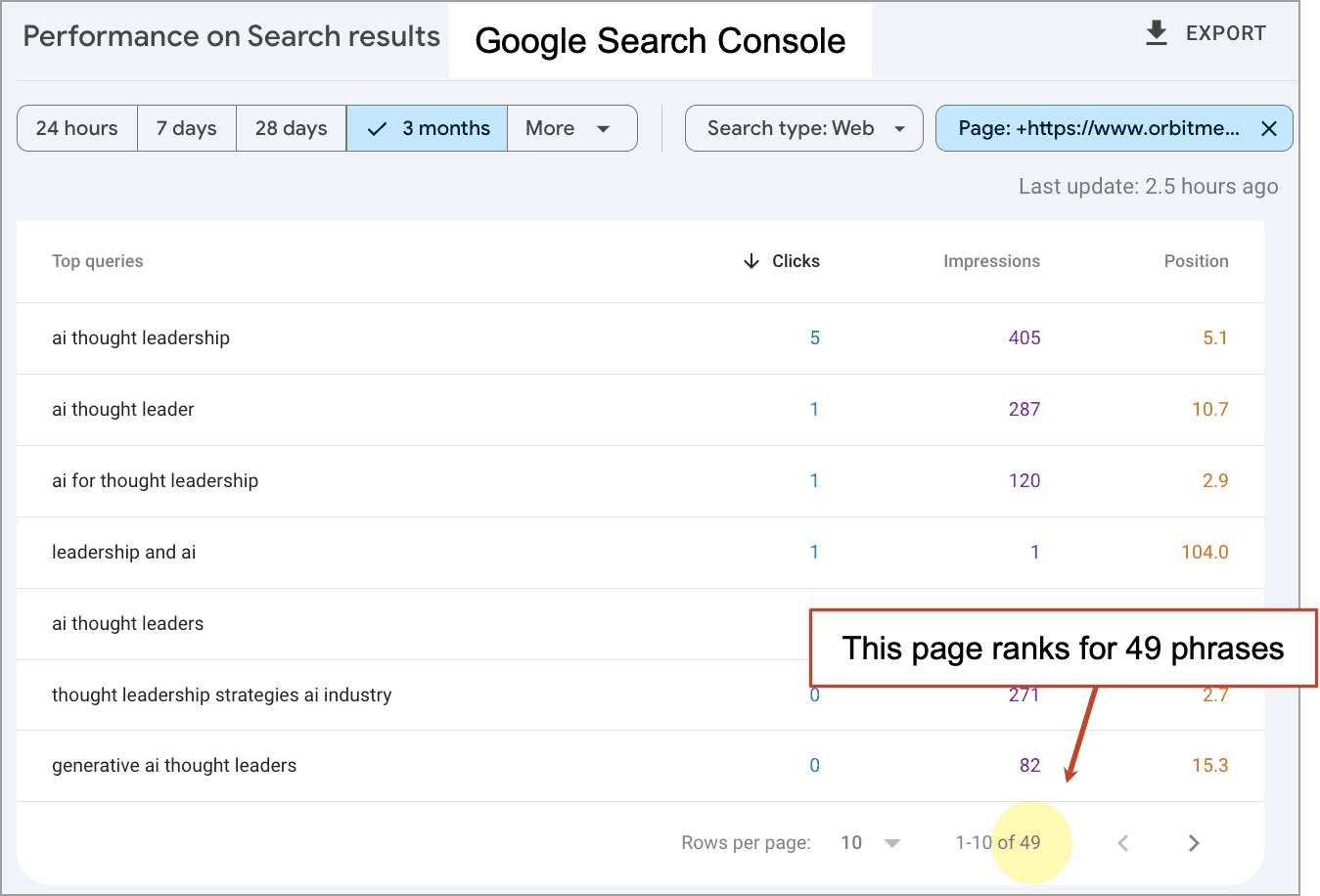

Market manipulation in the cryptocurrency world is rampant—and fewer than 500 people are responsible for as much as $250 million a year in profits and over $3.2 trillion in artificial trading, according to a new study published on Cornell University’s preprint server arXiv. Honglin Fu and colleagues at University College London have developed a tool that can track the coordination of pump-and-dump schemes, where crypto coin holders artificially inflate the price of a cryptocurrency by touting fake recommendations and generating nonexistent hype, making ordinary people intrigued enough to buy into a cryptocurrency before the owners then pull their stake and crash the price. Telegram, a popular encrypted messaging platform widely used by cryptocurrency investors, has become a favored tool for coordinating these schemes. Perseus, the tool Fu and his colleagues developed, identified more than 400 so-called masterminds that helped seed fake hype for crypto coins through millions of Telegram messages. By eavesdropping on Telegram chats where pump-and-dump schemes are discussed, then training Perseus on what happens, the team were able to identify nearly 750,000 messages organizing such scams. “There is one kind of bad actor, we call a mastermind in the paper. They’re the main distributor, you can think of them as, of the pump-and-dump method,” says Fu. “Then they have followers: what they do is the mastermind will distribute messages to the others, and they’ll spread the message further to attract as many investors as possible.” The accomplices are crucial to carrying out the scam, Fu says, because they’re the ones that convince people at scale that a cryptocurrency is worth investing in. The ease with which the scammers are able to organize their activities and bank profits is a concern to Fu, who hopes that more awareness of the way the scams work, thanks to Perseus, will help raise awareness and push an impetus to action. “The crypto market is not really regulated, and it should be regulated to ensure that there are at least some safety measures for the public,” Fu says. “Right now, the crypto market has so many scams out there. It’s like a Wild West.”

Market manipulation in the cryptocurrency world is rampant—and fewer than 500 people are responsible for as much as $250 million a year in profits and over $3.2 trillion in artificial trading, according to a new study published on Cornell University’s preprint server arXiv.

Honglin Fu and colleagues at University College London have developed a tool that can track the coordination of pump-and-dump schemes, where crypto coin holders artificially inflate the price of a cryptocurrency by touting fake recommendations and generating nonexistent hype, making ordinary people intrigued enough to buy into a cryptocurrency before the owners then pull their stake and crash the price.

Telegram, a popular encrypted messaging platform widely used by cryptocurrency investors, has become a favored tool for coordinating these schemes. Perseus, the tool Fu and his colleagues developed, identified more than 400 so-called masterminds that helped seed fake hype for crypto coins through millions of Telegram messages. By eavesdropping on Telegram chats where pump-and-dump schemes are discussed, then training Perseus on what happens, the team were able to identify nearly 750,000 messages organizing such scams.

“There is one kind of bad actor, we call a mastermind in the paper. They’re the main distributor, you can think of them as, of the pump-and-dump method,” says Fu. “Then they have followers: what they do is the mastermind will distribute messages to the others, and they’ll spread the message further to attract as many investors as possible.” The accomplices are crucial to carrying out the scam, Fu says, because they’re the ones that convince people at scale that a cryptocurrency is worth investing in.

The ease with which the scammers are able to organize their activities and bank profits is a concern to Fu, who hopes that more awareness of the way the scams work, thanks to Perseus, will help raise awareness and push an impetus to action.

“The crypto market is not really regulated, and it should be regulated to ensure that there are at least some safety measures for the public,” Fu says. “Right now, the crypto market has so many scams out there. It’s like a Wild West.”

![How 6 Leading Brands Use Content To Win Audiences [E-Book]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/content-marketing-examples-600x330.png?#)

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)