Protecting Your Business A Deep Dive into Anti Money Laundering Consultancy in Dubai

AML compliance services in Dubai encompass a wide range of offerings tailored to the specific needs of various industries. One core aspect is customer due diligence (CDD) and enhanced due diligence (EDD). This involves verifying the identity of customers, assessing the risks associated with their transactions, and conducting ongoing monitoring of their activities.

Dubai’s reputation as a global financial and business hub attracts a vast array of investments and commercial activities. However, with this rapid growth comes an inherent exposure to financial crime, particularly money laundering. To safeguard the integrity of its financial system and align with international standards set by bodies like the Financial Action Task Force (FATF), the UAE has implemented stringent Anti-Money Laundering (AML) regulations. For businesses operating in this dynamic environment, adhering to these rules is not merely a legal obligation but a strategic imperative. This is where the expertise of anti money laundering consultants becomes indispensable.

The Role of AML Advisors

Anti money laundering consulting services in Dubai play a critical role in helping businesses comply with the complex regulatory landscape. These specialized firms offer comprehensive assistance, ranging from risk assessment to the development and implementation of robust AML frameworks. They serve as trusted advisors, ensuring that companies not only meet their legal obligations but also proactively mitigate the risks associated with illicit financial activities. Their work is vital in maintaining the UAE's reputation as a secure and transparent place to conduct business.

Why Compliance Matters

Failure to comply with anti money laundering regulations in Dubai can lead to severe consequences. Businesses face hefty fines, reputational damage, and even legal action, including imprisonment for individuals involved. Beyond the punitive measures, non-compliance can erode trust among clients, partners, and stakeholders, making it difficult to operate effectively in the long run. Moreover, a robust AML compliance program fosters a culture of transparency and accountability, which is essential for sustainable growth and a positive public image.

Essential Compliance Services

AML compliance services in Dubai encompass a wide range of offerings tailored to the specific needs of various industries. One core aspect is customer due diligence (CDD) and enhanced due diligence (EDD). This involves verifying the identity of customers, assessing the risks associated with their transactions, and conducting ongoing monitoring of their activities. Such measures are crucial for identifying and reporting suspicious transactions to the relevant authorities, like the Financial Intelligence Unit (FIU).

Another key area is the development and implementation of internal policies and procedures. Expert consultants assist businesses in crafting customized AML frameworks that align with their unique risk profiles and regulatory mandates. This includes establishing clear guidelines for reporting suspicious activities, maintaining accurate records, and ensuring proper training for employees. Regular compliance testing and audits are also vital to assess the effectiveness of these programs and identify any vulnerabilities.

Who Needs AML Support

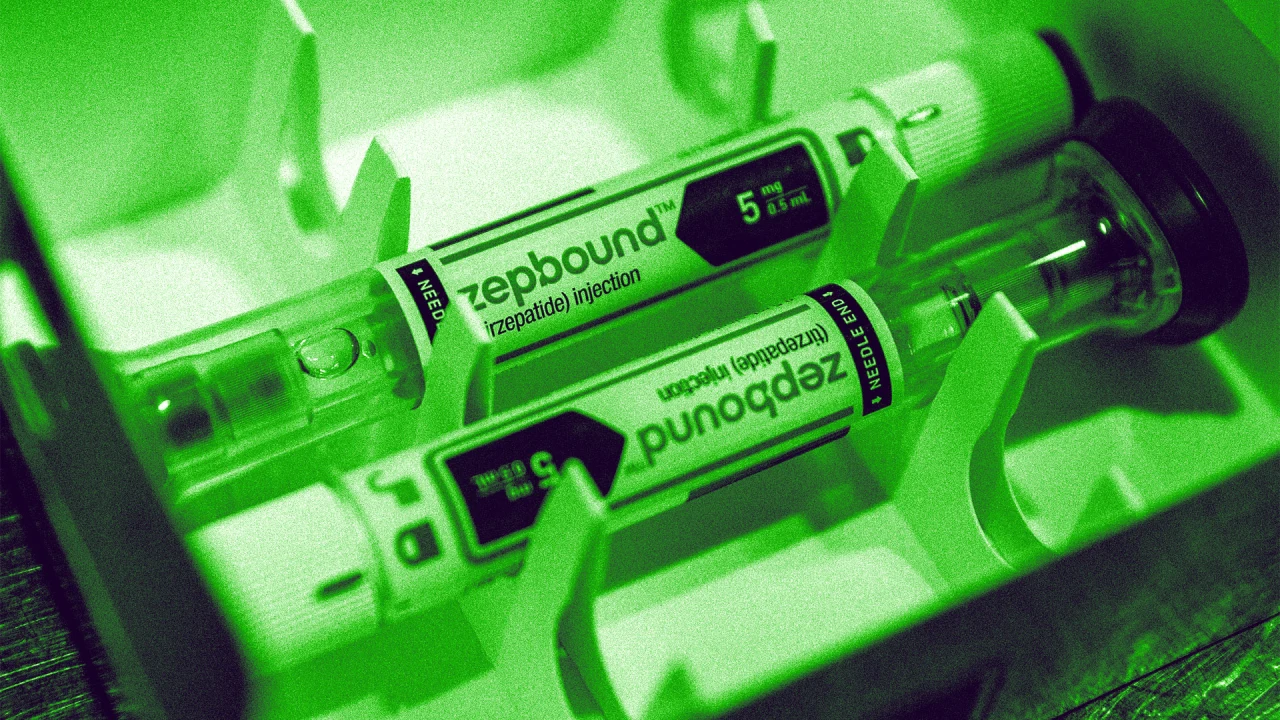

The scope of anti money laundering laws in the UAE extends beyond traditional financial institutions like banks and insurance companies. Designated Non-Financial Businesses and Professions (DNFBPs) are also subject to stringent AML obligations. This includes a broad spectrum of entities such as real estate agents and brokers, dealers in precious metals and stones, auditors and independent accountants, and corporate service providers. The booming real estate market in Dubai, for instance, requires careful scrutiny of capital origins to prevent its misuse for illicit purposes. Similarly, the growing cryptocurrency sector necessitates robust AML measures to mitigate risks associated with virtual asset transactions.

Benefits of Professional Guidance

Engaging an anti money laundering consultant offers numerous advantages. These specialists possess an in-depth understanding of local regulations, international standards, and emerging financial crime typologies. They can help businesses stay updated with evolving compliance requirements, which are frequently updated to address new threats. Their expertise in conducting comprehensive risk assessments enables companies to identify their specific vulnerabilities and implement targeted controls.

Furthermore, these professionals can provide valuable employee training, ensuring that staff members are well-versed in their AML obligations, including how to identify and report suspicious activities. This proactive approach significantly reduces the likelihood of inadvertent non-compliance. For businesses with cross-border operations, consultants can offer guidance on navigating the complexities of international AML regulations, facilitating smooth global business relationships.

Building Trust and Confidence

Ultimately, prioritizing AML compliance is about more than just avoiding penalties; it's about building trust and confidence. Businesses that demonstrate a strong commitment to ethical practices and regulatory adherence enhance their credibility with clients, investors, and regulators alike. This commitment contributes to a more secure and transparent financial ecosystem in Dubai and the wider UAE, fostering economic stability and sustainable growth. By partnering with knowledgeable specialists, businesses can confidently operate, knowing they are contributing to the global fight against financial crime.

Read more exciting news on newsquo.com

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)

![[PATREON EXCLUSIVE] The Power of No: How to Say It, Mean It, and Lead with It](https://tpgblog.com/wp-content/uploads/2025/06/just-say-no.jpg?#)