Protein Ingredients Market Insights 2021-2030| Growth & Opportunity Analysis

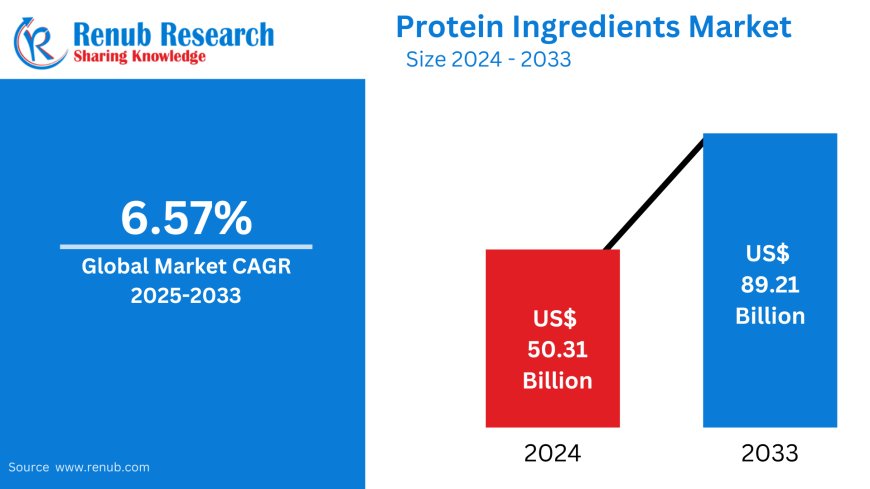

According to Renub Research, the global protein ingredients market reached a valuation of US$ 50.31 billion in 2024 and is projected to surpass US$ 89.21 billion by 2033, expanding at a CAGR of 6.57% from 2025 to 2033.

Global Protein Ingredients Market Report (2025–2033)

By Products (Dairy Protein, Egg Protein, Fish Protein, and Gelatin), Form (Concentrate Protein, Isolate Protein, Others), Applications (Food & Beverages, Infant Formulations, Clinical Nutrition, Animal Feed, Others), Country and Company Analysis

Market Overview

According to Renub Research, the global protein ingredients market reached a valuation of US$ 50.31 billion in 2024 and is projected to surpass US$ 89.21 billion by 2033, expanding at a CAGR of 6.57% from 2025 to 2033. The market is witnessing robust growth driven by rising health consciousness, growing demand for functional foods, and the expanding scope of protein utilization in diverse sectors such as dietary supplements, food and beverages, and clinical nutrition.

Protein ingredients, derived from animal, plant, and microbial sources, serve as essential macronutrients promoting muscle repair, tissue development, and metabolic health. Major variants such as whey, casein, soy, pea, rice, and hemp proteins cater to varied dietary and functional needs, with increasing consumer interest in personalized and plant-based nutrition.

Press Release Highlights

Beyond Meat (July 2024): Launched a revolutionary new plant-based protein product designed to attract health-conscious consumers, emphasizing clean labeling and high bioavailability.

Synthite (June 2023): Announced a joint venture with IISc and US-based PMEDS to produce and distribute branded plant-derived nutrients and proteins.

Amber Wave (November 2023): Began operations at what is expected to be North America's largest wheat protein production facility, backed by significant investments from Summit Agricultural Group.

Coca-Cola India (August 2022): Introduced Limca Sportz, a functional hydration drink enriched with glucose and electrolytes, signaling growing corporate interest in protein-based functional beverages.

Market Drivers

1. Health Awareness and Fitness Trends

A surge in fitness and health-conscious consumers has resulted in elevated demand for high-protein diets. From athletes to wellness-driven individuals, protein-rich snacks, supplements, and drinks are increasingly integrated into daily consumption. The consumer trend is not only about muscle building but also about weight management and holistic wellness, creating vast opportunities for protein-enriched product innovation.

2. Rise in Plant-Based and Vegan Diets

The global shift toward plant-based nutrition is substantially impacting the protein ingredient landscape. Pea, soy, rice, and hemp protein sources are gaining favor for their sustainability and suitability for vegan and vegetarian consumers. Plant proteins are now mainstream across various food categories, from dairy alternatives to plant-based meat and ready-to-drink shakes.

3. Growth in Functional Foods and Beverages

Protein-enriched functional foods and beverages, such as energy drinks, protein bars, and fortified meals, are experiencing growing demand. These products cater to busy, health-conscious consumers looking for quick, nutritious options. This segment is expected to be one of the fastest-growing within the broader protein ingredients market.

Key Challenges

1. Supply Chain Disruptions

Weather conditions, geopolitical tensions, and dependency on limited agricultural inputs (e.g., soy, peas, rice) contribute to fluctuations in raw material availability. These issues impact pricing, consistency, and production planning, especially for companies scaling up operations globally.

2. Regulatory Compliance and Quality Control

Navigating regional differences in labeling laws, food safety regulations, and clean-label standards poses hurdles for multinational manufacturers. Ensuring consistent quality, transparency in sourcing, and compliance with regional mandates can slow innovation and market entry.

Wheat Protein Ingredient Market Spotlight

Wheat protein, especially vital wheat gluten, is gaining traction due to its functional characteristics and compatibility with plant-based food innovation. Used in meat analogs, bakery items, and beverages, wheat protein delivers elasticity and structure. With rising consumer preference for protein-rich, sustainable foods, wheat protein's growth trajectory is strengthening. The launch of Amber Wave’s facility further amplifies supply capabilities and scalability in North America.

Market Segmentation

By Products

- Dairy Protein

- Egg Protein

- Fish Protein

- Gelatin

By Form

- Concentrate Protein

- Isolate Protein

- Others

By Applications

- Food & Beverages

- Infant Formulations

- Clinical Nutrition

- Animal Feed

- Others

Regional and Country-Level Analysis

North America

- United States

- Canada

- Mexico

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Switzerland

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Indonesia

Latin America

- Brazil

- Argentina

Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

Rest of World

Company Profiles

Each company analysis includes Overview, Recent Developments, and Revenue Insights:

- Archer Daniels Midland Co.

- DuPont de Nemours, Inc

- MGP Ingredients

- Kerry Group plc

- Tessenderlo

- CHS, Inc.

- Crop Energies AG

- Glanbia Plc

Conclusion

The global protein ingredients market is entering a phase of accelerated growth, fueled by the convergence of consumer health trends, innovations in plant-based and functional food segments, and increasing demand for alternative proteins. However, regulatory and supply chain challenges require strategic management to sustain long-term market leadership. With continued investments, partnerships, and new product launches, the protein ingredients industry is poised to meet evolving global nutritional needs across consumer segments.

![https //g.co/recover for help [1-866-719-1006]](https://newsquo.com/uploads/images/202506/image_430x256_684949454da3e.jpg)

![[PATREON EXCLUSIVE] The Power of No: How to Say It, Mean It, and Lead with It](https://tpgblog.com/wp-content/uploads/2025/06/just-say-no.jpg?#)