The Financial Perks (and Downsides) of Marriage

Love is priceless; but marriage comes with receipts.

Marriage: The sacred union of two hearts, two souls, and, less romantically, two tax returns. While poets and romantics wax lyrical about eternal love, accountants and financial advisors see matrimony through a different lens. After all, marriage is a significant economic transaction with its own balance sheet. Let's take a cold, calculating look at the institution that promises "for richer or poorer"—and find out which one you're more likely to experience.

The financial pros of marriage

For the most part, there are plenty of ways in which "I do" means "we save."

Tax benefits (sometimes)

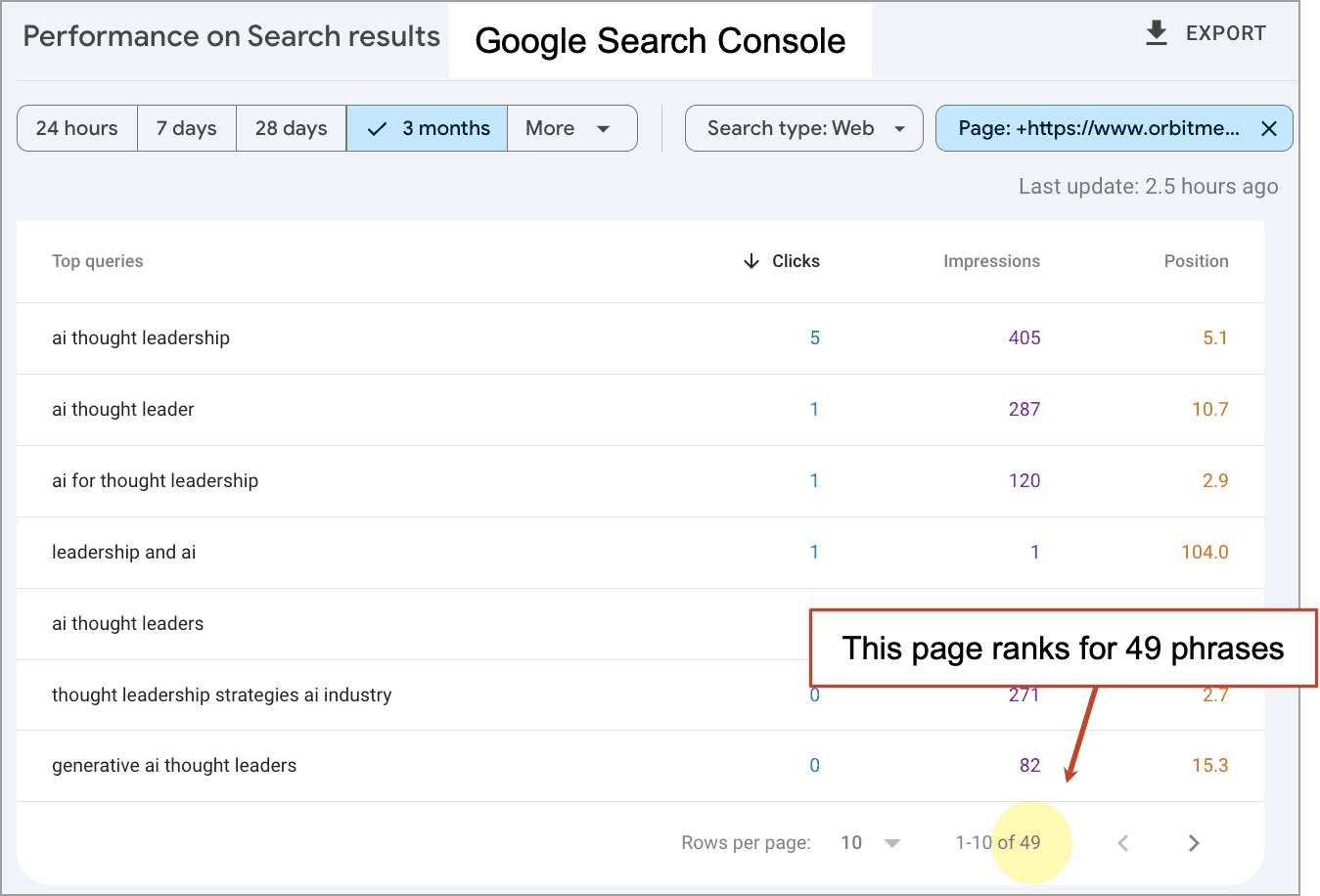

For some couples, marriage delivers an immediate return on investment through the "marriage bonus." Couples with disparate incomes often find themselves in a lower tax bracket together than they would be separately. However, the IRS doesn't send wedding gifts—this benefit typically favors traditional arrangements where one spouse significantly out-earns the other.

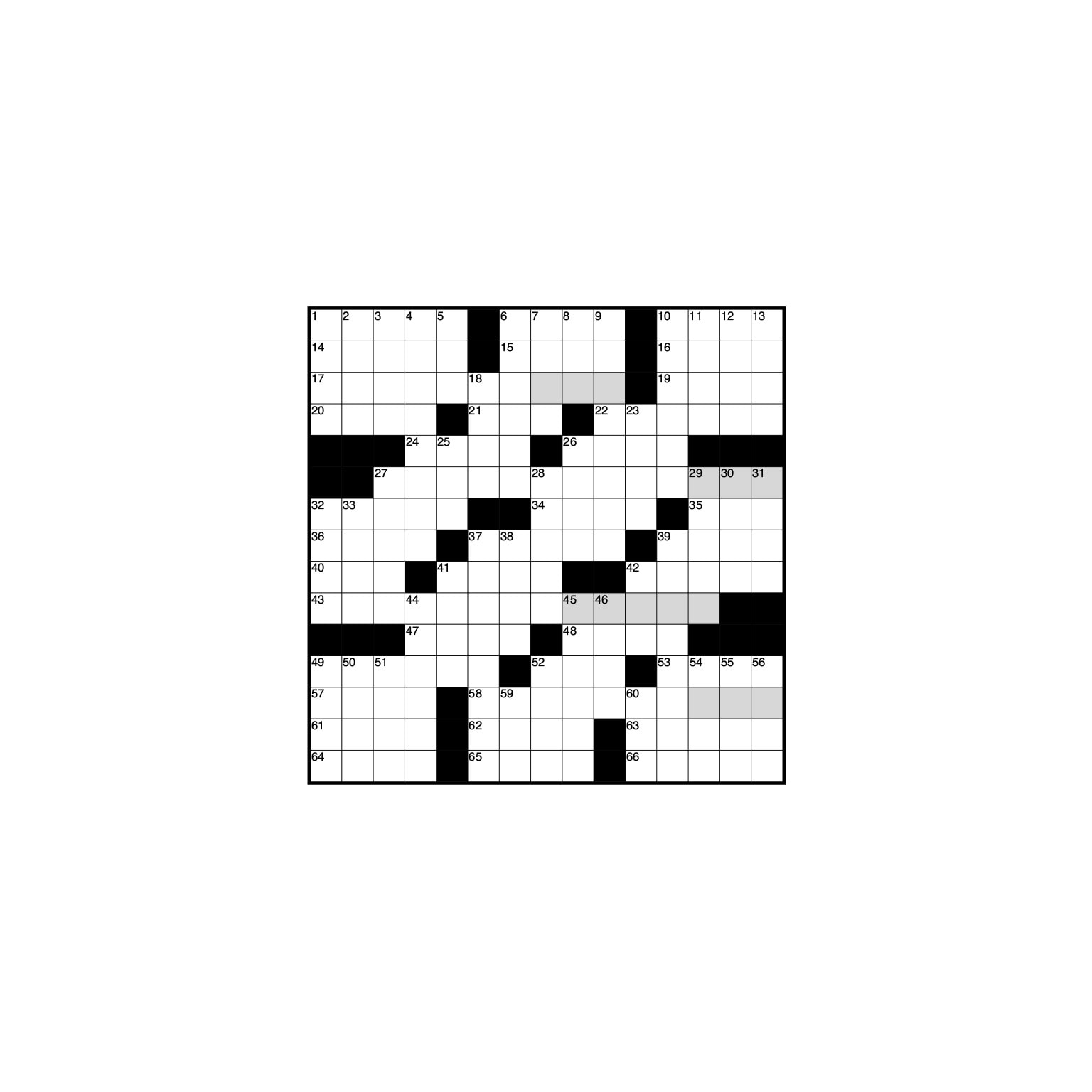

Check out this calculator from the Tax Policy Center to see how much federal income tax two people might pay if they were to marry. It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as single or head of household.

Healthcare savings

Nothing says romance like discounted health insurance premiums. Many employers offer family coverage that costs less than two individual plans. Plus, you'll only need to meet one family deductible instead of two individual ones when you both get sick from the same wedding buffet.

Economies of scale

Married or not, two can live almost as cheaply as one—especially when it comes to housing, utilities, and streaming subscriptions. Why maintain two half-empty refrigerators when you can maintain one completely full one? The shared-expense model makes everyday living more efficient, assuming you can agree on a thermostat setting.

Social security advantages

Marriage offers a built-in retirement safety net. Surviving spouses can claim their deceased partner's Social Security benefits if they exceed their own. It's the government's way of saying, "Sorry for your loss—here's some money."

The financial cons of marriage

When "I do" becomes "I'm due...to pay." Hey, not all of my wordplay is perfect, OK?

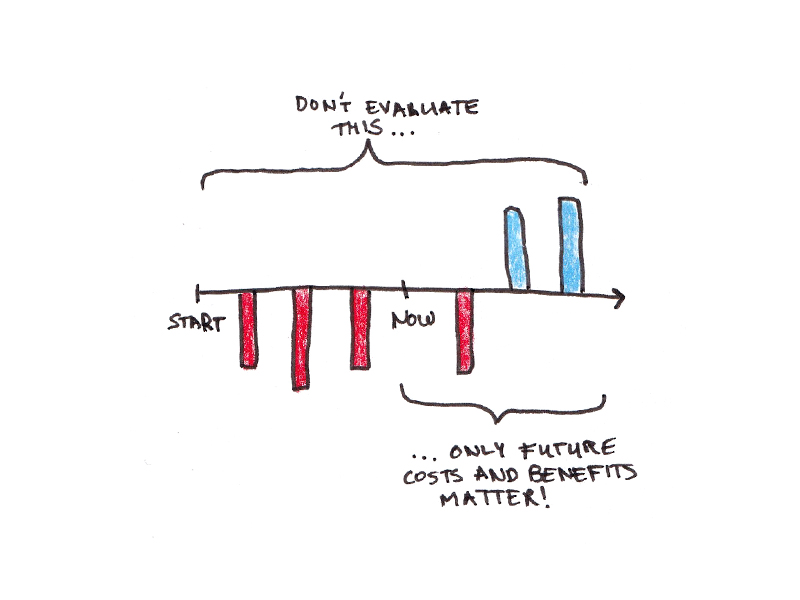

The marriage penalty

This is the flip side of the marriage bonus. Some dual-income couples with similar earnings find themselves paying more in taxes together than separately—the infamous "marriage penalty." Nothing strengthens a relationship like realizing you're paying thousands more annually for the privilege of filing jointly. Here's that calculator again.

Shared debts

When you marry someone, you don't just get their charming quirks—you might get their debt too. While premarital debt typically remains separate, any debt accumulated during the marriage can become shared responsibility, depending on your state's laws. Their student loan debt remains theirs, but their impulsive decision to finance a luxury boat "for weekend getaways" becomes your shared financial burden.

Before you assume you’re on the hook for a debt, it’s usually worth it to take a breath and dig into whether you’re actually responsible.

Divorce as a financial risk

Approximately 40-50% of marriages end in divorce—a statistic that financial planners can't ignore. The average divorce costs between $15,000 and $30,000 in legal fees alone, not counting the financial aftermath of dividing assets, potential alimony, and the cost of establishing two separate households. No wedding DJ ever announces, "And now, let's factor in the statistical probability of spending $20,000 to undo this entire event!"

Benefit complications

Some income-based government benefits may decrease or disappear entirely when household income is calculated jointly. Marriage can inadvertently disqualify individuals from financial aid, assistance programs, or income-based repayment plans for student loans.

Tips to protect yourself financially

You'll hear people say, "Sign a pre-nup," but what exactly does that entail? And what else can you do to protect your finances in your marriage?

The prenuptial agreement conversation

Nothing says "romance" like discussing how to divide assets in case of divorce before you've even cut the wedding cake. Despite its unromantic reputation, a prenuptial agreement provides clarity and protection for both parties. Think of it as insurance—you don't buy home insurance because you expect your house to burn down, but because you recognize it could.

Prioritize financial transparency

Before marriage, schedule a judgment-free financial disclosure session. Reveal credit scores, debt loads, assets, spending habits, and financial goals. Finding out your spouse has $60,000 in credit card debt during your honeymoon makes those "for richer or poorer" vows feel a bit more literal than intended.

Establish a financial framework

Decide early how you'll handle money: Will you merge everything, keep separate accounts, or create a hybrid system? Determine who pays for what, how savings will be allocated, and how major purchases will be decided. This prevents the "I thought you were paying the electric bill" conversation in the dark.

Create an exit strategy for your accounts

Consider maintaining some financial independence, like a personal emergency fund or credit card in your own name. This isn't about planning for divorce—it's about maintaining financial identity and credit history, which becomes crucial if you face unexpected circumstances like a spouse's death or incapacitation.

The bottom line

Marriage represents many things: a romantic milestone, a legal contract, and—whether we like to admit it or not—a financial partnership with significant economic implications. While love may be the reason you marry, money will likely be something you discuss daily for the rest of your lives together.

The good news? Financial compatibility doesn't require identical views on money—just open communication, mutual respect, and occasionally, the willingness to compromise on whether a $7 daily latte habit constitutes "essential spending."

After all, as the old saying goes: Love may be blind, but marriage is a long-term investment strategy with variable returns and significant tax implications.

![How 6 Leading Brands Use Content To Win Audiences [E-Book]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/content-marketing-examples-600x330.png?#)

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How Human Behavior Impacts Your Marketing Strategy [Video]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/human-behavior-impacts-marketing-strategy-cover-600x330.png?#)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)