What happens to mortgage rates if conservatorship ends for Freddie Mac and Fannie Mae?

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Last month, new Treasury Secretary Scott Bessent said that the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) could get released from government conservatorship if doing so doesn’t push up mortgage rates. “Right now the priority is tax policy—once we get through that, then we will think about that [ending conservatorship]. The priority for a Fannie and Freddie release, the most important metric that I’m looking at is any study or hint that mortgage rates would go up. Anything that is done around a safe and sound release [of Fannie Mae and Freddie Mac] is going to hinge on the effect of long-term mortgage rates,” Bessent said. While some in the Trump administration have alluded to an interest in ending the conservatorship of Fannie Mae and Freddie Mac, Trump and Bessent also earlier expressed interest in bringing down long-term rates and yields. Bessent suggests that their goal of lowering mortgage rates could take precedence over releasing Fannie Mae and Freddie Mac from conservatorship. Fannie Mae and Freddie Mac, which support the mortgage industry by buying mortgages from lenders and selling mortgage-backed securities to investors, were placed into conservatorship by the Federal Housing Finance Agency (FHFA) in September 2008. That was after they suffered massive losses during the housing crash, which threatened the stability of the U.S. financial system. The U.S. Treasury provided a bailout to keep them afloat, and they have remained under government control ever since, despite returning to profitability. While the U.S. Treasury owns the majority of their profits through senior preferred stock agreements, the common and preferred shares that existed before conservatorship were never fully wiped out. Immediately following Trump’s November election win, the stock prices of Freddie Mac and Fannie Mae both soared and the market started to price in higher odds of conservatorship coming to an end. To better understand what the end of conservatorship for Freddie Mac and Fannie Mae could mean for the housing market and mortgage rates, ResiClub reached out to Moody’s chief economist Mark Zandi—who has published several reports (including in 2017 and 2025) on how the end of conservatorship could impact financial markets. Zandi provided ResiClub with his odds for five scenarios and how each could impact mortgage rates, including whether the government offers an “implicit” or “explicit” guarantee of Fannie and Freddie. An “explicit guarantee” means the government formally guarantees Fannie Mae and Freddie Mac’s obligations, ensuring that investors will be repaid no matter what. This reduces risk for investors, leading to lower mortgage rates. An “implicit guarantee” means the government does not commit to backing the GSEs, but markets assume it would intervene to prevent failure. (This was the case before the 2008 financial crisis when investors believed the government would rescue the GSEs if needed.) Since there’s no formal guarantee, this scenario can lead to higher borrowing costs because investors demand extra compensation for the uncertainty. 1. Conservatorship status quo remains in place: 65% probability “The status quo with the [Government-Sponsored Enterprises] remaining in conservatorship is the most likely scenario,” Zandi tells ResiClub. “This is the most likely scenario as it is consistent with the status quo and current mortgage rates. The housing finance system has worked very well since the GSEs were put into conservatorship in 2008. And the GSEs have been effectively privatized through their credit risk transfers to the private sector. Those advocating for taking the GSEs out of conservatorship need to explain what the benefit of privatization is.” 2. Release of Freddie Mac and Fannie Mae with an “implicit government guarantee”: 20% probability “Release of the GSEs as systemically important financial institutions (SIFIs) with an implicit government guarantee like that which prevailed prior to the GSEs’ conservatorship,” says Zandi. “This is going back to the future, and while the GSEs will be better capitalized and with a much smaller and less risky balance sheet than when they failed, global investors will be highly wary of this approach, pushing mortgage rates up 20-40 basis points compared to the status quo for the typical borrower through the business cycle. Given the nightmares this will conjure up, it is a less likely scenario.” 3. Full release of Freddie Mac and Fannie Mae without an “implicit” or “explicit” government guarantee: 10% probability “This would add an estimated 60-90 basis points to 30-year fixed mortgage rates compared to the current status quo for the typical borrower through the business cycle,” Zandi projects. “Without a government guarantee, th

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Last month, new Treasury Secretary Scott Bessent said that the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) could get released from government conservatorship if doing so doesn’t push up mortgage rates.

“Right now the priority is tax policy—once we get through that, then we will think about that [ending conservatorship]. The priority for a Fannie and Freddie release, the most important metric that I’m looking at is any study or hint that mortgage rates would go up. Anything that is done around a safe and sound release [of Fannie Mae and Freddie Mac] is going to hinge on the effect of long-term mortgage rates,” Bessent said.

While some in the Trump administration have alluded to an interest in ending the conservatorship of Fannie Mae and Freddie Mac, Trump and Bessent also earlier expressed interest in bringing down long-term rates and yields. Bessent suggests that their goal of lowering mortgage rates could take precedence over releasing Fannie Mae and Freddie Mac from conservatorship.

Fannie Mae and Freddie Mac, which support the mortgage industry by buying mortgages from lenders and selling mortgage-backed securities to investors, were placed into conservatorship by the Federal Housing Finance Agency (FHFA) in September 2008. That was after they suffered massive losses during the housing crash, which threatened the stability of the U.S. financial system. The U.S. Treasury provided a bailout to keep them afloat, and they have remained under government control ever since, despite returning to profitability.

While the U.S. Treasury owns the majority of their profits through senior preferred stock agreements, the common and preferred shares that existed before conservatorship were never fully wiped out. Immediately following Trump’s November election win, the stock prices of Freddie Mac and Fannie Mae both soared and the market started to price in higher odds of conservatorship coming to an end.

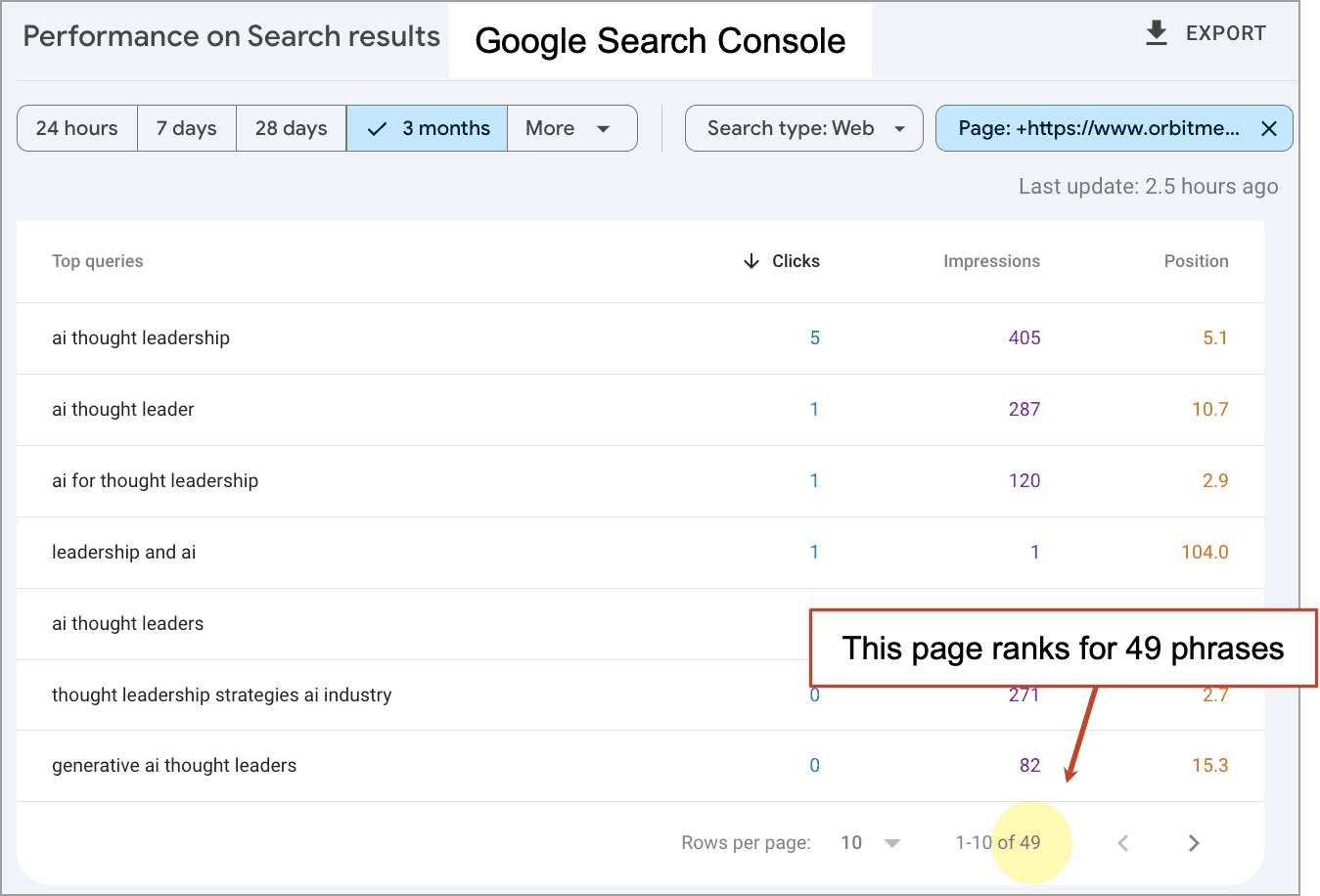

To better understand what the end of conservatorship for Freddie Mac and Fannie Mae could mean for the housing market and mortgage rates, ResiClub reached out to Moody’s chief economist Mark Zandi—who has published several reports (including in 2017 and 2025) on how the end of conservatorship could impact financial markets.

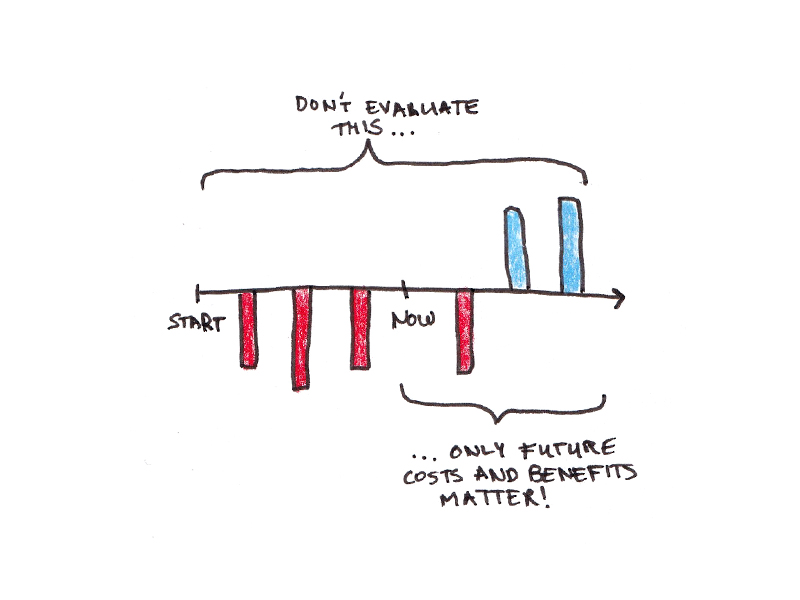

Zandi provided ResiClub with his odds for five scenarios and how each could impact mortgage rates, including whether the government offers an “implicit” or “explicit” guarantee of Fannie and Freddie.

An “explicit guarantee” means the government formally guarantees Fannie Mae and Freddie Mac’s obligations, ensuring that investors will be repaid no matter what. This reduces risk for investors, leading to lower mortgage rates. An “implicit guarantee” means the government does not commit to backing the GSEs, but markets assume it would intervene to prevent failure. (This was the case before the 2008 financial crisis when investors believed the government would rescue the GSEs if needed.) Since there’s no formal guarantee, this scenario can lead to higher borrowing costs because investors demand extra compensation for the uncertainty.

1. Conservatorship status quo remains in place: 65% probability

“The status quo with the [Government-Sponsored Enterprises] remaining in conservatorship is the most likely scenario,” Zandi tells ResiClub. “This is the most likely scenario as it is consistent with the status quo and current mortgage rates. The housing finance system has worked very well since the GSEs were put into conservatorship in 2008. And the GSEs have been effectively privatized through their credit risk transfers to the private sector. Those advocating for taking the GSEs out of conservatorship need to explain what the benefit of privatization is.”

2. Release of Freddie Mac and Fannie Mae with an “implicit government guarantee”: 20% probability

“Release of the GSEs as systemically important financial institutions (SIFIs) with an implicit government guarantee like that which prevailed prior to the GSEs’ conservatorship,” says Zandi. “This is going back to the future, and while the GSEs will be better capitalized and with a much smaller and less risky balance sheet than when they failed, global investors will be highly wary of this approach, pushing mortgage rates up 20-40 basis points compared to the status quo for the typical borrower through the business cycle. Given the nightmares this will conjure up, it is a less likely scenario.”

3. Full release of Freddie Mac and Fannie Mae without an “implicit” or “explicit” government guarantee: 10% probability

“This would add an estimated 60-90 basis points to 30-year fixed mortgage rates compared to the current status quo for the typical borrower through the business cycle,” Zandi projects. “Without a government guarantee, the Federal Reserve would not be able to buy the GSEs’ [mortgage-backed securities], and there is the risk that the rating agencies would downgrade the GSEs’ debt and securities. The GSEs’ share of the mortgage market would significantly decline, and it would increase for private lenders and the [Federal Housing Administration], resulting in greater taxpayer exposure, as taxpayers bear all the risk in FHA loans.”

4. Release of Freddie Mac and Fannie Mae with an “explicit” government guarantee: 5% probability

“Release of the GSEs with an explicit government guarantee would result in a small decline in mortgage rates (as much as 25 basis points) compared to the current status quo. But this is not likely as it would require legislation that would be difficult and [nearly] impossible to pass,” says Zandi.

5. Freddie Mac and Fannie Mae fully chartered as government corporations: 0% probability

“[If the] GSEs are chartered as government corporations (much like Fannie pre-1968) with an explicit government guarantee, [this] would effectively codify the current status quo to get the full faith and credit guarantee of the federal government. This would result in the lowest mortgage rates, but also requires legislation and is not at all likely in a Trump administration,” says Zandi.

While the Trump administration is interested in releasing Freddie Mac and Fannie Mae from conservatorship, it is also sensitive to any increase in mortgage rates. Given this concern and the evidence presented by Moody’s, it is fair to assume that the administration will proceed with caution over the next year. If conservatorship does end, it is likely to happen later in the Trump administration, once concerns around mortgage rates have been addressed.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How 6 Leading Brands Use Content To Win Audiences [E-Book]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/content-marketing-examples-600x330.png?#)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)