Why Amazon is doubling down on movie theaters

Amazon is betting big on movie theaters—even if it isn’t counting on mega profits. The Silicon Valley giant told The New York Times last week that it is planning to release about 14 movies annually in theaters across the United States, an untraditional move for a company that has for years focused on streaming. Instead of simply dropping films directly onto Prime Video, its streaming service, Amazon wants audiences to see its movies on the big screen first—typically for 45 days—before they’re available for streaming. Three years after Amazon bought MGM for $8.5 billion, the tech giant is signaling that it is ready to compete more directly with Hollywood’s biggest studios. According to eMarketer analyst Jeremy Goldman, the theatrical push has more to do with earning customer loyalty than it does raking in game-changing revenues. “By investing in wide releases with A-list talent and 45-day exclusive theatrical windows, Amazon is signaling that it wants its films to matter—not just be content that quietly drops on a Thursday night,” Goldman says. In the past 10 years, Amazon has acted as distributor for a number of critically acclaimed films, including Nickel Boys, American Fiction, Sound of Metal, and Manchester by the Sea, all of which were nominated for Best Picture Oscars and received at least limited theatrical releases. In recent years, Amazon has released five to eight films in theaters annually, often with varying time frames before they became available on Prime Video. The newly announced 14-film, 45-day-window strategy is in league with what the five major studios—Universal, Paramount, Warner Bros., Walt Disney, and Sony—do each year. The shift could be a boon for the movie theater business, which has struggled to recover from the COVID-19 pandemic. Box office receipts are down 20% to 25% from pre-pandemic levels in 2019, according to a research note Bloomberg Intelligence shared with Fast Company. Bloomberg Intelligence analysts Geetha Ranganathan and Kevin Near noted that this investment could fill a competition gap left when Disney bought 21st Century Fox in 2019. In addition to award-winning releases, Amazon has blockbuster films at the ready. The company reportedly paid an additional $1 billion earlier this year to take full control of the James Bond franchise, and is expected to name a new Bond to replace Daniel Craig soon. Amazon is honing its theatrical strategy as other streaming giants continue to tinker with theirs in an effort to fuel both streaming user and theatergoer demands. Apple and Netflix have limited theatrical releases, while Disney is stuck between fueling its Disney+ streaming services and giving moviegoing audiences the theater experience they crave for blockbusters. Mike Proulx, vice president and research director at Forrester, sees a parallel to Amazon’s model in Disney: “The company’s theatrical release strategy is akin to what Disney has been doing for years with Disney+ as the eventual beneficiary of the content.” Proulx adds that while Amazon is trying to find the right balance between its streaming and theater strategies, an uptick in quality films is ultimately a net positive for the company. “Better content makes Prime Video more valuable,” he says, “even if some people opt to wait for it to end up there.”

Amazon is betting big on movie theaters—even if it isn’t counting on mega profits.

The Silicon Valley giant told The New York Times last week that it is planning to release about 14 movies annually in theaters across the United States, an untraditional move for a company that has for years focused on streaming. Instead of simply dropping films directly onto Prime Video, its streaming service, Amazon wants audiences to see its movies on the big screen first—typically for 45 days—before they’re available for streaming.

Three years after Amazon bought MGM for $8.5 billion, the tech giant is signaling that it is ready to compete more directly with Hollywood’s biggest studios.

According to eMarketer analyst Jeremy Goldman, the theatrical push has more to do with earning customer loyalty than it does raking in game-changing revenues. “By investing in wide releases with A-list talent and 45-day exclusive theatrical windows, Amazon is signaling that it wants its films to matter—not just be content that quietly drops on a Thursday night,” Goldman says.

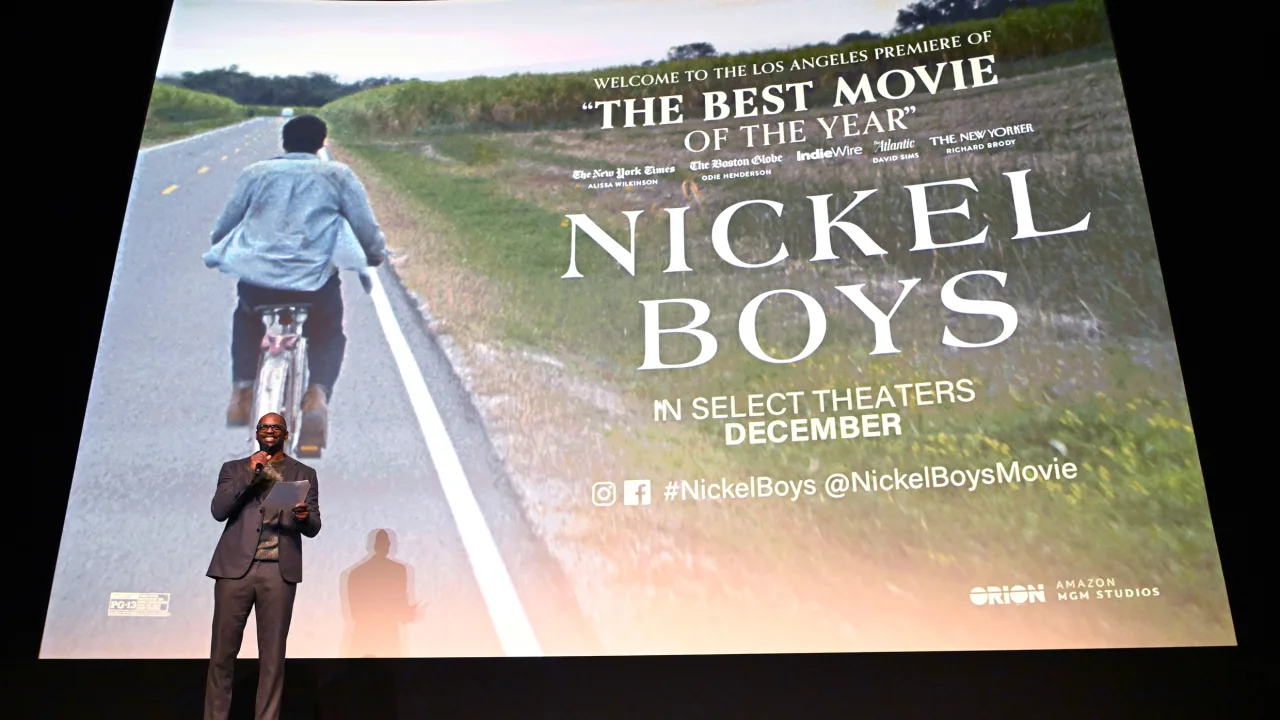

In the past 10 years, Amazon has acted as distributor for a number of critically acclaimed films, including Nickel Boys, American Fiction, Sound of Metal, and Manchester by the Sea, all of which were nominated for Best Picture Oscars and received at least limited theatrical releases.

In recent years, Amazon has released five to eight films in theaters annually, often with varying time frames before they became available on Prime Video. The newly announced 14-film, 45-day-window strategy is in league with what the five major studios—Universal, Paramount, Warner Bros., Walt Disney, and Sony—do each year.

The shift could be a boon for the movie theater business, which has struggled to recover from the COVID-19 pandemic. Box office receipts are down 20% to 25% from pre-pandemic levels in 2019, according to a research note Bloomberg Intelligence shared with Fast Company. Bloomberg Intelligence analysts Geetha Ranganathan and Kevin Near noted that this investment could fill a competition gap left when Disney bought 21st Century Fox in 2019.

In addition to award-winning releases, Amazon has blockbuster films at the ready. The company reportedly paid an additional $1 billion earlier this year to take full control of the James Bond franchise, and is expected to name a new Bond to replace Daniel Craig soon.

Amazon is honing its theatrical strategy as other streaming giants continue to tinker with theirs in an effort to fuel both streaming user and theatergoer demands.

Apple and Netflix have limited theatrical releases, while Disney is stuck between fueling its Disney+ streaming services and giving moviegoing audiences the theater experience they crave for blockbusters. Mike Proulx, vice president and research director at Forrester, sees a parallel to Amazon’s model in Disney: “The company’s theatrical release strategy is akin to what Disney has been doing for years with Disney+ as the eventual beneficiary of the content.”

Proulx adds that while Amazon is trying to find the right balance between its streaming and theater strategies, an uptick in quality films is ultimately a net positive for the company. “Better content makes Prime Video more valuable,” he says, “even if some people opt to wait for it to end up there.”

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How One Brand Solved the Marketing Attribution Puzzle [Video]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/marketing-attribution-model-600x338.png?#)