Why You Should Think Twice Before Using Buy Now, Pay Later With Apple Pay

Apple discontinued their "buy now, pay later" program, but third party plans still work with Apple Pay.

As you're checking out your Prime Day deals in just a few weeks, one payment option you'll want to reconsider is "buy now, pay later" financing.

Last year Apple discontinued its own take on “buy now, pay later” (BNPL), Apple Pay Later. The service may no longer be available in name, but BNPL purchases are readily available when you check out with Apple Pay. So, what exactly has changed about paying with installments via Apple Pay, and what sets it apart from other BNPL programs—for better or for worse?

What is “buy now, pay later?”

A “buy now, pay later” service is exactly what it sounds like: You can make a purchase immediately, and then pay for it through a series of installments over time. Although BNPL has some perks for breaking up a major expense, there are risks involved. Even if these loans have little-to-no interest, you are still taking on debt. And while BNPL plans don’t directly impact users’ credit scores at the moment, that's set to change. Coming this fall, FICO says it will start including BNPL payment histories in how it calculates credit scores. If you're at risk of not getting your BNPL payments in according to schedule, you'll be putting your credit score at risk, too.

Any personal finance writer with a semblance of a conscience will advise against making a habit of using these services. They’re helpful if you really need to finance something big, but whenever possible, it’s best to avoid taking on debt for everyday expenses.

How can you pay with installments using Apple Pay?

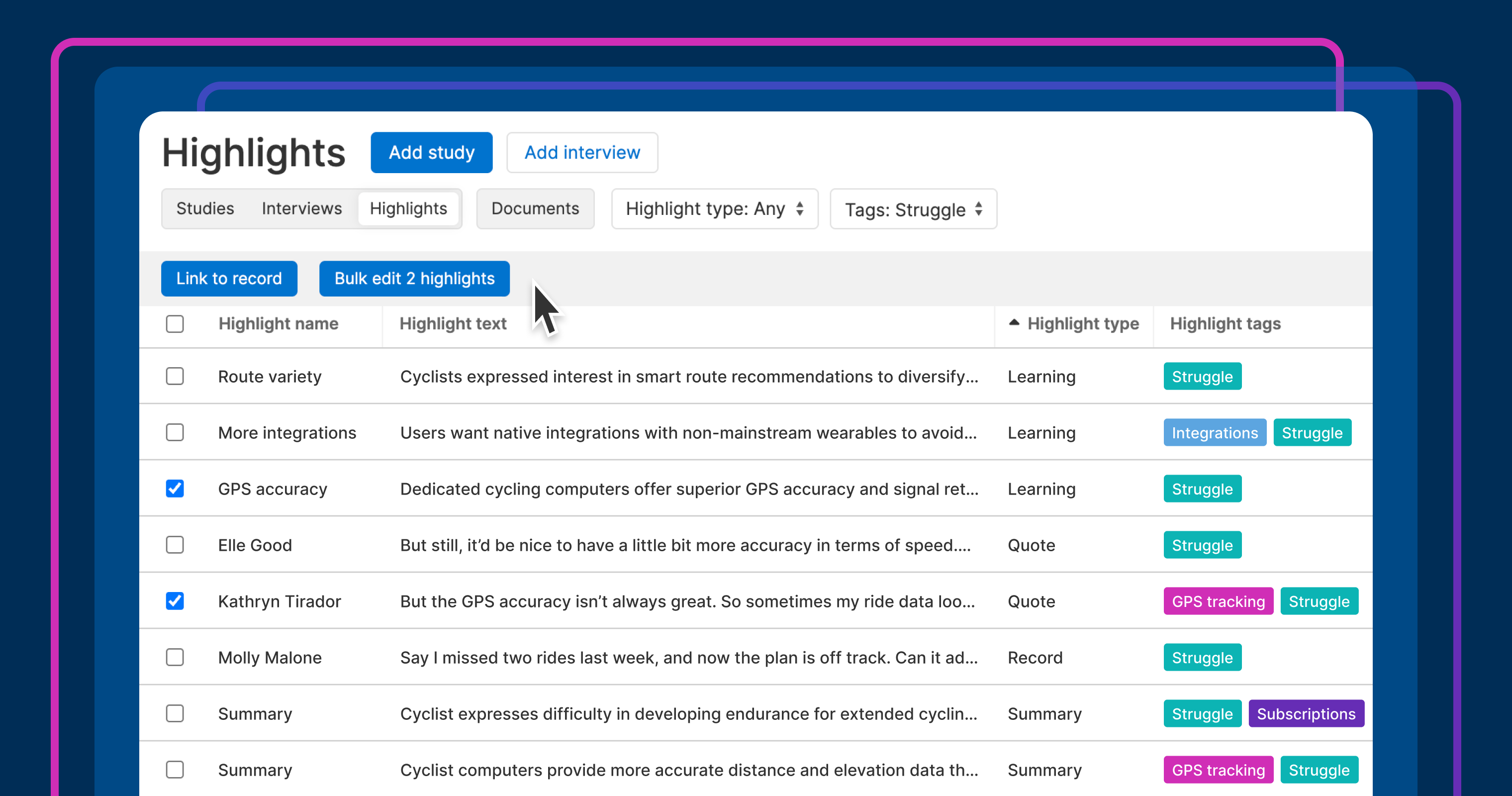

The official "Apple Pay Later" is no more, but Apple Pay is still an omnipotent digital wallet with BNPL options. Major BNPL providers like Affirm, Afterpay, and Klarna have partnered with Apple to offer their services directly through Apple Pay.

How to set up BNPL with Apple Pay

The setup process varies slightly depending on your BNPL provider:

For Klarna:

Download the Klarna app and create an account.

Complete the verification process.

In the Klarna app, look for the option to add to Apple Wallet.

Follow the prompts to add your Klarna card to Apple Pay.

For Affirm:

Create an Affirm account through their app or website.

Get pre-qualified for spending limits, up to $30,000.

Add the Affirm virtual card to your Apple Wallet.

Use it like any other payment method in Apple Pay.

For Afterpay:

Download the Afterpay app and set up your account.

Link a debit or credit card for your installment payments.

Afterpay should pop up directly at checkout when using Apple Pay.

When you make a purchase using BNPL through Apple Pay, the total amount is automatically divided into your installment plan. Your first installment is typically charged immediately, while the BNPL company pays the merchant the full amount. All your subsequent installments are automatically charged to your linked payment method according to schedule.

What are the risks of these BNPL programs?

Naturally, Apple users may be drawn to the convenience of a BNPL options during Apple Pay checkout. However, that convenience might just be the biggest risk. They can make it all too easy to spend more than you can actually afford. The Consumer Financial Protection Bureau released a report that shows BNPL users were more likely to have higher credit card debt, delinquencies on other credit products, and lower credit scores than nonusers.

The bottom line

If you are going to use any BNPL service, keep these tips in mind:

Think about your current and future budget. When a bigger payment gets broken down into smaller installments, you might find yourself overspending in the long run because it "feels" like you can afford it. Stay on top of how much you’re actually spending, and how it will impact your overall budget going forward.

Stick to the essentials. BNPL should really only be used on completely necessary purchases that you can’t afford upfront, but can afford in six weeks.

Keep an eye on your account balance. Klarna, Affirm, or an BNPL service are not credit cards. Even if Apple doesn’t charge fees for missed payments, your bank will still charge you overdraft fees. Plus, if you default on a BNPL loan, you’re at risk of damaging your credit score.

The most important thing is that you know what you're doing: Before you pay for anything with installments, be thoughtful about why you’re taking on this debt in the first place.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)