Housing market inventory with a price cut just hit a decade high

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Just because a home listing gets a price cut doesn’t necessarily indicate that the home actually sold for less than its comps. Some real estate agents use pricing strategies that intentionally list too high to test the market or create negotiation room. After all, even during the pandemic housing boom—when home prices were surging—18.7% of U.S. homes for sale in March 2021 still saw a price cut. That said, if the share of inventory receiving a price cut rises beyond typical seasonal patterns, it can suggest a market where homebuyers are gaining leverage. Conversely, if the share of inventory receiving a price cut falls beyond seasonality, it can indicate a market where home sellers are gaining leverage. Here’s how the percentage of U.S. active housing inventory receiving a price cut in March 2025 compared to the historical totals: March 2017: 25.6% March 2018: 26.6% March 2019: 26.4% March 2020: 22.8% March 2021: 18.7% March 2022: 21.3% March 2023: 29.4% March 2024: 31.7% March 2025: 33.9% How did ResiClub calculate this? We divided the number of U.S. homes for sale that received a price reduction in March by the total number of active U.S. home listings during that same month. The table below shows the raw data. (The Realtor.com data series we used for this analysis only goes back to July 2016.) Big picture: This data is just one more bit of evidence showing that the national housing market’s supply-demand equilibrium has begun shifting in homebuyers’ favor ever since mortgage rates spiked in late spring 2022 and the pandemic housing boom fizzled out. Of course, this all varies significantly across the country. Some housing markets—particularly in parts of the Midwest and Northeast—remain relatively tight, with sellers still in control. Others markets have just shifted into balanced markets, while some pockets of the Sun Belt have turned into outright buyer’s markets.

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Just because a home listing gets a price cut doesn’t necessarily indicate that the home actually sold for less than its comps. Some real estate agents use pricing strategies that intentionally list too high to test the market or create negotiation room. After all, even during the pandemic housing boom—when home prices were surging—18.7% of U.S. homes for sale in March 2021 still saw a price cut.

That said, if the share of inventory receiving a price cut rises beyond typical seasonal patterns, it can suggest a market where homebuyers are gaining leverage. Conversely, if the share of inventory receiving a price cut falls beyond seasonality, it can indicate a market where home sellers are gaining leverage.

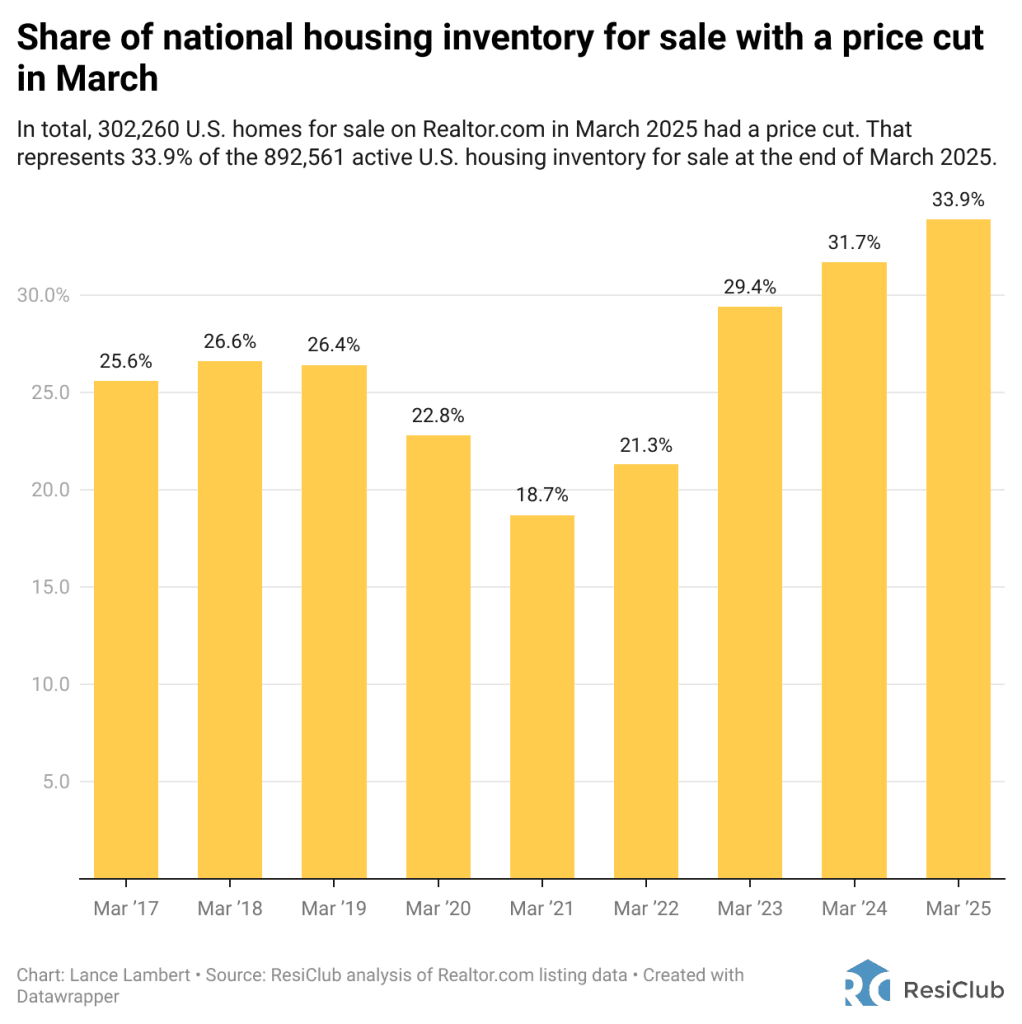

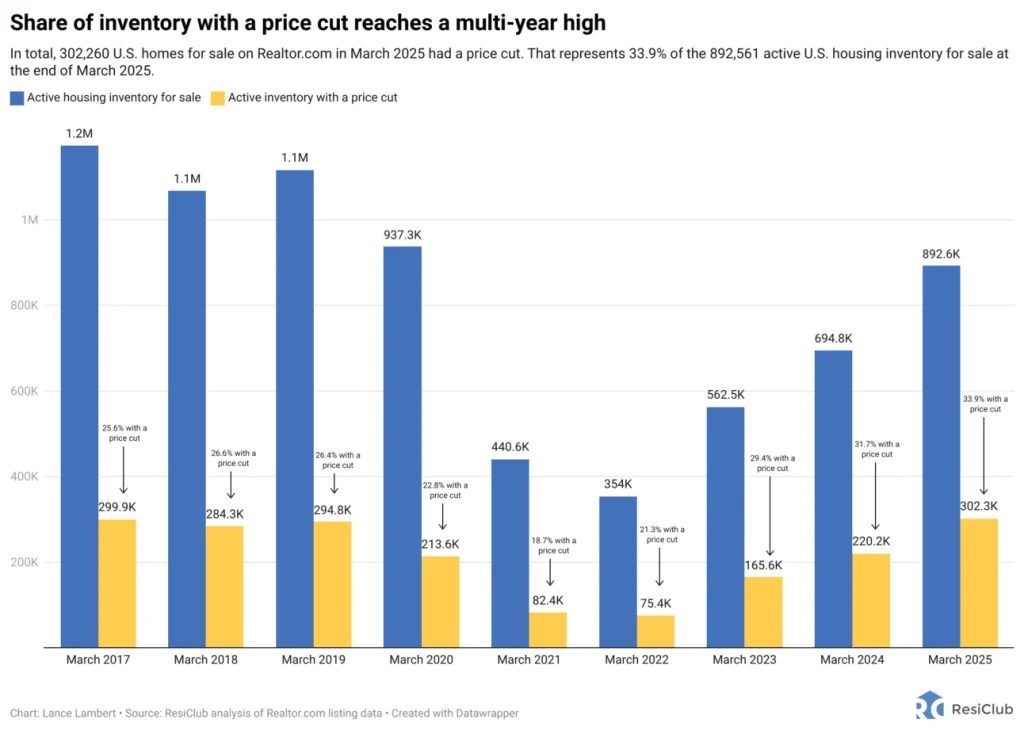

Here’s how the percentage of U.S. active housing inventory receiving a price cut in March 2025 compared to the historical totals:

March 2017: 25.6%

March 2018: 26.6%

March 2019: 26.4%

March 2020: 22.8%

March 2021: 18.7%

March 2022: 21.3%

March 2023: 29.4%

March 2024: 31.7%

March 2025: 33.9%

How did ResiClub calculate this? We divided the number of U.S. homes for sale that received a price reduction in March by the total number of active U.S. home listings during that same month.

The table below shows the raw data. (The Realtor.com data series we used for this analysis only goes back to July 2016.)

Big picture: This data is just one more bit of evidence showing that the national housing market’s supply-demand equilibrium has begun shifting in homebuyers’ favor ever since mortgage rates spiked in late spring 2022 and the pandemic housing boom fizzled out.

Of course, this all varies significantly across the country.

Some housing markets—particularly in parts of the Midwest and Northeast—remain relatively tight, with sellers still in control. Others markets have just shifted into balanced markets, while some pockets of the Sun Belt have turned into outright buyer’s markets.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)