Managing Supply Chains in a Tariff-Fueled Trade War

Alice Mollon/Ikon Images Companies routinely retune their supply chains in response to market changes, but the gyrations caused by the Trump administration’s on/off tariff regime are far from routine. How do supply chain planners address the immediate challenges, and what are the long-term implications they should consider? Many larger companies can cope with the new […]

Alice Mollon/Ikon Images

Companies routinely retune their supply chains in response to market changes, but the gyrations caused by the Trump administration’s on/off tariff regime are far from routine. How do supply chain planners address the immediate challenges, and what are the long-term implications they should consider?

Many larger companies can cope with the new level of uncertainty they now face. When the tariff policies were announced, I participated in a gathering of chief supply chain officers from some of the world’s biggest companies. The consensus among the participants was that managing the new tariffs requires a lot of work, but having already endured COVID-19 and various armed conflicts worldwide, they regard this as just “another day in the office.” These market leaders will quickly re-optimize their networks, relationships, orders, products, contracts, routes, and prices, mitigating the worst impacts of the tariffs.

Still, mitigating the impacts completely, or even significantly, will be challenging. This is particularly true for companies that do not possess larger rivals’ supply chain planning resources. For many enterprises, steering a course through these treacherous tariff waters is a matter of survival.

While each enterprise’s approach to the challenge is unique, some key elements are common to most strategies. Companies should:

Watch the changing landscape. While new announcements about tariffs come from the White House, the full executive orders describing how the tariffs work appear in the Federal Register. These details are important for understanding which product families and derivatives are taxed, and by how much. Companies should be part of the public comment period and the final rules, which may change after the public comment period. Furthermore, the U.S. Customs and Border Protection agency’s web page on the tariffs may still include somewhat different details that can be exploited to minimize their cost.

Decide who shoulders the burden. Companies must decide whether to force their suppliers to reduce costs, cut their margins, or pass the costs to consumers through higher prices. The likely solution will be a combination of all three, depending on the nature of the market. In today’s politically charged environment, these decisions must also factor in potential government intervention. To wit, China recently warned Walmart against forcing suppliers in that country to absorb the cost of tariffs. Companies should be mindful that price increases may be less than the tariffs that triggered them but still consequential.

Locate costs. Understanding where profits are earned along the supply chain will help managers make investments and smart cost-cutting decisions. Which customer, product, or supplier contributes to profit, and by how much? And how might the picture change under a new tariff regime? This capability requires some version of activity-based costing.

Look to suppliers for help. Core suppliers, particularly those with which a company has mutually supportive relationships, can share the burden of tariff-related costs. Even so, supplier bases may need to be reshuffled as tariffs change sourcing strategies. Review single-source relationships, and consider measures to make supplier networks more flexible, such as finding substitutes for critical ingredients and components, and streamlining supplier qualification processes.

Prioritize improved visibility. Companies know that excellent supply chain visibility has become a competitive necessity. However, managing a seesawing tariff regime has made good visibility even more critical. Quickly reconfiguring supply chains to account for yet another policy shift requires a clear, real-time picture of the logistics attributes of the products flowing through supply chains.

Minimize the impact. The full effect of the tariffs can be reduced by careful analysis of customs regulations. Look for exemptions and drawbacks (refunds), and reclassify products. Naturally, making product changes, including redesigning items and making substitutions, may also bring relief. Companies should increase their safety stock and take advantage of tariff oscillations to buy when costs are relatively low, regardless of their immediate needs.

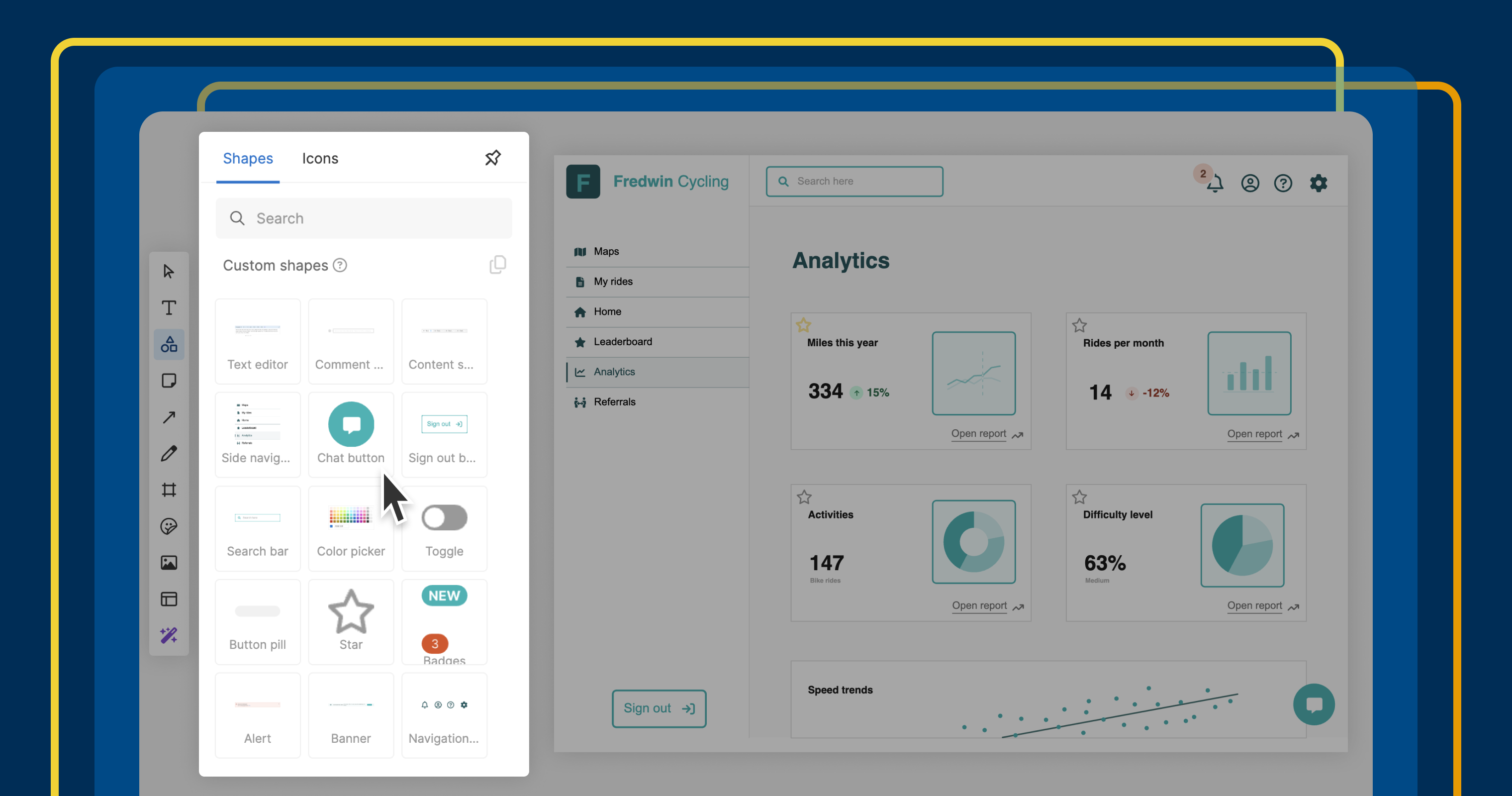

Leverage up-to-date supply chain network design (SCND) methods. Technology is revolutionizing managers’ ability to model different supply chain configurations and identify the most competitive options. Today’s SCND systems can quickly analyze different versions of a supply chain from a cross-functional perspective. A shift in tariff policies can influence decisions such as where to locate manufacturing facilities and warehouses or how changing suppliers impacts network efficiency. Companies should consider using this powerful tool to adjust their supply chains to an ever-shifting tariff environment.

Guard customers’ trust in your company. Consumer mistrust in products and the companies that supply them is already uncomfortably high. Tariffs compound the problem. As we saw during President Trump’s first term, when punitive tariffs are imposed on targeted products, companies unaffected by the levies may see an opportunity to raise prices. As I explained in a recent blog post, the supply chain is probably the most crucial repository of trust in a company because it is responsible for consistently meeting or exceeding the organization’s service promises. Companies should not underestimate the importance of minimizing reputational risk when responding to tariff increases.

Looking Ahead to Tariffs’ Long-Term Effects

In addition to grappling with the day-to-day challenges of the Trump administration’s tariff changes, companies must keep the longer-term consequences in mind. Being mindful of how tariffs can reshape global trading patterns helps companies reset their supply chain strategies as needed. The following issues are particularly salient.

Reshoring. The rationale behind the tariffs — bringing manufacturing back to the U.S. — cannot be achieved in the short run. It takes years to build manufacturing plants and even longer to get many Tier 1 suppliers to relocate. Also, the U.S. does not have the human talent to staff numerous new plants, even if these facilities did materialize. This issue is particularly worrisome in the face of immigration restrictions. Further, bringing manufacturing to the U.S. does not mean that entire supply chains can be reshored. Even if shallow-tier suppliers move to the U.S., deep-tier suppliers that typically serve more than one industry and region are unlikely to do so. Importantly, many commodities are found only in China, Canada, and elsewhere, and the reshoring of manufacturing will not lessen America’s dependence on China and other countries for these materials. Embarking on such long-term and expensive initiatives requires comprehensive analyses.

Stickiness. If the tariff regime remains in place for several months or longer, dialing it down won’t be easy. Every economic system creates winners and losers. Tariffs will generate a constituency of enterprises that, for example, can raise domestic prices, avoid competition, and, as a result, become wedded to the tariff system. This constituency will lobby and pressure the administration to stick with the system that works for them. Furthermore, industries that are less protected will lobby for more tariff protections in the future.

Extensions. Additional tariffs will likely be implemented soon. These may include levies on lumber and pharmaceuticals. Another tariff is likely to be introduced in response to the flood of Chinese-built and -operated cargo ships worldwide. China accounts for over half of the world’s vessel deliveries, supported by multibillion-dollar state subsidies. The administration is considering a fee on each Chinese ship unloading cargo in a U.S. port. This will impose additional taxes on every imported item from China or elsewhere that is carried on a Chinese ship.

Retaliation. We should anticipate further retaliatory actions from important trading partners. Significantly, some of these actions may be in forms other than tariffs, like restricting exports of unique materials to the U.S., such as China’s restrictions on exports of certain rare earth minerals used in advanced technology products. Canada could restrict oil and electricity exports to U.S. states that depend on such imports, while India could limit medicines and other medical product supplies. Several countries could remove intellectual property protection from American companies, enabling local businesses to avoid R&D costs.

Recession. The new trade regime may lead to a global recession. This will hit poor countries such as Bangladesh and Sri Lanka (facing 37% and 44% tariffs, respectively) particularly hard. In many of these countries, the result will be a significant decline in manufacturing, widespread social unrest, and even starvation among the poorest segments of their populations. Even if, in the long run, the Trump administration achieves some of its goals, the likelihood is that over the next two-plus years, the global economy will contract, increasing inequality. In the U.S., small businesses will be hit, with many going out of business.

Quality. In the short term, a tariff regime that isolates American companies from world competition will cause higher prices. Product quality will almost certainly decline under such a regime in the long term. Recall the sorry state of U.S. automobiles before competition from Japan forced American manufacturers to adopt versions of the Toyota Production System and improve product quality. The Reagan administration had to resort to “voluntary quotas” on Japanese cars to avoid a total collapse of the U.S. auto industry.

Expect the Unexpected

Rightly or wrongly, companies will continue to be buffeted by tariff uncertainty for the foreseeable future. Some countries may negotiate tariff reductions or exemptions, and as higher prices hit consumers, the U.S. Congress might come under pressure to reassert its constitutional jurisdiction over tariffs — control that it has, in the past, granted to U.S. presidents under specific conditions. Trump, however, simply claimed authority to levy new tariffs by invoking the International Emergency Economic Powers Act, an action now facing legal challenges.

For supply chain planners, machinations like these add to the uncertainty that is part and parcel of managing supply chains. To handle tariff-induced volatility, they can deploy tried and tested disruption response methods, like risk management, and build supply chain resilience, responsiveness, and agility. However, if the Trump administration succeeds in its stated aim of resetting the global trading system, future supply chains — and how they are designed and managed — may look significantly different than they do today.

![Are AI Chatbots Replacing Search Engines? AI vs Google [New Research]](https://www.orbitmedia.com/wp-content/uploads/2025/05/How-often-are-we-using-AI-chatbots_.webp)