Why Walmart is betting big on this 2-year-old ‘clean’ digestive health brand

Lucas Kraft’s friends knew him as the guy who always had an antacid. His recovery from bulimia left him with gastrointestinal damage, which made him reliant on over-the-counter digestive medicines. But they were also filled with chemicals that didn’t mesh with his health-conscious SoCal lifestyle. Luckily, his brother Noah had an eye for predicting where consumer interests are headed. He founded Doppler Labs, the buzzy 2010s startup hoping to create an in-ear computer, three years before Apple launched their AirPods. Doppler Labs was too early, but Wonderbelly—the brothers’ digestive health brand—has been right on time with its focus on clean ingredients and opposition to existing giants of OTC medicines. In the late 2010s, clean beauty was already surging. Whole Foods and Erewhon were on the rise, but they were siloed within wealthy communities. But a new and growing swatch of health obsessives—both within and without Robert F. Kennedy Jr.’s “Make America Healthy Again” movement—has put Wonderbelly in an unusually dominant position. The superstores came knocking: First Target, then CVS, and now Walmart. [Image: courtesy Wonderbelly] Wonderbelly products now feature prominently at 2,500 Walmart stores nationwide via a fleet of endcaps. These offerings include reworked packaging as well as a debut multisymptom product designed to compete with Pepto-Bismol. Noah contrasts Wonderbelly—which is sold as an OTC product with health claims that are regulated by the Food and Drug Administration—with the $53 billion supplements market. “Supplements are the Wild West. They are unregulated, so when you take a supplement, it’s hard to determine whether it works or is a placebo,” he says. “As an FDA-regulated OTC medicine . . . credibility is key. Growing the the old-fashioned way Medicine moves slower than Noah’s native tech world. The brothers incorporated Wonderbelly in 2021, before spending two years deep in product development. (Noah got antsy in this period, so he made an app to track digestive health.) When the company’s clean Tums alternative was ready in April 2023, Target was immediately on board. The retailer asked to place Wonderbelly in 2,000 stores, but the Kraft brothers needed more time, eventually agreeing to 650. Even that pared-back retail presence was important to Wonderbelly’s vision to build its brand credibility the old-fashioned way—in brick and mortar. “People buy medicine as a bottom-of-funnel product,” Noah says. “You go into your supermarket, you’re picking up bananas, and you grab some Tums. It is not the sort of thing where you go to someone’s website like you do with Casper.” With more stores, Wonderbelly brought more products. For the company’s CVS launch, it debuted a clean Gas-X alternative. Now, with Wonderbelly’s new placement in Walmart, it’s rolling out a clean Pepto-Bismol challenger. Wonderbelly intentionally positions itself against these name brands; it’s not interested in customers shopping for generics. Even the store placement matters—the company isn’t interested in selling in Whole Foods or Sprouts, because they don’t carry Tums. “We don’t want to sit next to apple cider vinegar,” Noah says. [Image: courtesy Wonderbelly] Wonderbelly’s bet is that, when given the choice between a chemical-filled name brand and a cleaned up alternative, the premium customer will choose it instead. The strategy has been lucrative. While he declined to disclose specific financials, Noah notes that the company hit profitability in April. As of April 2024, Wonderbelly was valued at about $53 million, according to market insight tool PitchBook—a number that Noah confirmed is still roughly accurate. Jeff Behm, Wonderbelly’s VP of sales, points out that the company will double its sales year over year, having reached 100,000 points of distribution. (It helps that the company is incredibly slim: Wonderbelly has 12 employees, and Noah has no desire to hire more.) The Walmart launch is poised to skyrocket sales by introducing 2,500 colorful endcaps nationwide. Walmart has a different customer, than the deep-pocketed shoppers that frequent the likes of Erewhon and similarly priced boutique grocers that dominate the “clean” space. So Wonderbelly created a new, cheaper $9.99 version of its antacid—with fewer tablets—to meet Walmart’s “everyday low prices” mandate. It seems to have paid off: Looking at the first-week data from the brand’s soft launch, Noah says sales are where he expected them be after three months of a concerted marketing push. “Customers are familiar with these legacy brands, and they’re going to stay connected to these legacy brands,” says Kristin Piper, Walmart’s vice president of wellness merchandising. “Some customers are looking for innovation, like [what] Wonderbelly is bringing to the space.” [Image: courtesy Wonderbelly] Navigating a MAHA minefield The Krafts grew up in Los Angeles, where their mother enforced a clean regim

Lucas Kraft’s friends knew him as the guy who always had an antacid. His recovery from bulimia left him with gastrointestinal damage, which made him reliant on over-the-counter digestive medicines. But they were also filled with chemicals that didn’t mesh with his health-conscious SoCal lifestyle.

Luckily, his brother Noah had an eye for predicting where consumer interests are headed. He founded Doppler Labs, the buzzy 2010s startup hoping to create an in-ear computer, three years before Apple launched their AirPods. Doppler Labs was too early, but Wonderbelly—the brothers’ digestive health brand—has been right on time with its focus on clean ingredients and opposition to existing giants of OTC medicines.

In the late 2010s, clean beauty was already surging. Whole Foods and Erewhon were on the rise, but they were siloed within wealthy communities. But a new and growing swatch of health obsessives—both within and without Robert F. Kennedy Jr.’s “Make America Healthy Again” movement—has put Wonderbelly in an unusually dominant position. The superstores came knocking: First Target, then CVS, and now Walmart.

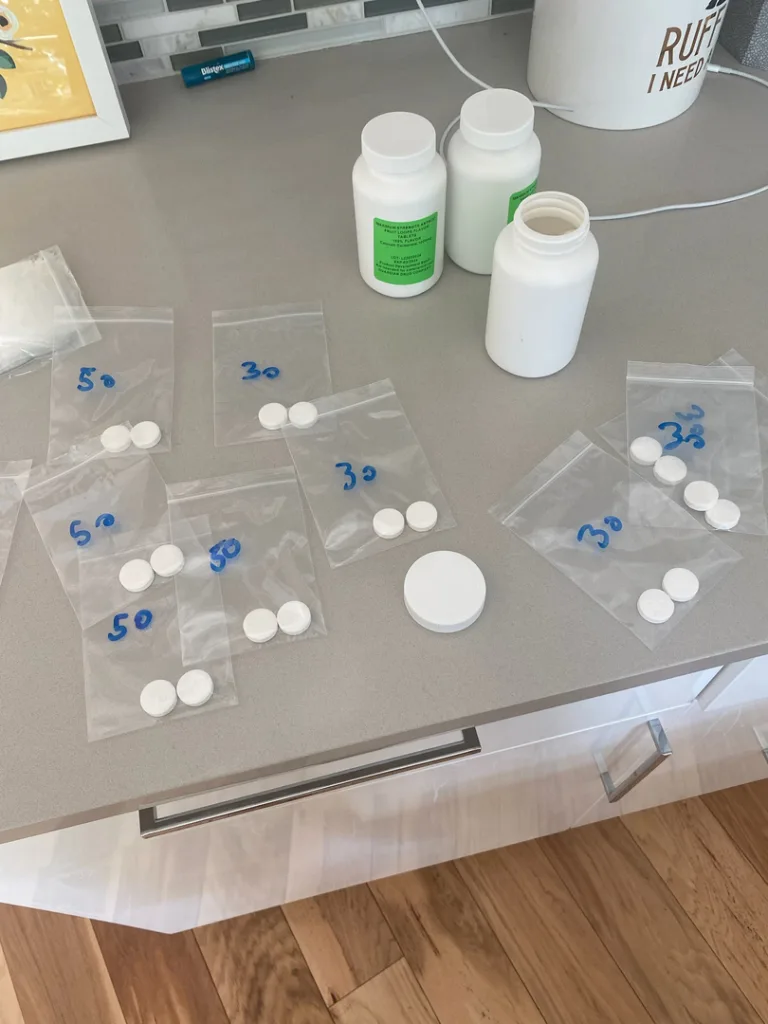

Wonderbelly products now feature prominently at 2,500 Walmart stores nationwide via a fleet of endcaps. These offerings include reworked packaging as well as a debut multisymptom product designed to compete with Pepto-Bismol.

Noah contrasts Wonderbelly—which is sold as an OTC product with health claims that are regulated by the Food and Drug Administration—with the $53 billion supplements market. “Supplements are the Wild West. They are unregulated, so when you take a supplement, it’s hard to determine whether it works or is a placebo,” he says. “As an FDA-regulated OTC medicine . . . credibility is key.

Growing the the old-fashioned way

Medicine moves slower than Noah’s native tech world. The brothers incorporated Wonderbelly in 2021, before spending two years deep in product development. (Noah got antsy in this period, so he made an app to track digestive health.) When the company’s clean Tums alternative was ready in April 2023, Target was immediately on board. The retailer asked to place Wonderbelly in 2,000 stores, but the Kraft brothers needed more time, eventually agreeing to 650. Even that pared-back retail presence was important to Wonderbelly’s vision to build its brand credibility the old-fashioned way—in brick and mortar.

“People buy medicine as a bottom-of-funnel product,” Noah says. “You go into your supermarket, you’re picking up bananas, and you grab some Tums. It is not the sort of thing where you go to someone’s website like you do with Casper.”

With more stores, Wonderbelly brought more products. For the company’s CVS launch, it debuted a clean Gas-X alternative. Now, with Wonderbelly’s new placement in Walmart, it’s rolling out a clean Pepto-Bismol challenger. Wonderbelly intentionally positions itself against these name brands; it’s not interested in customers shopping for generics. Even the store placement matters—the company isn’t interested in selling in Whole Foods or Sprouts, because they don’t carry Tums. “We don’t want to sit next to apple cider vinegar,” Noah says.

Wonderbelly’s bet is that, when given the choice between a chemical-filled name brand and a cleaned up alternative, the premium customer will choose it instead. The strategy has been lucrative. While he declined to disclose specific financials, Noah notes that the company hit profitability in April. As of April 2024, Wonderbelly was valued at about $53 million, according to market insight tool PitchBook—a number that Noah confirmed is still roughly accurate.

Jeff Behm, Wonderbelly’s VP of sales, points out that the company will double its sales year over year, having reached 100,000 points of distribution. (It helps that the company is incredibly slim: Wonderbelly has 12 employees, and Noah has no desire to hire more.) The Walmart launch is poised to skyrocket sales by introducing 2,500 colorful endcaps nationwide.

Walmart has a different customer, than the deep-pocketed shoppers that frequent the likes of Erewhon and similarly priced boutique grocers that dominate the “clean” space. So Wonderbelly created a new, cheaper $9.99 version of its antacid—with fewer tablets—to meet Walmart’s “everyday low prices” mandate. It seems to have paid off: Looking at the first-week data from the brand’s soft launch, Noah says sales are where he expected them be after three months of a concerted marketing push.

“Customers are familiar with these legacy brands, and they’re going to stay connected to these legacy brands,” says Kristin Piper, Walmart’s vice president of wellness merchandising. “Some customers are looking for innovation, like [what] Wonderbelly is bringing to the space.”

Navigating a MAHA minefield

The Krafts grew up in Los Angeles, where their mother enforced a clean regime. Lucas describes a house full of “alternative brands that always tasted so much worse.” That includes drinking imitation milk at age 5. Noah points out that they weren’t allowed to drink Diet Coke. The brothers have mostly carried this clean ethos to their adult life, leading Lucas to count the ingredients on the back of his medicine bottles.

Though Wonderbelly’s antacid has six ingredients to the average of 20 in Tums, that model of ingredient numbering can be reductive, especially in medicine, where some foreign chemicals are crucial to the product’s transportation around the body. So Wonderbelly makes its definition even clearer: non-GMO, vegan, free of artificial dyes, sweeteners, talc, titanium dioxide, parabens, and gluten.

The siblings’ timing with Wonderbelly couldn’t have been better. The consumer wellness market skyrocketed coming out of the pandemic. “Clean beauty,” once a miniscule portion of the makeup market, is now valued at more than $8 billion. Consumers are buying Oura Rings and drinking kombucha. It’s also not lost on the Krafts that their product appeals to a broad enough consumer base to include those buying into the “Make America Healthy Again” movement.

“We strongly believe in science, but we also align heavily with a lot of the things that the MAHA movement is pushing for,” Lucas says, adding that he and his brand are still positioned for people eating food that can upset their stomachs. “Antacids usually don’t come after you’ve had a big meal of kale salad.”

MAHA’s reach is also broad, and has spurred actions that range from Sweetgreen eliminating seed oils in its food to the state of Utah banning fluoride in drinking water against prevailing medical consensus of the element’s public health benefits.

As a result, the Krafts have had to be somewhat judicious about who they associate the brand with. “There have been several instances where we’re talking to someone and then we go to their socials, and we’re like, ‘Thanks for the support. Please don’t mention our company name,’” Noah says.