End-to-End Mortgage Processor

A company is looking for an End to End Mortgage Processor.

Key Responsibilities

Own the loan file from submission to closing, ensuring accuracy, compliance, and timeliness

Review loan applications and documentation for completeness and compliance with guidelines

Conduct proactive follow-up with stakeholders to obtain required documentation and resolve conditions

Required Qualifications

Minimum 5 to 7 years of experience as an end-to-end mortgage loan processor

Deep understanding of loan programs, investor guidelines, and documentation requirements

Experience with various loan types, including conventional, FHA, VA, and construction loans

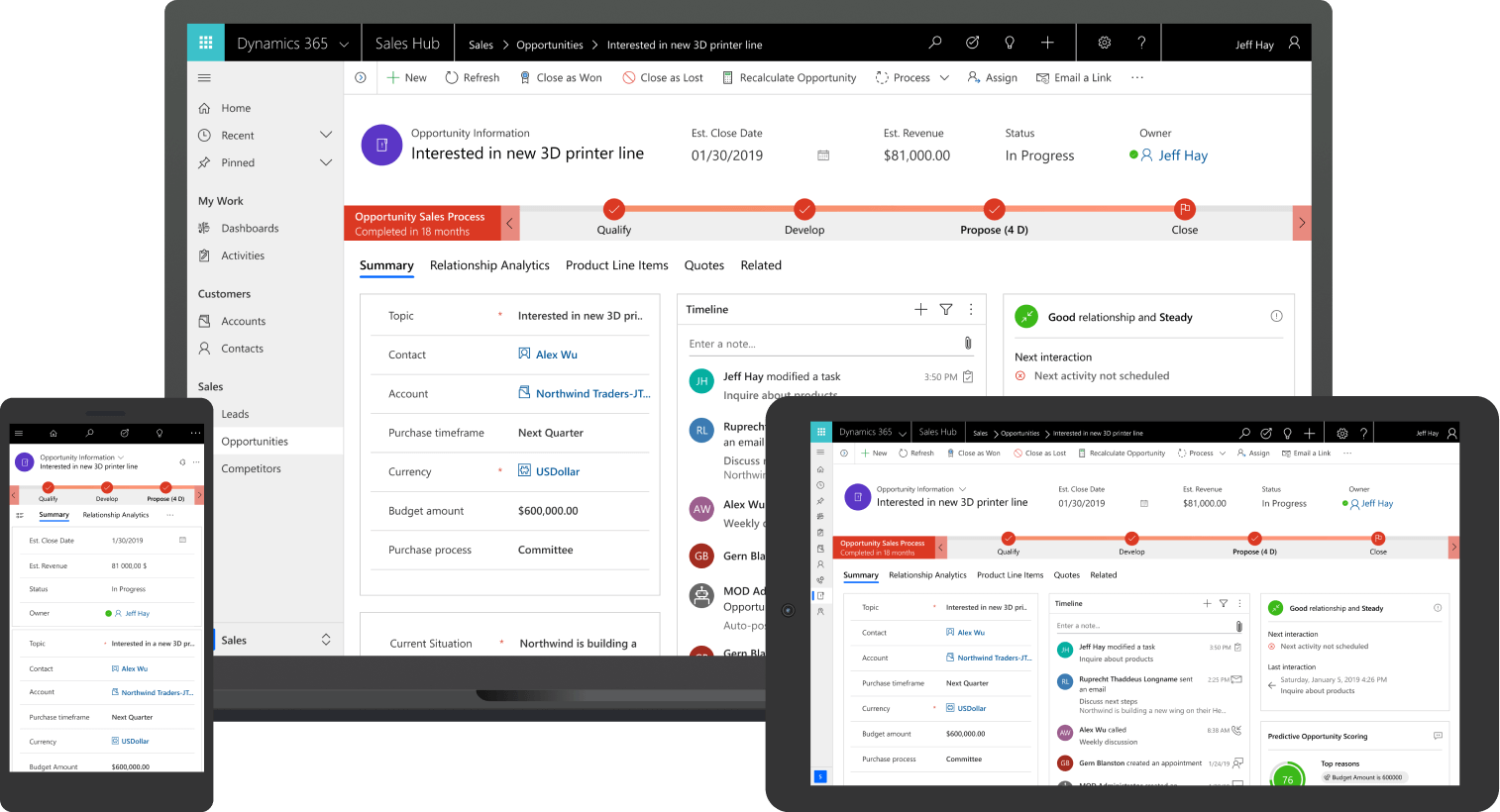

Familiarity with LOS platforms and third-party vendor integrations

Strong analytical skills and a solution-oriented mindset

A company is looking for an End to End Mortgage Processor.

Key Responsibilities

Own the loan file from submission to closing, ensuring accuracy, compliance, and timeliness

Review loan applications and documentation for completeness and compliance with guidelines

Conduct proactive follow-up with stakeholders to obtain required documentation and resolve conditions

Required Qualifications

Minimum 5 to 7 years of experience as an end-to-end mortgage loan processor

Deep understanding of loan programs, investor guidelines, and documentation requirements

Experience with various loan types, including conventional, FHA, VA, and construction loans

Familiarity with LOS platforms and third-party vendor integrations

Strong analytical skills and a solution-oriented mindset

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)