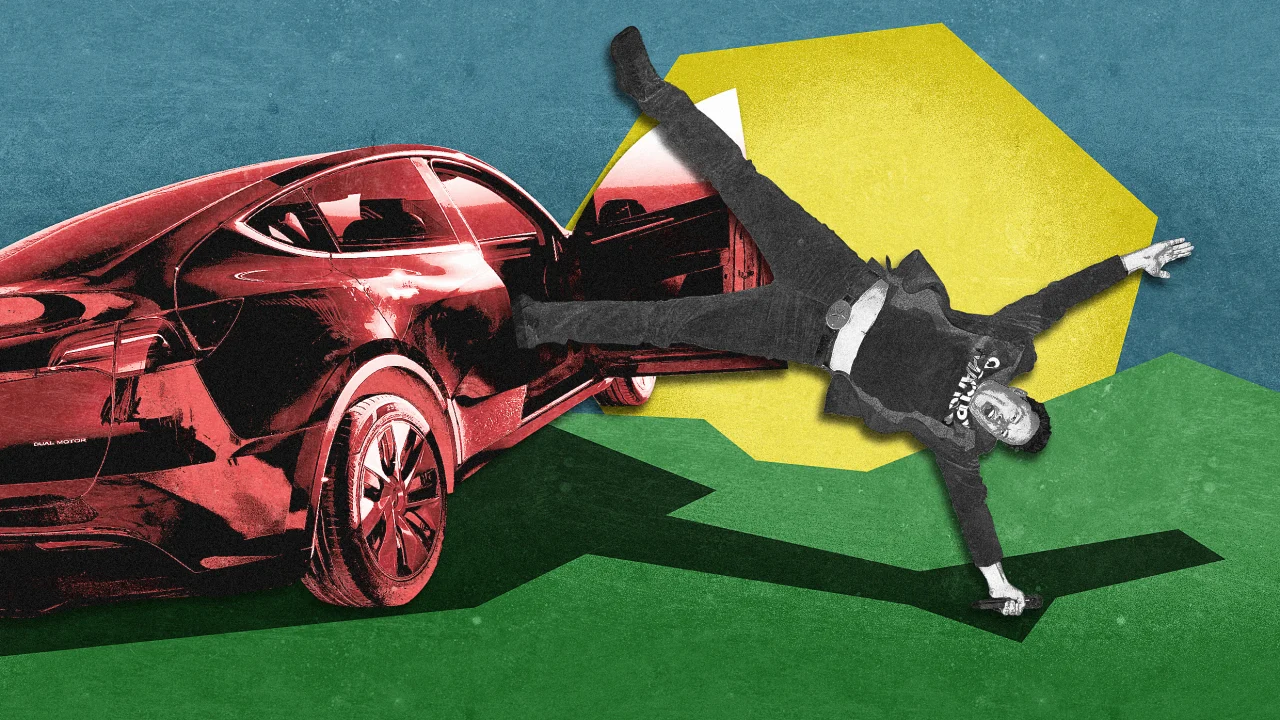

Tesla earnings: Revenue falls 9.2% as disdain for Elon Musk and the unpopular DOGE seem to damage the EV brand

The hits keep coming for world’s richest man Elon Musk. Tesla reported another weak quarter of performance as car buyers around the world increasingly opt for other brands. That wasn’t entirely surprising as analysts had forecast dismal first-quarter results, though the carmaker reported revenue and earnings that were significantly worse than the consensus of analysts’ estimates. The Austin-based carmaker reported that revenue fell 9.2% to $19.34 billion during the three months ended March 31, while the decline in the company’s automotive revenue was even worse, falling 20% from the first quarter of 2024. Adjusted earnings per share for the quarter came in at 27 cents. The company cited issues stemming from policy to politics for its performance. “Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure of Tesla and our peers,” the company said in the report. “This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term.” An update from Elon Musk In an effort to revitalize the beleaguered carmaker, investors are hopeful that CEO Elon Musk will make a newsworthy announcement in a live company update following the release of the quarterly results, scheduled to begin at 5:30 p.m. ET. Investors have been looking for any silver linings amid a 50% crash in the stock’s price since its all-time high in December. One long-awaited update that Musk could offer investors is regarding plans for a more affordable electric vehicle model. That said, three sources exclusively told Reuters last week that the launch of such a vehicle has been delayed by at least several months. Likewise, there’s been speculation on Wall Street that Musk might use the conference call to update investors about the planned debut of robotaxis, driverless ride-hailing services, in Austin in June and in California later this year. There’s also been speculation that Musk might announce the timing of his departure from the Trump Administration. Tesla shares fell nearly 1% in after-hours trading, after posting a 4.6% gain Tuesday alongside a broader rally in the U.S. stock market. Disdain reigns supreme Analysts and investors alike were bracing for what was widely expected to be a disastrous earnings report that coincides with Musk assuming a heavy-handed role as a senior advisor in President Donald Trump’s second administration. Musk has become one of the most polarizing figures in the new administration, and there’s palpable disdain for the man and the brand: About half of Americans have a negative view of both Musk and Tesla, according to the results of a CNBC survey released Tuesday. Tesla has become “arguably the most scrutinized company in the world,” Matt Britzman, senior equity analyst at Hargreaves Lansdown, told The Associated Press ahead of the earnings results. In addition to being the target of protests and vandalism, Tesla was recently dealt a blow by regulators, who issued a recall of nearly all Cybertrucks last month. A fork in the road for Tesla Once a darling of Wall Street, Tesla’s performance has hit more than a few bumps in the road this year. Not only has vehicle production has slowed, so too has delivery of these vehicles. In a report released earlier this month, the Austin-based company reported 336,681 vehicle deliveries in the first quarter, a 13% decline from the same period a year ago. This missed the mark of various analysts estimates, which expected deliveries to number as much as nearly 378,000, according to the average estimate of select estimates that Tesla’s investor relations team sent to select analysts. That report highlighted a particular weakness for Tesla: Delivery of models other than the Model 3 and Model Y, the most popular in its fleet, slumped more than 24% to less than 13,000 vehicles, compared with 17,027 in 2024. This group of vehicles includes the much-hyped—though increasingly much-maligned—Cybertruck model that debuted in 2023. Following the release of that report, Dan Ives, an analyst with Wedbush Securities, posted on the social media platform X that the numbers “were a disaster on every metric” and represented a “fork in the road moment” for the carmaker.

The hits keep coming for world’s richest man Elon Musk. Tesla reported another weak quarter of performance as car buyers around the world increasingly opt for other brands. That wasn’t entirely surprising as analysts had forecast dismal first-quarter results, though the carmaker reported revenue and earnings that were significantly worse than the consensus of analysts’ estimates.

The Austin-based carmaker reported that revenue fell 9.2% to $19.34 billion during the three months ended March 31, while the decline in the company’s automotive revenue was even worse, falling 20% from the first quarter of 2024. Adjusted earnings per share for the quarter came in at 27 cents.

The company cited issues stemming from policy to politics for its performance.

“Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure of Tesla and our peers,” the company said in the report. “This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term.”

An update from Elon Musk

In an effort to revitalize the beleaguered carmaker, investors are hopeful that CEO Elon Musk will make a newsworthy announcement in a live company update following the release of the quarterly results, scheduled to begin at 5:30 p.m. ET.

Investors have been looking for any silver linings amid a 50% crash in the stock’s price since its all-time high in December.

One long-awaited update that Musk could offer investors is regarding plans for a more affordable electric vehicle model. That said, three sources exclusively told Reuters last week that the launch of such a vehicle has been delayed by at least several months.

Likewise, there’s been speculation on Wall Street that Musk might use the conference call to update investors about the planned debut of robotaxis, driverless ride-hailing services, in Austin in June and in California later this year. There’s also been speculation that Musk might announce the timing of his departure from the Trump Administration.

Tesla shares fell nearly 1% in after-hours trading, after posting a 4.6% gain Tuesday alongside a broader rally in the U.S. stock market.

Disdain reigns supreme

Analysts and investors alike were bracing for what was widely expected to be a disastrous earnings report that coincides with Musk assuming a heavy-handed role as a senior advisor in President Donald Trump’s second administration. Musk has become one of the most polarizing figures in the new administration, and there’s palpable disdain for the man and the brand: About half of Americans have a negative view of both Musk and Tesla, according to the results of a CNBC survey released Tuesday.

Tesla has become “arguably the most scrutinized company in the world,” Matt Britzman, senior equity analyst at Hargreaves Lansdown, told The Associated Press ahead of the earnings results. In addition to being the target of protests and vandalism, Tesla was recently dealt a blow by regulators, who issued a recall of nearly all Cybertrucks last month.

A fork in the road for Tesla

Once a darling of Wall Street, Tesla’s performance has hit more than a few bumps in the road this year. Not only has vehicle production has slowed, so too has delivery of these vehicles.

In a report released earlier this month, the Austin-based company reported 336,681 vehicle deliveries in the first quarter, a 13% decline from the same period a year ago. This missed the mark of various analysts estimates, which expected deliveries to number as much as nearly 378,000, according to the average estimate of select estimates that Tesla’s investor relations team sent to select analysts.

That report highlighted a particular weakness for Tesla: Delivery of models other than the Model 3 and Model Y, the most popular in its fleet, slumped more than 24% to less than 13,000 vehicles, compared with 17,027 in 2024. This group of vehicles includes the much-hyped—though increasingly much-maligned—Cybertruck model that debuted in 2023.

Following the release of that report, Dan Ives, an analyst with Wedbush Securities, posted on the social media platform X that the numbers “were a disaster on every metric” and represented a “fork in the road moment” for the carmaker.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How One Brand Solved the Marketing Attribution Puzzle [Video]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/marketing-attribution-model-600x338.png?#)