Rethink the Growth Imperative

Paul Tong/Ikon Images Karl-Johan Perrson, the chairman and former CEO of H&M, once asked, “What would it mean if we all consumed 20% less? I believe it would be catastrophic. It would mean 20% less jobs, 20% less taxes, 20% less money for schools, doctors, roads. The global economy would collapse. I’m firmly convinced that […]

Paul Tong/Ikon Images

Karl-Johan Perrson, the chairman and former CEO of H&M, once asked, “What would it mean if we all consumed 20% less? I believe it would be catastrophic. It would mean 20% less jobs, 20% less taxes, 20% less money for schools, doctors, roads. The global economy would collapse. I’m firmly convinced that growth has made the world a better place today than it was 20 years ago. And it will be better in 20 years than it is today.”

Is this true? If it is, we face what writer J.B. MacKinnon calls the “consumer’s dilemma.” In his book The Day the World Stops Shopping, he writes that “the planet says we consume too much: In North America, we burn the earth’s resources at a rate five times faster than they can regenerate. And despite our efforts to ‘green’ our consumption — by recycling, increasing energy efficiency, or using solar power — we have yet to see a decline in global carbon emissions. The economy says we must always consume more [but] … the 21st century has brought a critical dilemma into sharp relief: We must stop shopping.”

The rub is that business education is predicated on a belief that the economy can and must continue to grow — a belief that manifests in corporate strategy as an imperative that companies, too, must continually grow or risk becoming irrelevant. The problem is that perpetual economic growth is not possible, and the shibboleth that growth is essential for human flourishing creates a trap that many see no way out of. Paul Farrell writes in The Wall Street Journal that “we are addicted to the myth of perpetual economic growth” and it is “killing America.” We must begin to teach about limits to growth and different kinds of growth.

Limits to Growth

In 1798, Thomas Robert Malthus wrote his famous “Essay on the Principle of Population,” in which he argued for the first time that there may be limits to the carrying capacity of the Earth. He reasoned that the rate of growth of the population exceeded the rate of growth of food production and, eventually, humanity would face starvation. While his premise may have been sound, some of his underlying assumptions and his conclusions were not. He failed to anticipate technological advancements in pesticides, fertilizers, and commercial farming techniques. Yet his central argument has remained in many forms, with many supporters and detractors. In 1968, Stanford University ecologist Paul Ehrlich wrote the bestselling book The Population Bomb, in which he predicted worldwide famine and other major societal upheavals if we did not limit population growth. That prophecy also did not come true.

In 1992, Donella Meadows, Dennis Meadows, and Jorgen Randers wrote Beyond the Limits (a follow-up to the 1972 book The Limits to Growth) in which they used systems dynamics models to come to a similar conclusion that “human use of essential resources and generation of pollutants has surpassed sustainable rates. … Unless there are significant reductions in material and energy flows, the world faces an uncontrolled decline in per capita food output, energy use, and industrial production. … In order to avoid this decline, growth in material consumption and population must be eased down at the same time as there is a rapid and drastic increase in the efficiency of materials and energy use.” The critical factor they identified as driving resource depletion to unsustainable levels is overshoot, whereby humanity doesn’t know the damage that it is doing until well after it is done, and the environmental and human value is lost.

Existing within the limits imposed by natural systems seems like a rather self-evident necessity. Yet business education rarely incorporates insights from natural sciences for perspectives on the biosphere or addresses the environmental impact of business decisions. Few business students will have encountered Herman Daly’s famous argument that the economy is a subsystem of the environment, “which is finite, nongrowing, and materially closed, although open to a continual, but nongrowing, throughput of solar energy. When the economy grows in physical dimensions, it incorporates matter and energy from the rest of the ecosystem into itself. It must, by the law of conservation of matter and energy (first law of thermodynamics), encroach on the ecosystem, diverting matter from previous natural uses. More human economy (more people and commodities) means less natural ecosystem.”

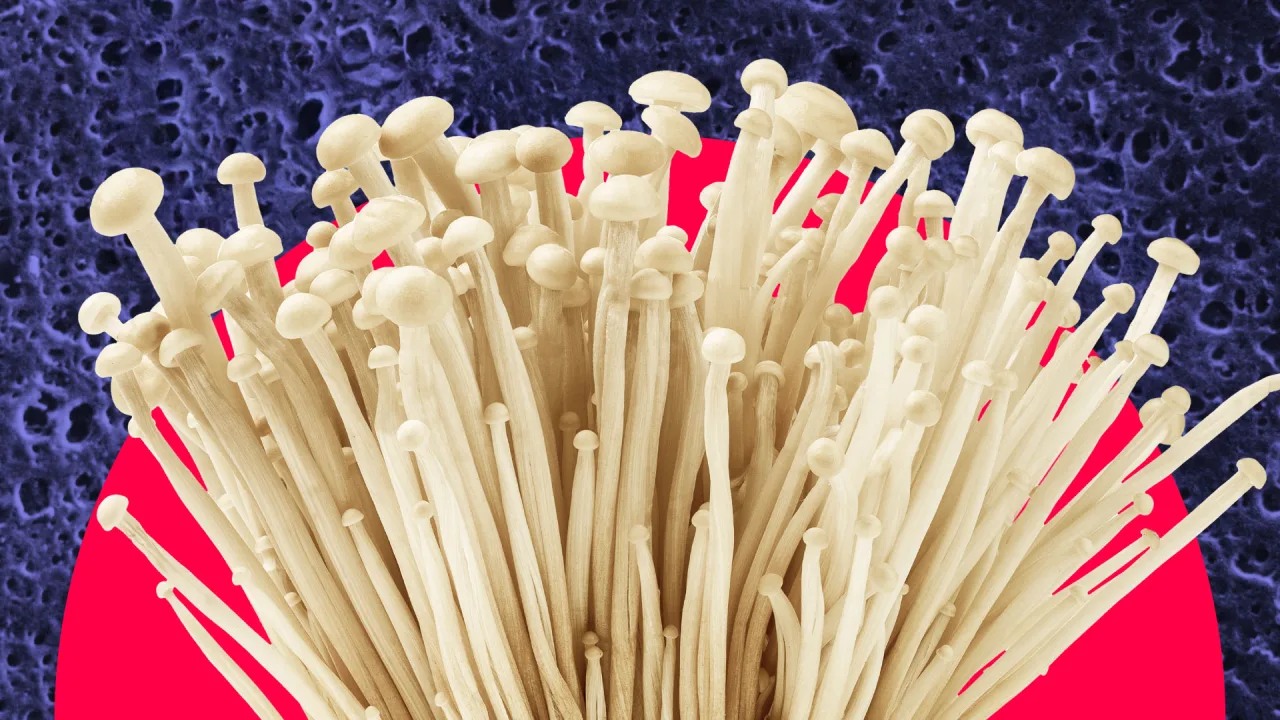

To feed our growing economy, humans consume more than 100 billion tons of natural resources per year, or roughly 11 tons of natural resources for every person on Earth. That includes more than 42 billion tons of nonmetallic minerals, 23 billion tons of biomass, 15 billion tons of fossil fuels, and 10 billion tons of metal ores. We also produce more than 2 billion tons of solid waste each year, more than 10 million tons of toxic chemicals, 36 billion tons of carbon dioxide, and 460 million tons of plastic waste, which are buried in landfills, burned for fuel, or released into terrestrial or aquatic environments.

These numbers have been increasing for decades to meet our rapidly growing demands for food, fresh water, timber, fiber, and fuel, such that we are changing ecosystems more rapidly and extensively than in any comparable period in human history. This has resulted in a substantial and largely irreversible loss in the diversity of life on Earth. On our current trajectory, 90% of the Earth’s precious topsoil may be at risk by 2050; oceans may carry more plastic than fish (by weight) by 2050; an estimated 57%–70% of the world’s species could go extinct by 2070; and global mean temperatures could reach 2.7°C above preindustrial levels by 2100. While the impact of these changes would be felt differently around the world, nowhere would be immune to prolonged heat waves, droughts, and extreme weather events that become increasingly common and severe. Tim Jackson, a professor of sustainable development at the University of Surrey, warns that if these trends continue, “by the end of the century our children and grandchildren will face a hostile climate, depleted resources, the destruction of habitats, the decimation of species, food scarcities, mass migrations, and, almost inevitably, war.”

Scientists think that the Earth has a maximum carrying capacity of between 9 billion and 10 billion people, based on nature’s limited availability of fresh water, capacity to produce food, and ability to absorb pollution. But this number assumes the technology we have today, that everyone consumes what they need, and that consumption levels are similar around the world. Meanwhile, the arithmetic grows increasingly daunting each year. As of the early 2000s, the average middle-class American consumes 3.3 times the subsistence level of food and almost 250 times the subsistence level of clean water needed for a single person. If everyone on Earth lived like a middle-class American, then the planet might have a carrying capacity of around 2 billion. As a result, if global population reaches 9.6 billion by 2050, the equivalent of almost three planets could be required to provide the natural resources needed to sustain current lifestyles. To avoid this impossibility, we can hope for technological miracles that not only address climate change but make food production, biodiversity conservation, waste removal, and more all suddenly feasible. But hope is always a gamble — and usually a long shot at that. It would be irresponsible to not also rethink the kind of growth we actually seek.

Different Kinds of Growth

We need to consider alternative models of growth, ranging from the more moderate to the more extreme views of economic progress and the technological advancement that makes it possible. Those might include embracing more modest growth rates, growth that is less resource-intensive, or even redefining growth or shifting away from macroeconomic metrics that equate growth with success.

Slow growth. Dietrich Vollrath, an economist at the University of Houston and the author of Fully Grown: Why a Stagnant Economy Is a Sign of Success (The University of Chicago Press), argues that constantly higher growth rates are neither possible nor desirable. In fact, he argues, slower rates of economic growth are “the optimal response to massive economic success” and the result of personal choices of individual consumers. He points out that as countries like the United States have become wealthier, their inhabitants have chosen to spend less time at work and have smaller families. Vollrath estimates that about two-thirds of the recent slowdown in GDP growth can be accounted for by the decline in the growth of labor inputs. But rather than seeing this as any sort of failure, it reflects “the advance of women’s rights and economic success.” He cites a switch in spending patterns from tangible goods, such as clothes and furniture, to services, such as child and health care, which have risen from 40% of GDP in 1950 to more than 70% in 2023. And service industries, which tend to be labor-intensive, exhibit lower rates of productivity growth since their output is intangible. In the manufacturing sector, on the other hand, outputs are tangible and can be counted easily in economic calculations of productivity. Since rising productivity is a key component of GDP growth, the expansion of the service sector will constrain it. But again, he writes, “That reallocation of economic activity away from goods and into services comes down to our success. We’ve gotten so productive at making goods that this has freed up our money to spend on services.” Vollrath’s analysis implies that all the major economies are likely to see slower growth rates as their populations become more affluent and, importantly, age — a pattern established in Japan in the 1990s.

Green growth and decoupling. While Vollrath challenges the growth imperative, other thinkers and economists have proposed different kinds of growth that we should pursue. Economist Joseph Stiglitz argues for what many call “green growth,” which seeks to grow the economy while decoupling its impact on the environment. In short, the idea is predicated on the belief that we innovate products that are less resource-intensive and, coupled with behavior change, use less energy and generate less waste. Many European governments, the World Bank, and the Organization for Economic Cooperation and Development have taken positions that, given the right policy measures, we can enjoy a different form of growth and prosperity while reducing carbon emissions and our consumption of natural resources. A 2018 report by the Global Commission on the Economy and Climate declares, “We are on the cusp of a new economic era: one where growth is driven by the interaction between rapid technological innovation, sustainable infrastructure investment, and increased resource productivity. This is the only growth story of the 21st century. It will result in efficient, livable cities; low-carbon, smart, and resilient infrastructure; and the restoration of degraded lands while protecting valuable forests. We can have growth that is strong, sustainable, balanced, and inclusive.”

While many warn that this approach relies too much on technology alone, there are some indications this prediction is already playing out. The U.S. watched national greenhouse emissions fall by 15%-18% between 2005 and 2019, while GDP increased by around 29%. Further, 41 U.S. states plus the District of Columbia reduced their CO2 emissions while increasing GDP between 2005 and 2017. Globally, at least 25 countries have reduced greenhouse gas emissions while increasing GDP between 2005 and 2019. These results were possible through renewable energy generation, reductions in electricity use, reductions in industrial and residential energy use, and changes in behavior. To continue such trends, green-growth advocates argue, governments should fund scientific research into green technology and pass taxes on fossil fuels, all while maintaining the pursuit of continued economic growth. Not all agree.

Post-growth. Some contend that green growth is misguided, unrealistic, and not sustainable, calling instead for a post-growth economy. Pointing out that continued economic growth is projected to drive a significant increase in energy demand during the coming decades, post-growth advocates argue that decarbonizing the economy in its present form will be impossible. They take umbrage with the concept of relative decoupling, where the growth rate of environmental damage is less than the growth rate for the economy but still positive (that is, carbon emissions decrease as a percentage of GDP but still increase). Instead, they argue, there should be absolute decoupling, wherein the environmental damage decreases irrespective of economic growth. And many post-growth advocates resist the idea of gambling on dramatic technological change to drive absolute decoupling because so many technological advancements in the past have resulted in profoundly negative unintended consequences.

Tim Jackson takes this extreme view in his book Prosperity Without Growth (Earthscan Publications), declaring that green growth and decoupling is a myth. Starting from the premise that endless growth is not possible on a planet with finite resources, he argues that green growth through technological innovation fails to account for planetary boundaries and that we will cross tipping points that exceed environmental limits. He claims that since economic growth cannot be separated from environmental damage on an absolute basis, growth will have to be abandoned. He does not see this as a negative but envisions a post-growth capitalism in which prosperity is redefined to transcend material concerns. Rather than seeking flourishing lives by endlessly accumulating more stuff, he reasons, societies can attain a truer prosperity that “consists in our ability to participate in the life of society, in our sense of shared meaning and purpose, and in our capacity to dream.” Lives of frugality and simplicity, with stronger communities and healthier relationships, will make us more genuinely prosperous than our present obsession with material pleasures. He sets out the framework for what he calls the economy of tomorrow in which we challenge some assumptions. We treat the nature of enterprise as a form of social organization, the meaning of work as participation in society, the function of investment as a commitment to the future, and the role of money as a social good, offering a view of the economy that is transformed in ways that protect employment, promote and facilitate social investment, reduce inequality, and support both ecological and financial stability.

Degrowth. For some, even that is not far enough, and they advocate for a push toward degrowth, under which the only real solution is to produce and consume less by shrinking our economies to cope with the carrying capacity of the planet. First proposed in the 1970s by a group of French intellectuals and widely dismissed as too radical for its time, degrowth has been reinvigorated by the current challenge of the climate crisis. It is based on the idea of shifting from a GDP-driven economy to an economy driven by concerns for the well-being of humans and the ecosystem, using metrics like life expectancy, health, education, housing, ecologically sustainable initiatives, and work. The goal is to make the economy work for people, not people working for the economy. People such as Noam Chomsky, Yanis Varoufakis, and Sir Anthony Giddens have expressed some degree of support for the idea, which has found its greatest support at a grassroots level. In a 2018 poll in France, 54% of respondents supported degrowth, while 46% supported green growth.

According to Julia Steinberger, a professor of ecological economics at the University of Lausanne, the amount of stuff people need in order to be satisfied in their lives is decreasing. “The empirical evidence is very, very strong, and it shows that human development indicators, life satisfaction indicators, all of these things, do saturate at a moderate level of income, at a moderate level of energy use, and, not only that, but those income and energy levels are actually dropping over time.” The degrowth movement calls on advanced countries to embrace zero or even negative GDP growth. As ecological economist Giorgos Kallis wrote in his manifesto Degrowth, “The faster we produce and consume goods, the more we damage the environment. ... There is no way to both have your cake and eat it. ... If humanity is not to destroy the planet’s life support systems, the global economy should slow down.”

Each of these different growth models — Vollrath’s vision of slow growth, the aspirations of green growth, post-growth ideologies, and even the radical notion of degrowth — offer unique insights. Yet it’s clear there is no definitive answer on which path is best. What binds them together, however, is the implication that a fundamental reevaluation of consumption is essential. How we measure growth in both our companies and in our economy is directly related to the strategy we pursue and the success we will achieve. In today’s market, we default to one type of growth: more. But without questioning the growth imperative, we will pursue goals that may not be in our long-term interests. With an understanding of both a more nuanced conception of growth and the costs of unrestrained growth, we can begin to fashion a strategy that serves our stakeholders and our purpose, without mortgaging the future.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How One Brand Solved the Marketing Attribution Puzzle [Video]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/marketing-attribution-model-600x338.png?#)