The Property World: Navigating Real Estate Rates Today

This comprehensive article provides an in-depth analysis of the current state of the global and local real estate market as of May 2025. It examines the "corrugated" recovery in global dealmaking, highlighting the impact of geopolitical factors and the resilience of real estate debt markets. A significant portion is dedicated to the persistent influence of interest rates, providing current mortgage APRs and discussing their future trajectory. The content meticulously breaks down the myriad factors influencing property values, from location and supply-demand to economic growth and government policies. It further delineates the diverging paths of residential and commercial real estate, offering insights into their respective challenges and opportunities. Finally, the article concludes with a focused discussion on the direct and significant impact of inflation on property values and affordability.

The real estate market is a dynamic and complex beast, influenced by a myriad of global and local factors. For investors, homeowners, and aspiring buyers alike, understanding the current trends and underlying forces shaping Property World Real Estate Today is crucial. Today, in May 2025, we observe a nuanced landscape with varying conditions across different regions and property types.

Global Market Overview: A "Corrugated" Recovery

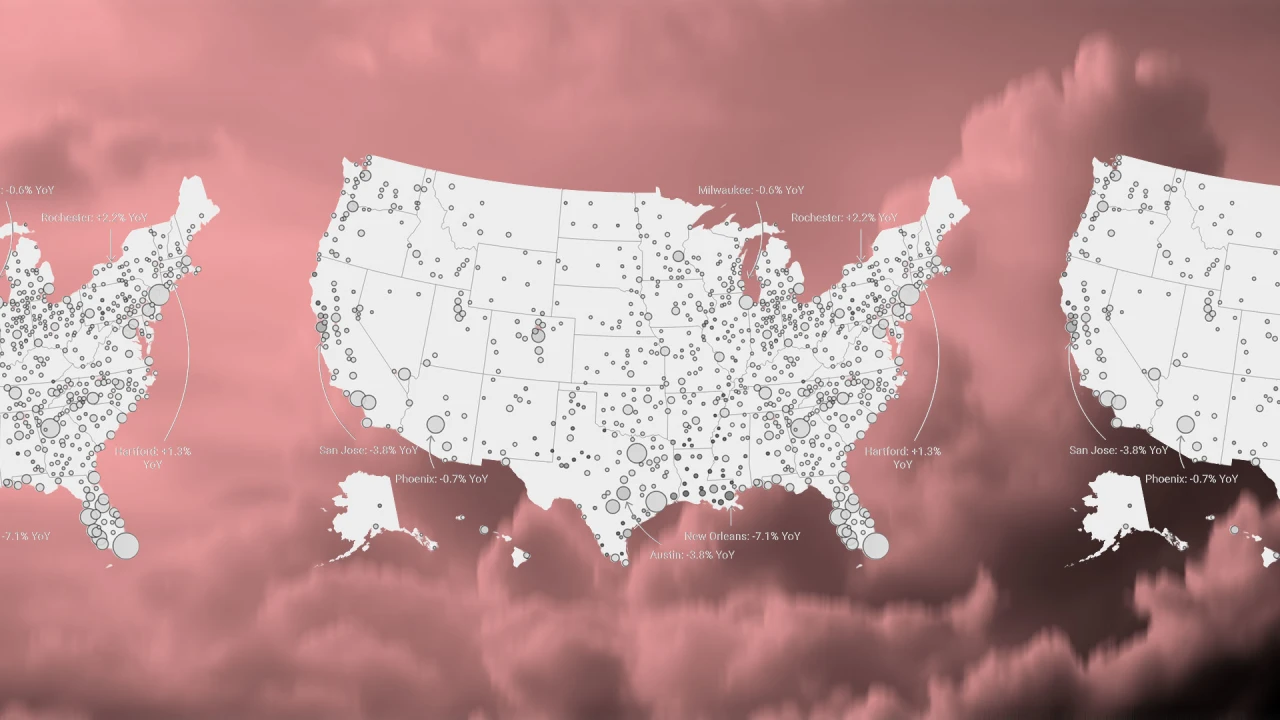

Globally, the real estate market is experiencing a "corrugated" recovery. After two challenging years, dealmaking is improving across major markets in Europe, the US, and Asia. However, an unpredictable geopolitical and trade policy environment continues to weigh on business confidence and financial markets. While most major markets anticipate positive economic growth in 2025, uncertainty is leading to a focus on short-term planning, particularly in sectors exposed to supply chain disruptions like industrial and retail. Commercial real estate values, despite some volatility, remain attractive relative to other asset classes, supported by waning supply in many mature markets.

One significant trend is the resilience of real estate debt markets, with substantial capital waiting to be deployed. Hospitality real estate, in particular, has seen a surge in interest, driven by its inflation-busting ability to reprice at short notice and a strong rebound in tourism, especially in Europe. High-yielding opportunities are also emerging in digital and energy infrastructure, with data centers ranking highly across the Americas, Asia Pacific, and Europe.

Interest Rates: A Persistent Influence

Interest rates continue to be a primary driver of real estate affordability and investment activity. As of May 20, 2025, the national average 30-year fixed mortgage APR in the US is around 7.02%, while the average 15-year fixed mortgage APR is about 6.24%. These rates, while slightly up this week despite cooling inflation, remain higher than in previous years, constraining the funding environment.

The expectation is that interest rates will soften further in the coming months, which would make property financing more accessible and create a more favorable investment environment. However, the exact trajectory remains uncertain, with housing economists divided on how much mortgage rates might fall by year-end. For potential buyers and investors, monitoring central bank policies and broader economic indicators related to inflation will be paramount.

Factors Influencing Property Values

Property values are not static; they are shaped by a complex interplay of factors:

- Location: Always paramount, location dictates proximity to essential amenities like schools, hospitals, public transport, and commercial hubs. Scenic views, low crime rates, and signs of economic growth in a neighborhood significantly boost value.

- Supply and Demand: When demand for a particular property type in an area outstrips supply, prices inevitably rise. Conversely, an oversupply can lead to price stagnation or even declines.

- Economic Growth and Stability: Robust regional economic growth, characterized by rising employment and wages, strengthens housing demand and boosts property values.

- Infrastructure Development: New roads, railways, airports, or commercial developments can dramatically increase property values in their vicinity by improving connectivity and convenience.

- Property Condition and Age: Newer properties or well-maintained older ones tend to command higher prices. Renovations and aesthetic upgrades can significantly enhance perceived worth.

- Demographics: Population shifts, age demographics, and income levels influence the demand for specific types of housing.

- Government Policies and Zoning: Policies promoting homeownership, tax breaks, or restrictive zoning laws that limit new housing supply can impact prices.

- Comparable Sales (Comps): The prices of recently sold, similar properties in the same neighborhood serve as a key benchmark for property valuation.

Residential vs. Commercial Real Estate: Diverging Paths

While both sectors are influenced by broader economic trends, their performance can differ significantly.

- Residential Real Estate: In many advanced economies, residential markets overheated post-COVID-19 due to cheap debt and a desire for larger homes during lockdowns. The rapid rise in inflation and subsequent interest rate hikes have since led to price corrections or slowing gains in many regions. However, increasing urbanization and government initiatives promoting affordable housing continue to stimulate market expansion in various countries. In some emerging economies, like Pakistan, residential property prices are showing an upward trend, driven by economic stability, falling inflation, and strong urban growth.

- Commercial Real Estate: The commercial sector faces its own set of challenges and opportunities. Higher inflation can increase financing and operating costs, potentially decreasing property values. However, many commercial lease terms include inflation-linked rent escalations, which can help income keep pace. New construction may become more expensive, potentially limiting supply and increasing the value of existing properties. Different commercial segments, such as office, retail, and industrial, are experiencing varied fortunes, with industrial and logistics properties generally showing resilience due to e-commerce growth.

The Impact of Inflation

Inflation has a direct and significant impact on real estate. While higher inflation can increase financing and operating costs for property owners, it can also lead to increased rental income for commercial properties with inflation-linked leases. For residential properties, real estate inflation can contribute to higher housing and rental prices, affecting overall economic inflation and potentially delaying homeownership for many. However, a cooling inflation rate often leads to lower borrowing costs, making property more accessible and potentially attracting more buyers and investors seeking stable returns. Watch it

Conclusion

The real estate market today presents a mixed bag of opportunities and challenges. While geopolitical uncertainties and higher interest rates continue to shape the landscape, signs of recovery and resilience are evident in various sectors and geographies. Understanding the interplay of economic indicators, interest rates, supply-demand dynamics, and local factors is essential for anyone looking to navigate the property world effectively. As the global economy continues to evolve, staying informed and adapting strategies will be key to successful real estate ventures.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)