Does Homeowners Insurance Cover Floods, Earthquakes & Hurricanes?

Natural disasters like floods, earthquakes, and hurricanes can cause significant damage to your home. While standard homeowners insurance provides essential coverage for many perils, it often excludes certain catastrophic events. Understanding what your policy covers—and where you may need additional protection—can help you avoid costly surprises.

1. Does Homeowners Insurance Cover Floods?

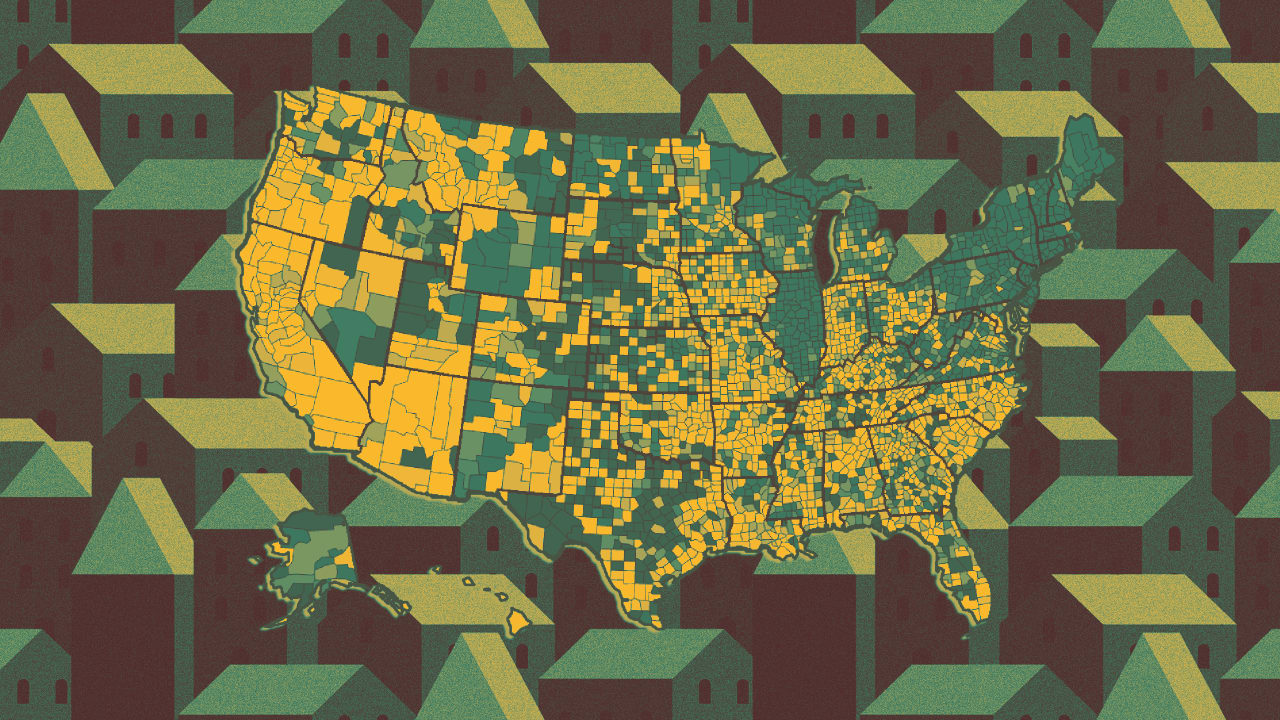

No, standard homeowners insurance policies do not cover flood damage. Flooding, whether from heavy rainfall, overflowing rivers, or storm surges, requires a separate flood insurance policy.

How to Get Flood Coverage:

-

Purchase flood insurance through the National Flood Insurance Program (NFIP).

-

Some private insurers also offer flood coverage, sometimes at competitive rates.

-

If you live in a high-risk flood zone, your mortgage lender may require flood insurance.

2. Does Homeowners Insurance Cover Earthquakes?

No, earthquakes are typically not covered under standard homeowners insurance. If you live in an earthquake-prone area (like California), you’ll need a separate earthquake insurance policy or an endorsement.

What Earthquake Insurance Covers:

-

Structural damage to your home.

-

Personal property losses.

-

Additional living expenses if your home is uninhabitable.

Considerations:

-

Deductibles for earthquake insurance are usually percentage-based (e.g., 10-20% of your home’s insured value).

-

Coverage may exclude certain types of damage, like landslides.

3. Does Homeowners Insurance Cover Hurricanes?

Partially. Standard homeowners insurance covers wind damage from hurricanes but not flooding caused by storm surges.

Key Points on Hurricane Coverage:

-

Wind Damage: Covered under most policies (but some coastal areas may require a separate windstorm policy).

-

Flood Damage: Requires a separate flood insurance policy.

-

Deductibles: Hurricane deductibles may apply (often 1-5% of your home’s insured value).

Do You Need Additional Coverage?

If you live in an area prone to floods, earthquakes, or hurricanes, consider:

-

Flood insurance (NFIP or private insurer).

-

Earthquake insurance (standalone policy or endorsement).

-

Windstorm coverage (if excluded from your policy).

Final Thoughts

Standard homeowners insurance provides essential protection, but it has limitations. Review your policy carefully and consider supplemental coverage to ensure full protection against natural disasters.

For more expert advice on insurance and home protection, visit Zoonse.com.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)