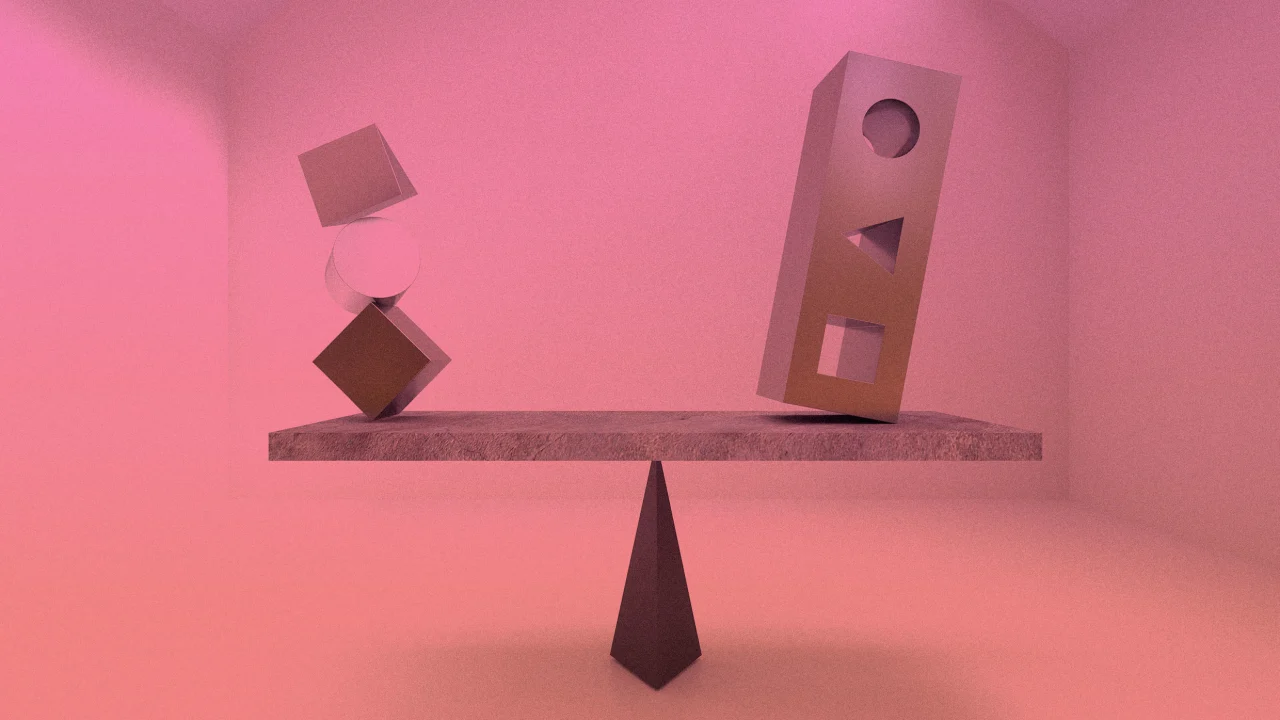

Replacement Cost vs. Actual Cash Value: Which Should You Choose?

When it comes to insurance policies, understanding the difference between Replacement Cost and Actual Cash Value (ACV) is crucial. These two valuation methods determine how much you’ll be reimbursed after a covered loss. Choosing the right one can significantly impact your financial recovery.

In this guide, we’ll break down the differences between Replacement Cost and Actual Cash Value, their pros and cons, and help you decide which option best suits your needs.

What Is Replacement Cost?

Replacement Cost is the amount needed to repair or replace damaged property with materials of similar kind and quality, without deducting for depreciation.

Pros of Replacement Cost:

✔ Full reimbursement – Covers the current cost of replacing items.

✔ Better protection – Ensures you can restore your property to its original condition.

✔ Ideal for new or well-maintained items – No deductions for wear and tear.

Cons of Replacement Cost:

✖ Higher premiums – More expensive than ACV policies.

✖ May require additional documentation – Insurers may ask for proof of item value.

What Is Actual Cash Value (ACV)?

Actual Cash Value reimburses you for the current market value of an item, accounting for depreciation based on age and condition.

Pros of Actual Cash Value:

✔ Lower premiums – More affordable than Replacement Cost coverage.

✔ Suitable for older items – Works well for belongings that have significantly depreciated.

Cons of Actual Cash Value:

✖ Lower payouts – Depreciation reduces reimbursement amounts.

✖ May not cover full replacement – You might need to pay out of pocket to replace lost items.

Key Differences Between Replacement Cost and ACV

| Factor | Replacement Cost | Actual Cash Value (ACV) |

|---|---|---|

| Depreciation | Not deducted | Deducted |

| Payout Amount | Higher | Lower |

| Premium Cost | More expensive | More affordable |

| Best For | New or high-value items | Older or depreciated items |

Which One Should You Choose?

The right choice depends on your budget and needs:

✅ Choose Replacement Cost if:

-

You want full coverage without depreciation deductions.

-

You own new or high-value items.

-

You can afford higher premiums for better protection.

✅ Choose Actual Cash Value if:

-

You’re looking for a budget-friendly policy.

-

Your belongings are older and have depreciated.

-

You’re okay with receiving a lower payout after a loss.

Final Thoughts

Both Replacement Cost and Actual Cash Value have their advantages. If you prioritize maximum coverage, Replacement Cost is the better option. However, if you want lower premiums, ACV might be sufficient.

Before deciding, assess your belongings, budget, and risk tolerance. Always review your policy details with your insurer to ensure you have the right coverage.

For more insurance insights and tips, visit zoonse.com today!

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)