Professional Liability Insurance: Who Needs It & Why?

In today’s competitive business landscape, professionals across various industries face the risk of lawsuits due to errors, omissions, or negligence in their services. Whether you're a consultant, doctor, architect, or freelancer, a single mistake—or even an unfounded claim—can lead to costly legal battles. That’s where Professional Liability Insurance (PLI), also known as Errors & Omissions (E&O) insurance, comes into play.

This guide explores who needs professional liability insurance, why it’s essential, and how it protects your career and finances.

What Is Professional Liability Insurance?

Professional Liability Insurance is a specialized policy that protects professionals against claims of:

-

Negligence – Allegations of failing to perform duties properly.

-

Misrepresentation – Claims of providing incorrect advice or misleading information.

-

Errors & Omissions – Mistakes in services that cause financial harm to clients.

-

Breach of Duty – Failure to meet contractual or legal obligations.

Unlike General Liability Insurance (which covers physical injuries or property damage), PLI focuses on financial losses resulting from professional services.

Who Needs Professional Liability Insurance?

While not legally required in most industries, PLI is crucial for professionals who provide expertise, advice, or specialized services. Here’s who should consider it:

1. Medical & Healthcare Professionals

Doctors, dentists, therapists, and nurses face malpractice claims. PLI (often called Malpractice Insurance) covers legal fees, settlements, and damages.

2. Legal & Financial Advisors

Lawyers, accountants, tax consultants, and financial planners can be sued for incorrect advice, leading to client losses.

3. IT & Tech Consultants

Software developers, cybersecurity experts, and IT consultants may face lawsuits if a system failure or data breach harms a client’s business.

4. Architects & Engineers

Design flaws or construction errors can lead to costly project delays or safety issues, making PLI essential.

5. Marketing & PR Agencies

A misleading ad campaign or failed PR strategy could result in lawsuits from clients claiming lost revenue.

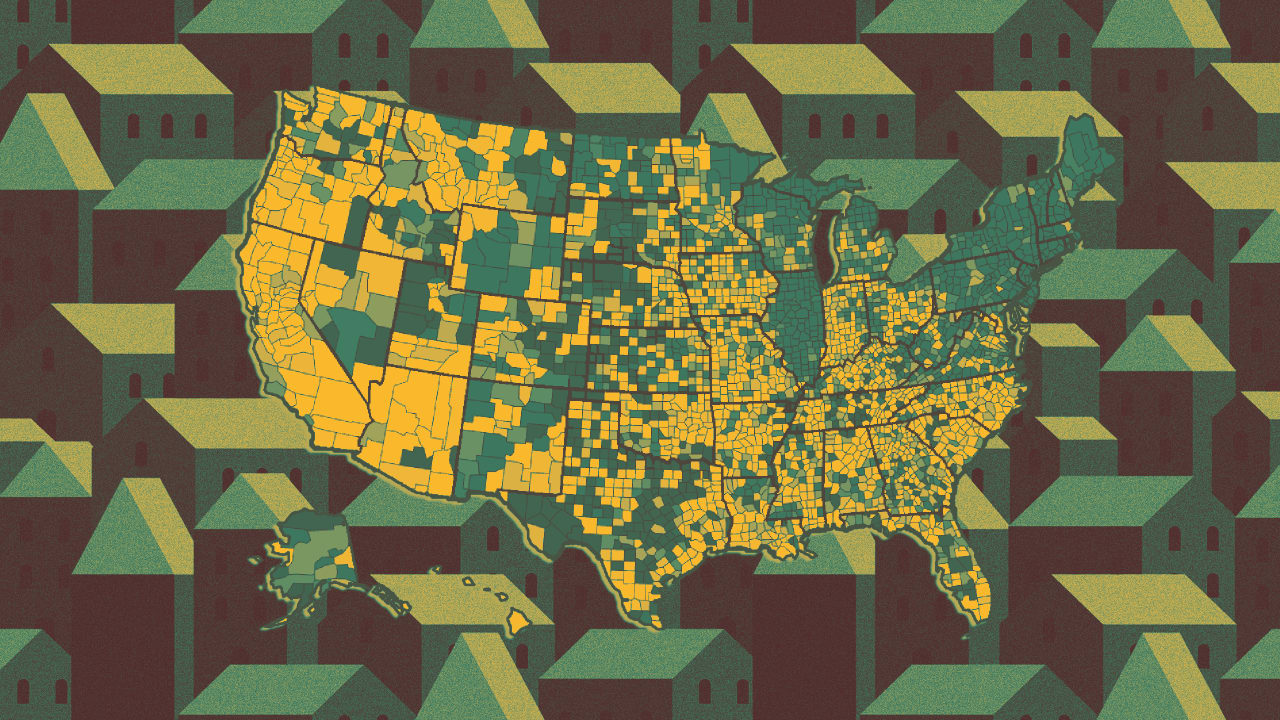

6. Real Estate Agents & Brokers

Mistakes in property transactions, misrepresentation, or contract errors can lead to legal disputes.

7. Freelancers & Independent Contractors

Writers, designers, and consultants often work without corporate legal protection, making PLI a smart investment.

8. Consultants & Coaches

Business, career, or life coaches may face lawsuits if clients claim their advice caused financial or personal harm.

Why Is Professional Liability Insurance Important?

1. Legal Defense Coverage

Even false claims can lead to expensive lawsuits. PLI covers attorney fees, court costs, and settlements.

2. Financial Protection

A single lawsuit can cost thousands (or millions) in damages. PLI prevents out-of-pocket expenses.

3. Client & Contract Requirements

Many clients, especially in government or corporate sectors, require vendors to carry PLI before signing contracts.

4. Reputation Management

Facing a lawsuit can damage your credibility. PLI helps resolve disputes professionally without harming your brand.

5. Peace of Mind

Knowing you’re protected allows you to focus on delivering quality services without constant legal worries.

How Much Does Professional Liability Insurance Cost?

Premiums vary based on:

-

Industry & Risk Level (Doctors pay more than graphic designers)

-

Coverage Limits (Higher limits = higher premiums)

-

Claims History (Past lawsuits may increase costs)

-

Business Size (More employees = greater exposure)

On average, freelancers may pay 2,000/year, while high-risk professionals (doctors, lawyers) could pay 15,000+ annually.

Final Thoughts

Professional Liability Insurance isn’t just for high-risk fields—anyone providing expert advice or services should consider it. A single lawsuit can devastate your finances and reputation, making PLI a smart, proactive investment.

Before choosing a policy, assess your risks, compare quotes, and consult an insurance expert to ensure proper coverage.

For more insights on business protection and financial security, visit Joknewz.xyz.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)