How to Lower Your Home Insurance Premiums Without Sacrificing Coverage

Home insurance is essential for protecting your property and belongings, but rising premiums can strain your budget. The good news? You can reduce your home insurance costs without compromising coverage. Here are smart, effective strategies to help you save money while keeping your home well-protected.

1. Shop Around and Compare Quotes

Insurance rates vary significantly between providers. Don’t settle for the first quote you receive—compare policies from multiple insurers. Online comparison tools make this easier, allowing you to find the best deal without sacrificing coverage.

2. Increase Your Deductible

A higher deductible means lower monthly premiums. If you can afford to pay more out-of-pocket in case of a claim, raising your deductible can lead to substantial savings. Just ensure you have enough savings to cover the higher deductible if needed.

3. Bundle Your Insurance Policies

Many insurers offer discounts when you bundle home and auto insurance. Combining policies with the same provider can save you 10% to 25% on premiums.

4. Improve Home Security

Installing security features like:

-

Burglar alarms

-

Smoke detectors

-

Deadbolt locks

-

Security cameras

-

Smart home monitoring systems

can qualify you for discounts. Insurers see these upgrades as reducing risk, which lowers your premiums.

5. Maintain a Good Credit Score

Most insurers use credit-based insurance scores to determine premiums. A higher credit score often translates to lower rates. Pay bills on time, reduce debt, and check your credit report for errors to improve your score.

6. Avoid Small Claims

Frequent small claims can increase your premiums. If the repair cost is only slightly above your deductible, consider paying out-of-pocket instead of filing a claim.

7. Review and Adjust Your Coverage Annually

Your home’s value and insurance needs change over time. Regularly review your policy to ensure you’re not over-insured (e.g., paying for coverage on items you no longer own) or under-insured.

8. Ask About Discounts

Many insurers offer discounts for:

-

Loyalty (staying with the same insurer for years)

-

Being claims-free

-

Retirees or seniors

-

Non-smokers

-

New or renovated homes

Always ask your provider about available discounts.

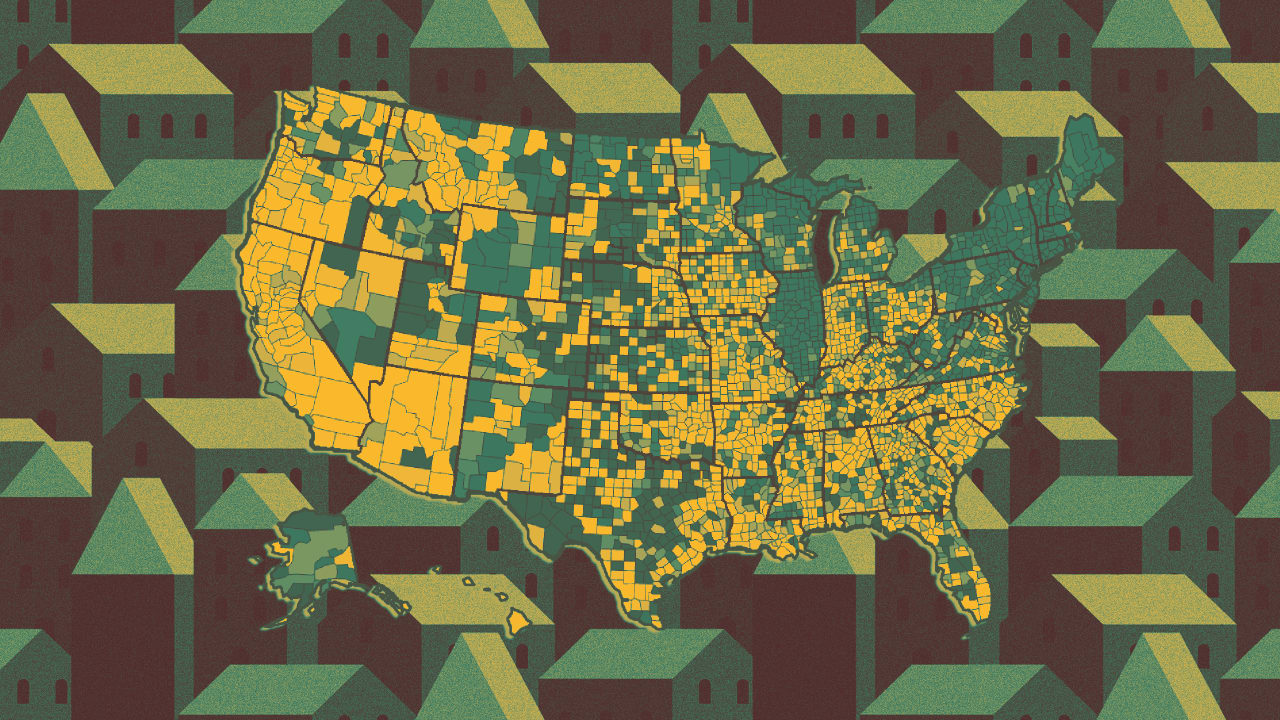

9. Consider Location-Based Factors

Living in a low-crime area or near a fire station can reduce premiums. If you’re moving, research insurance costs in different neighborhoods before buying a home.

10. Work with an Independent Insurance Agent

Independent agents can compare policies from multiple insurers to find you the best rates. They may also know about lesser-known discounts.

Final Thoughts

Lowering your home insurance premiums doesn’t mean sacrificing protection. By shopping around, improving home security, bundling policies, and maintaining a strong credit score, you can save money while keeping your home secure.

For more tips on smart homeownership and insurance savings, visit Zoonse.com.

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)