Housing market sees biggest home-flipping pullback since 2007

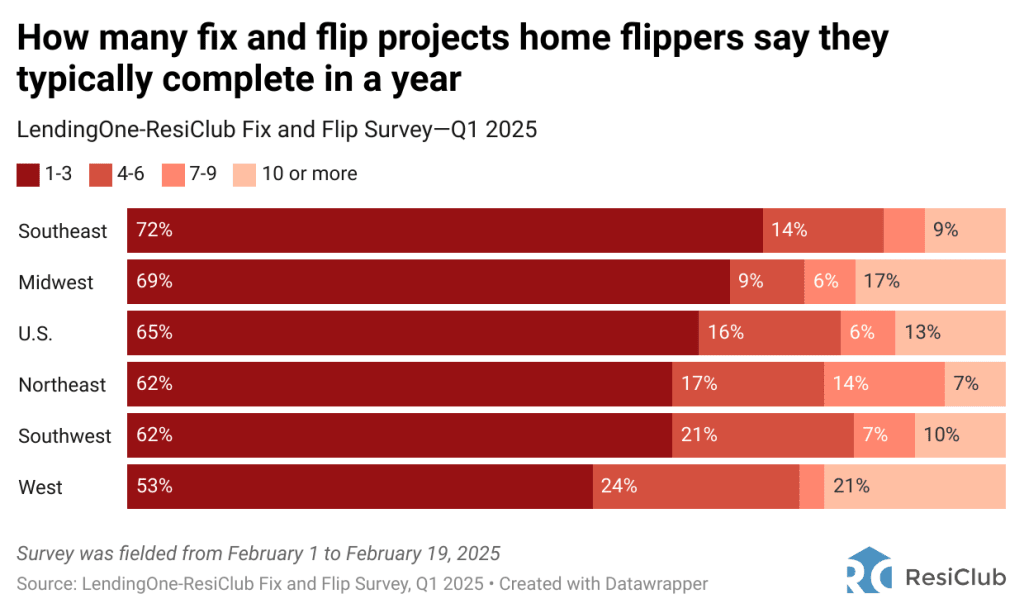

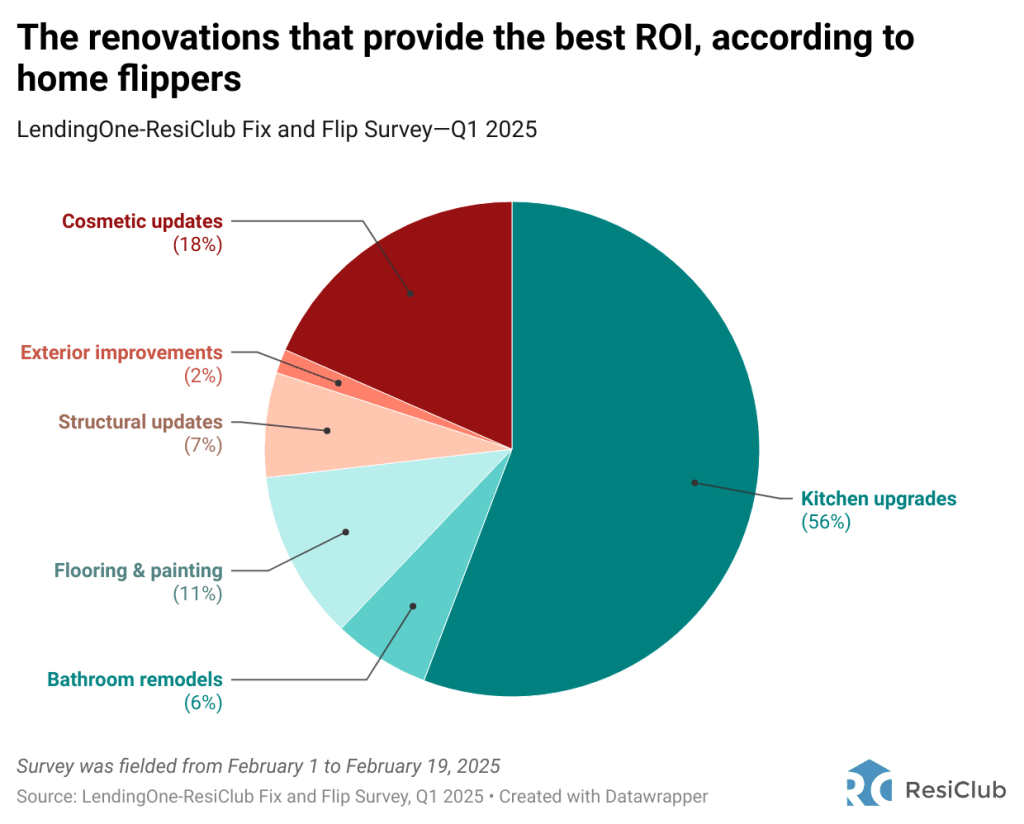

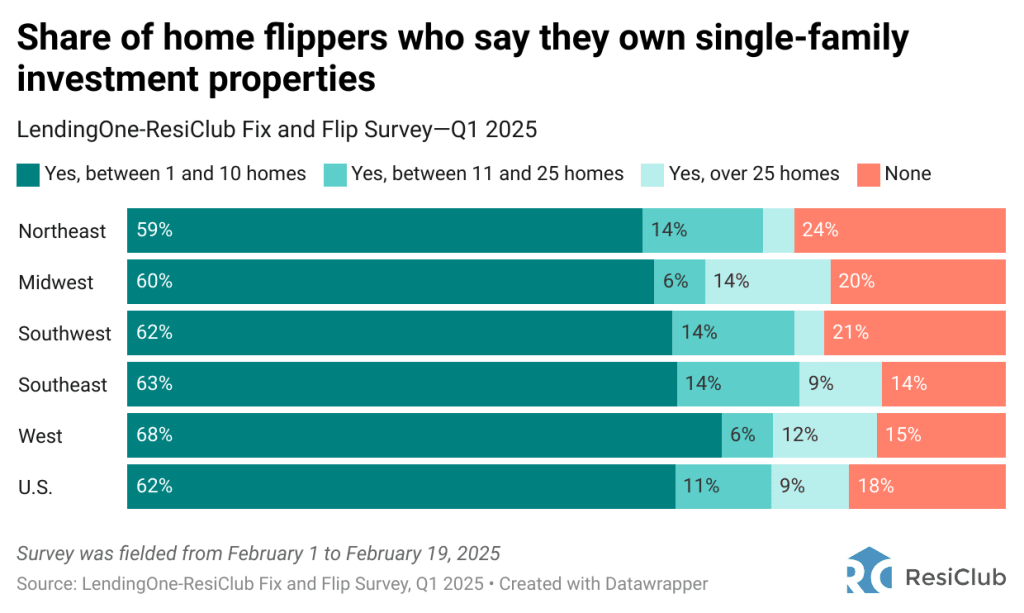

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. During the pandemic housing boom, home flipping surged as soaring home prices and ultralow-interest rates attracted more flippers, especially newcomers, to the market. However, as the market shifted due to the rate shock of 2022, home-flipping activity has seen the biggest pullback since 2007, and many of those newcomers pulled back. In the last quarter of 2018, there were 71,358 home flips. In the last quarter of 2021, that shot up to 120,531 flips, before falling to 87,851 flips in the last quarter of 2022. In the last quarter of 2024, there were just 69,929 flips. While some experienced flippers remain active, caution now prevails in the market. Regional challenges (including tight inventory in Connecticut and rising inventory in Florida) along with escalating costs have caused flippers to move forward with greater care. To better understand what’s going on in the home-flipping market, we’ve created the first-ever LendingOne-ResiClub Fix-and-Flip Survey. The flipper survey was fielded from February 1 to February 19, 2025. In total, 244 U.S. home flippers took the survey. To conduct the survey, ResiClub partnered with LendingOne, a private real estate lender. Our findings reveal that the home-flipping market in much of the Northeast remains competitive, as price appreciation, tight inventory, and aging housing stock create investment potential for fix-and-flip projects. However, home flippers in the region face intense competition for properties and elevated purchase prices. Here are some of the highlights: 1. Home flipper sentiment and plans Fix-and-flip activity: 89% of home flippers plan to conduct at least one fix-and-flip in 2025. 64% plan to convert at least one fix-and-flip project into a rental using the fix-to-rent method. Market outlook: 32% of home flippers say demand for fix-and-flip properties in spring 2025 is “very strong.” In the Northeast, 59% of home flippers described demand as “very strong.” 2. Financial considerations Renovation costs: 56% of U.S. home flippers say kitchen upgrades provide the best return on investment. 3. Flippers’ biggest concerns across the country Northeast: Housing inventory is the biggest challenge (34%). Midwest and Southwest: Competition for properties is reported as the top concern among flippers (31% and 34%). Southeast: Borrowing costs are the biggest concern, with several home flippers specifically noting trouble accessing enough financing for projects. West: Labor and material costs are the top challenge (24%). Below you will find the full results to the LendingOne-ResiClub Fix-and-Flip Survey. (Due to rounding, some total responses might not equal 100%.)

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

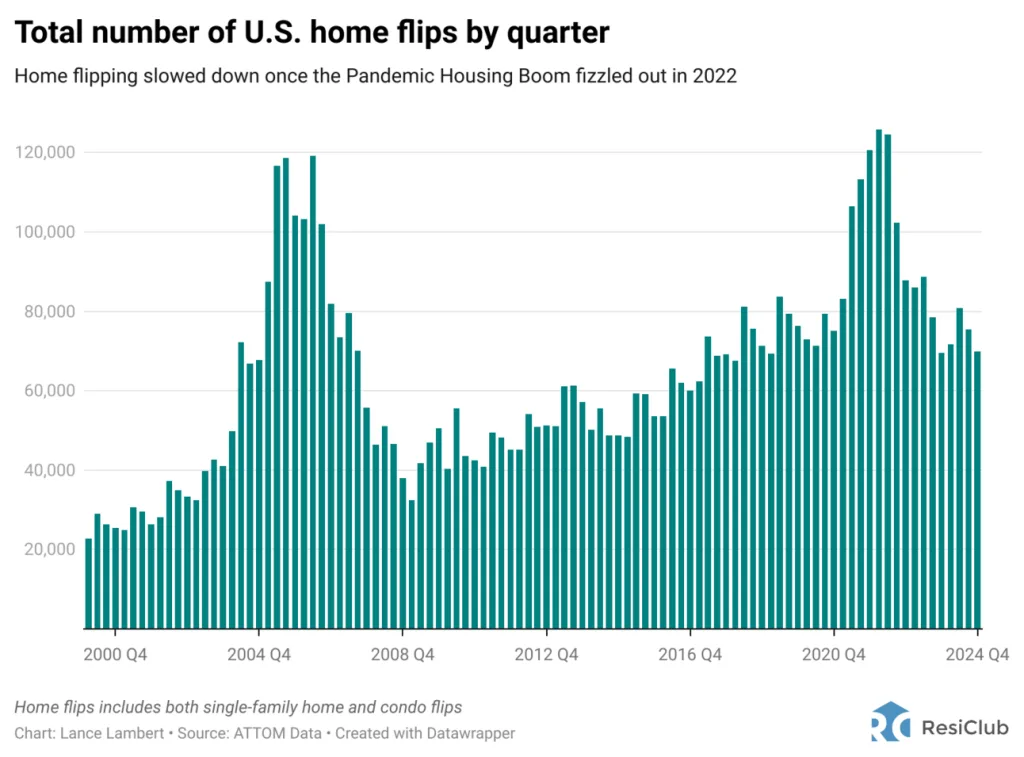

During the pandemic housing boom, home flipping surged as soaring home prices and ultralow-interest rates attracted more flippers, especially newcomers, to the market. However, as the market shifted due to the rate shock of 2022, home-flipping activity has seen the biggest pullback since 2007, and many of those newcomers pulled back.

In the last quarter of 2018, there were 71,358 home flips. In the last quarter of 2021, that shot up to 120,531 flips, before falling to 87,851 flips in the last quarter of 2022. In the last quarter of 2024, there were just 69,929 flips.

While some experienced flippers remain active, caution now prevails in the market. Regional challenges (including tight inventory in Connecticut and rising inventory in Florida) along with escalating costs have caused flippers to move forward with greater care.

To better understand what’s going on in the home-flipping market, we’ve created the first-ever LendingOne-ResiClub Fix-and-Flip Survey. The flipper survey was fielded from February 1 to February 19, 2025. In total, 244 U.S. home flippers took the survey. To conduct the survey, ResiClub partnered with LendingOne, a private real estate lender.

Our findings reveal that the home-flipping market in much of the Northeast remains competitive, as price appreciation, tight inventory, and aging housing stock create investment potential for fix-and-flip projects. However, home flippers in the region face intense competition for properties and elevated purchase prices. Here are some of the highlights:

1. Home flipper sentiment and plans

Fix-and-flip activity:

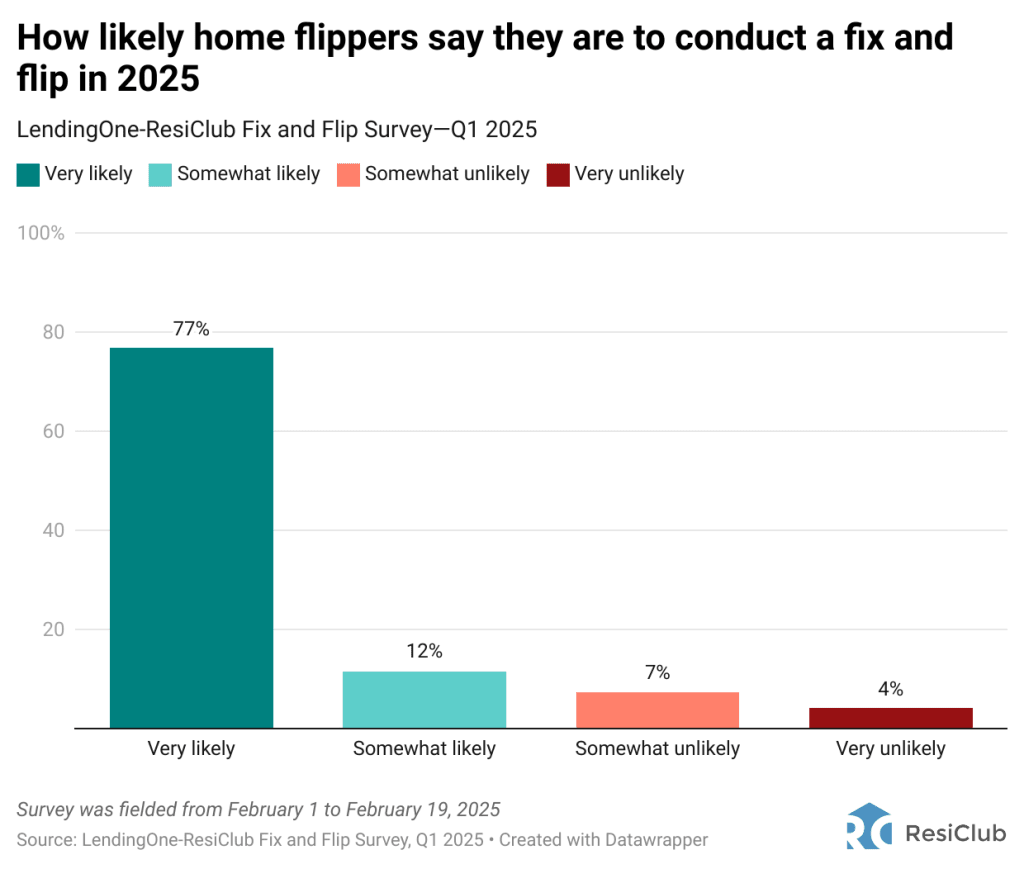

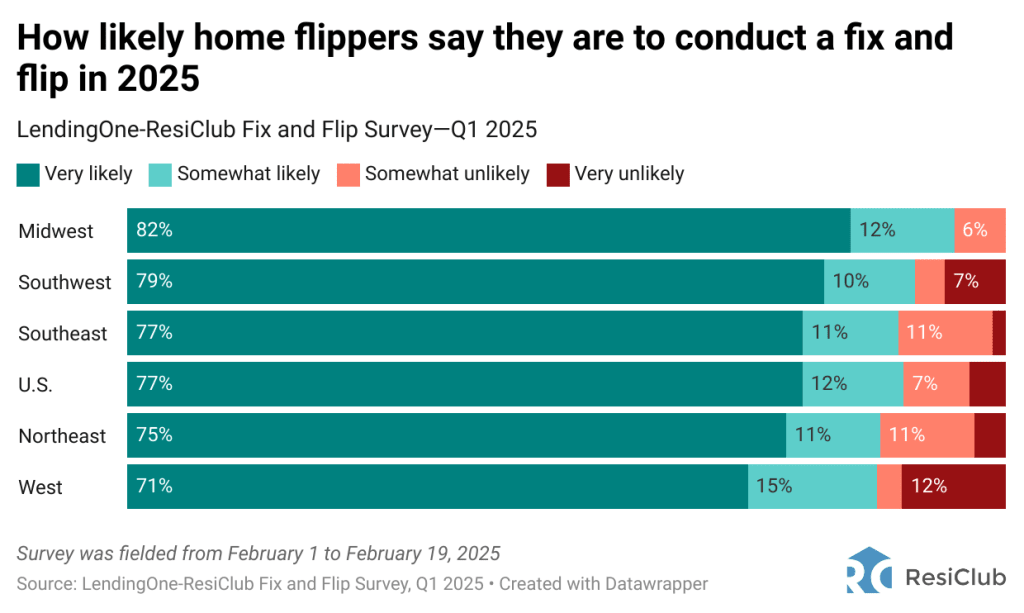

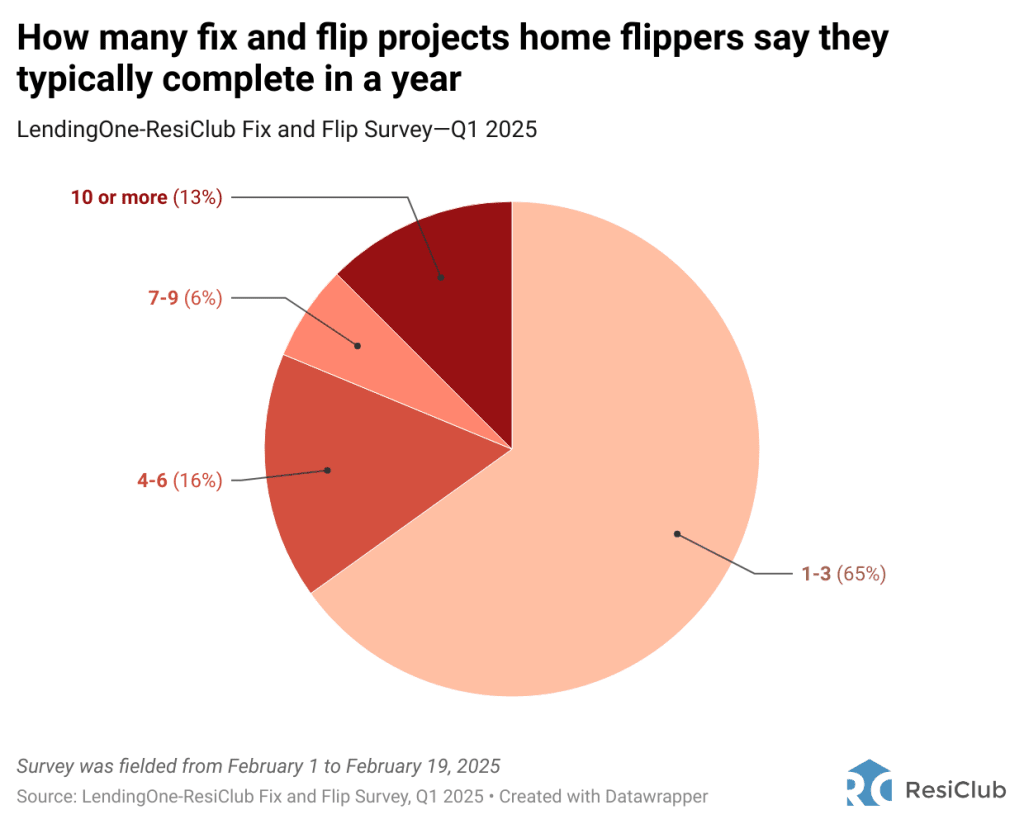

- 89% of home flippers plan to conduct at least one fix-and-flip in 2025.

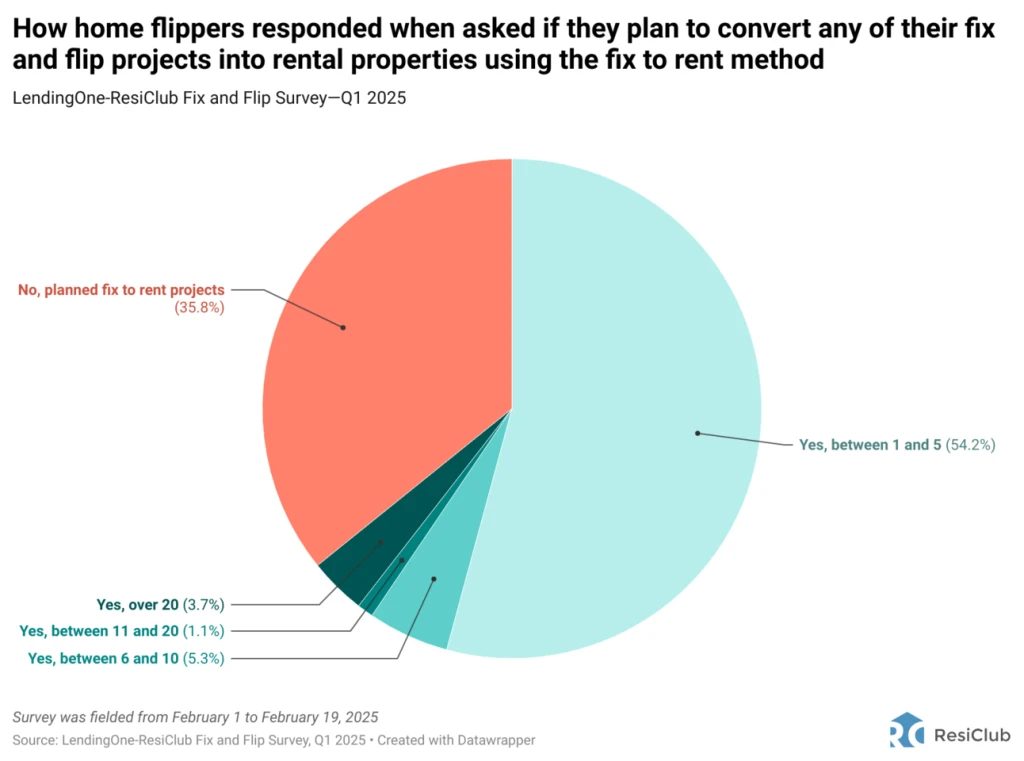

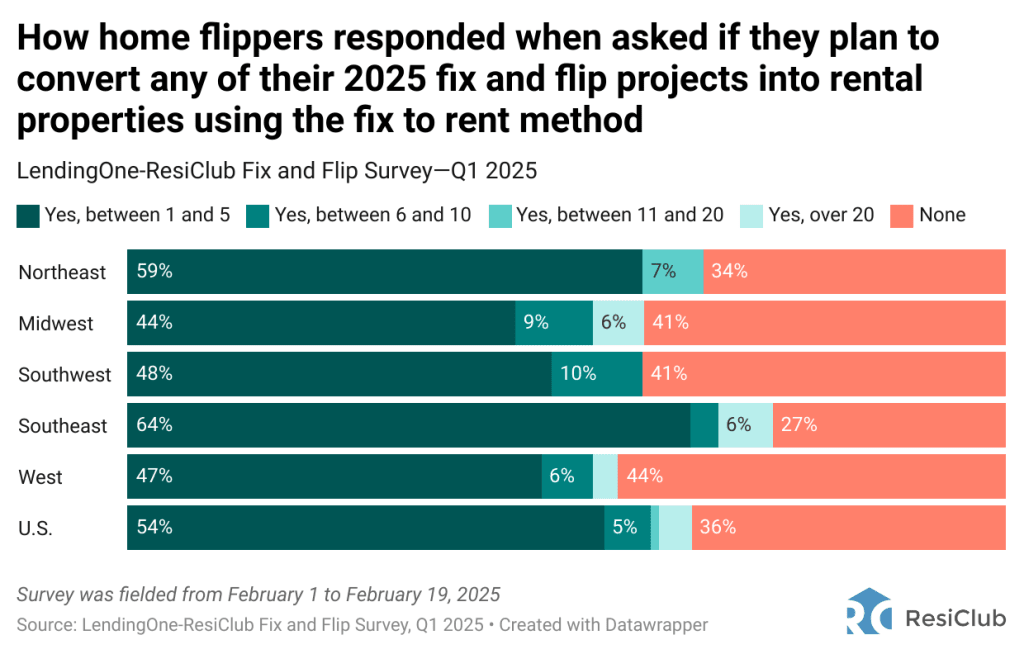

- 64% plan to convert at least one fix-and-flip project into a rental using the fix-to-rent method.

Market outlook:

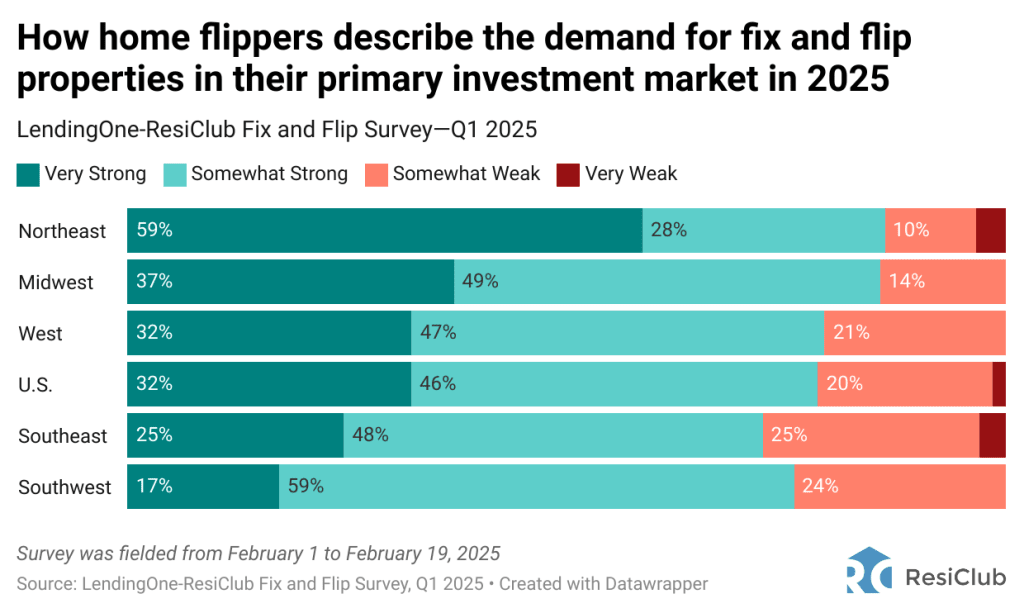

- 32% of home flippers say demand for fix-and-flip properties in spring 2025 is “very strong.” In the Northeast, 59% of home flippers described demand as “very strong.”

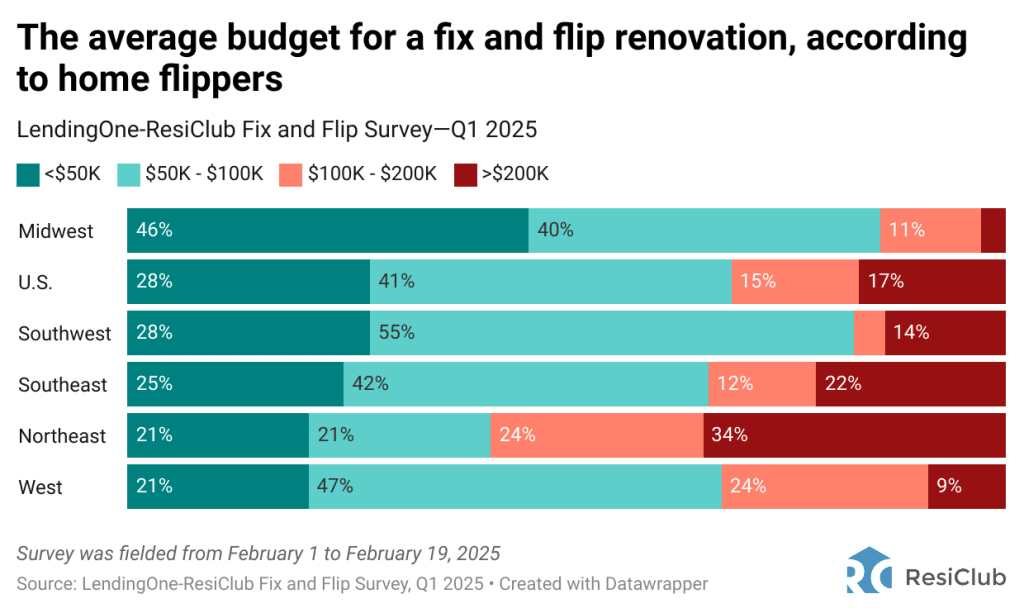

2. Financial considerations

Renovation costs:

- 56% of U.S. home flippers say kitchen upgrades provide the best return on investment.

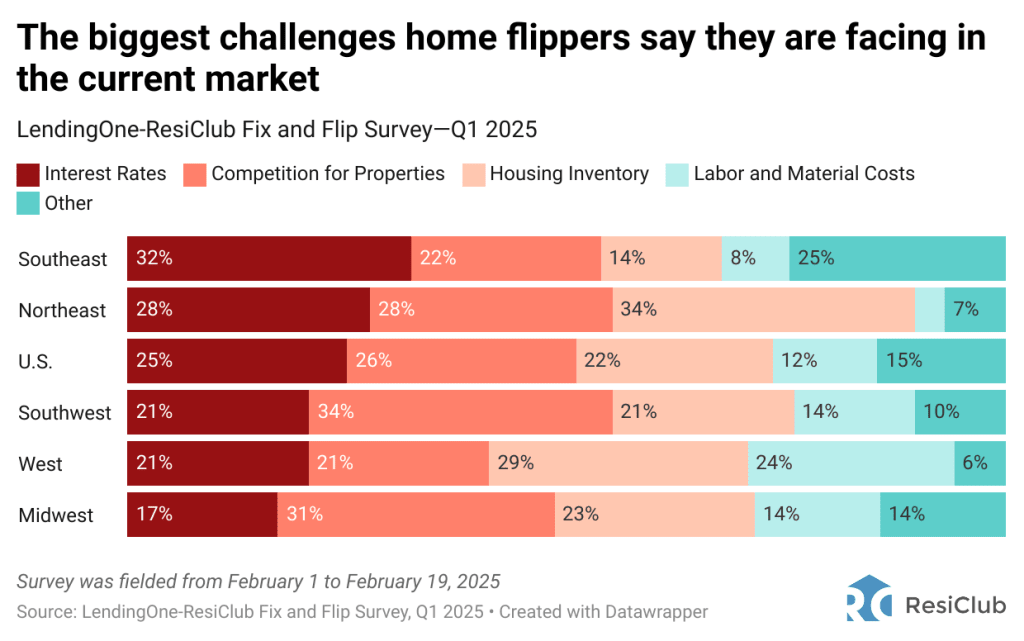

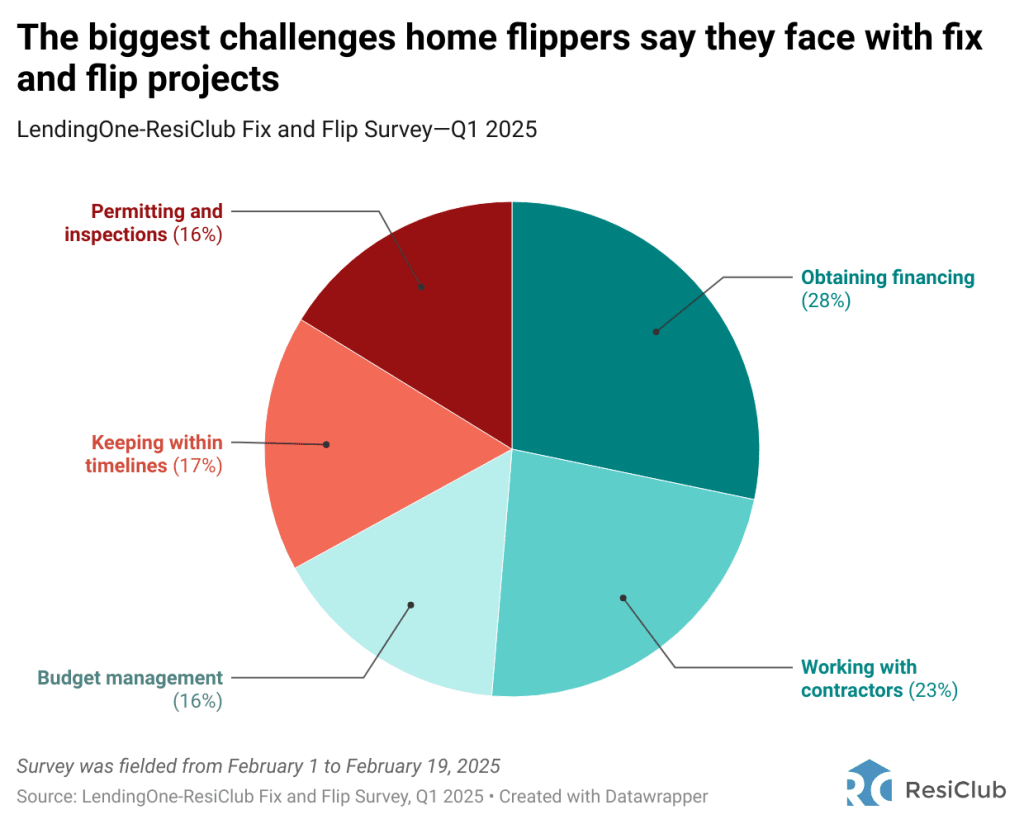

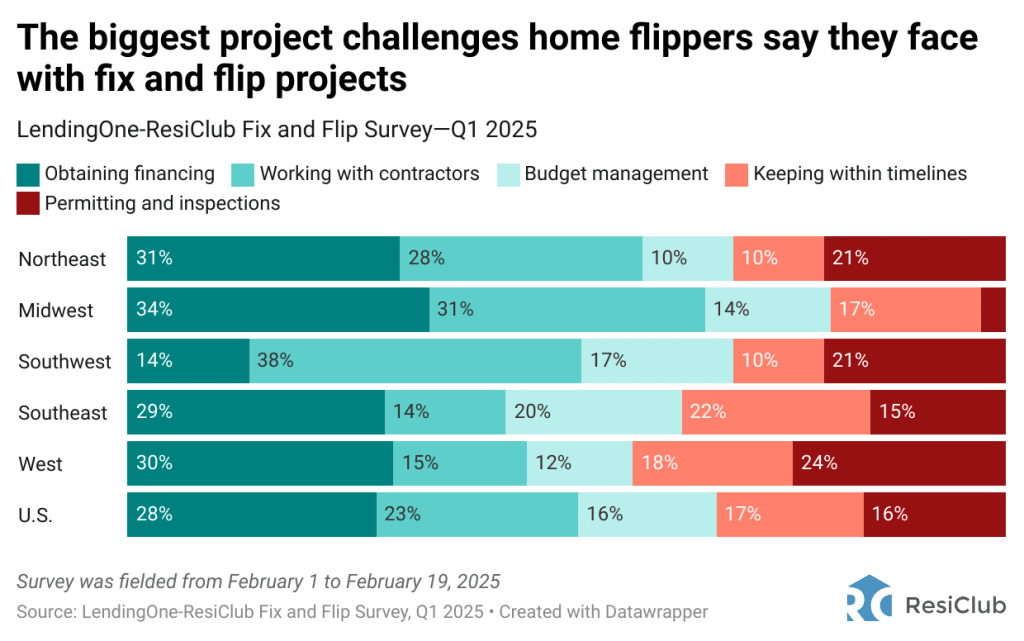

3. Flippers’ biggest concerns across the country

- Northeast: Housing inventory is the biggest challenge (34%).

- Midwest and Southwest: Competition for properties is reported as the top concern among flippers (31% and 34%).

- Southeast: Borrowing costs are the biggest concern, with several home flippers specifically noting trouble accessing enough financing for projects.

- West: Labor and material costs are the top challenge (24%).

Below you will find the full results to the LendingOne-ResiClub Fix-and-Flip Survey. (Due to rounding, some total responses might not equal 100%.)

![Building A Digital PR Strategy: 10 Essential Steps for Beginners [With Examples]](https://buzzsumo.com/wp-content/uploads/2023/09/Building-A-Digital-PR-Strategy-10-Essential-Steps-for-Beginners-With-Examples-bblog-masthead.jpg)

![How One Brand Solved the Marketing Attribution Puzzle [Video]](https://contentmarketinginstitute.com/wp-content/uploads/2025/03/marketing-attribution-model-600x338.png?#)

![How to Use GA4 to Track Social Media Traffic: 6 Questions, Answers and Insights [VIDEO]](https://www.orbitmedia.com/wp-content/uploads/2023/06/ab-testing.png)

![[Hybrid] Graphic Designer in Malaysia](https://a5.behance.net/920d3ca46151f30e69b60159b53d15e34fb20338/img/site/generic-share.png)